As a devoted pet owner, you’ve likely experienced the unique joy and companionship that comes from sharing your life with a furry freind. Though, alongside the wagging tails and playful purrs, there’s a responsibility that can become overwhelming—ensuring your pet’s health and well-being. As veterinary bills occasionally soar higher than a cat on a curtain rod, many pet parents find themselves pondering a pressing question: Is pet insurance worth the investment? In this article, we’ll explore the nuances of pet insurance, weighing its benefits and drawbacks to provide every pet owner with the essential facts needed to make an informed decision. With rising costs of veterinary care and the unpredictable nature of pet health, understanding your options is paramount for both your peace of mind and your pet’s future. Join us as we navigate through the considerations, potential savings, and key factors that will empower you to choose what’s best for your beloved companion.

Understanding the Basics of Pet Insurance and Its Importance

Pet insurance is a financial product designed to help pet owners mitigate unexpected veterinary expenses. Just like health insurance for humans, it offers a safety net that can aid in covering various medical costs. when your beloved furry friend suddenly becomes ill or requires surgery, the price of treatment can quickly escalate. Pet insurance can squarely address this concern, enabling you to focus on your pet’s well-being rather than your financial worries. By investing in this coverage, you are providing a shield against crippling vet bills, which can range from routine check-ups to emergency care.

Understanding the different types of pet insurance policies available is crucial for making an informed decision. Typically, policies can be categorized into three main types: accident-only, thorough, and wellness plans. Each type serves a distinct purpose and can cater to various needs:

- Accident-Only: Covers expenses related to injuries caused by accidents,such as fractures or foreign objects swallowed.

- Comprehensive: Offers a broader range of coverage, including accidents, illnesses, and sometimes preventive care.

- Wellness Plans: Focuses on routine care, such as vaccinations, flea treatments, and regular check-ups, frequently enough as an add-on to a comprehensive policy.

Another significant aspect to keep in mind is the cost-benefit analysis of pet insurance. Many pet owners express concerns about the monthly premiums and whether they outweigh potential benefits. To illustrate the financial impact, consider the following table that highlights some common veterinary procedures and their average costs:

| Procedure | Average Cost |

|---|---|

| Routine Check-Up | $50 – $150 |

| Spay/Neuter | $200 – $500 |

| Emergency Surgery | $1,500 – $3,000+ |

| Diagnostic X-Ray | $200 – $1,000 |

| Cancer Treatment | $5,000 – $20,000+ |

Considering that some treatments can reach astronomical sums, pet insurance can potentially save you thousands of dollars during critical moments. Thus, opting for this type of insurance is not merely about managing expenses; it’s about ensuring peace of mind and a greater quality of life for your pet. By fully grasping the various dimensions of pet insurance—coverage types,costs,and financial implications—pet owners are better equipped to make decisions that benefit both their pets and their wallets.

Evaluating the Cost-Benefit Ratio of Pet Insurance

The decision to invest in pet insurance requires a thoughtful evaluation of its potential cost-benefit ratio. For many pet owners, the allure of a safety net for unexpected veterinary expenses can be enticing; however, it’s essential to weigh these benefits against the ongoing costs associated with such policies.One must consider factors like monthly premiums, deductible amounts, co-pays, and coverage limits. A thorough examination of your pet’s health history and breed predispositions may also influence your decision. Certain breeds may be predisposed to specific health conditions, making insurance more appealing in those cases.

In assessing the financial implications,pet owners should also take into account the range of coverage options available. Some insurance plans cover just accidents and illnesses,while others may include wellness visits,vaccinations,and preventive care. This variance in coverage allows owners to tailor their insurance to meet both their needs and their budgets. Here are some points to consider regarding coverage types:

- Accident-only coverage: Typically the most affordable but limited to unforeseen incidents.

- comprehensive coverage: Encompasses accidents, illnesses, and, frequently enough, wellness care, leading to higher premiums.

- Wellness plans: These can be added to a standard policy to cover routine care but may not be available with all providers.

To visualize the potential long-term costs versus benefits, consider the average expenses associated with common pet illnesses and treatments. The following table outlines typical veterinary costs that pet owners may encounter, demonstrating how insurance can provide significant savings in crucial moments:

| Treatment | Average Cost Without Insurance | Estimated Cost With Insurance (after deductible) |

|---|---|---|

| Accident (e.g.,fracture) | $1,500 | $600 |

| Injury (e.g., soft tissue damage) | $1,200 | $480 |

| Chronic illness (e.g., diabetes) | $1,000/year | $400/year |

| Routine check-ups | $300 | $0 (if included in plan) |

Ultimately, the decision of whether pet insurance is worth the investment hinges on individual circumstances and preferences.A thorough evaluation of your financial situation,your pet’s health considerations,and the various plans available in the marketplace will lead to more informed choices. By carefully calculating both potential risks and savings, pet owners can achieve peace of mind, ensuring that they are prepared for the unpredictable journeys of pet ownership.

Common Coverage Options and What they Mean for Your Pet

When considering pet insurance, understanding the various coverage options available is paramount for making the right choice for your furry companion.Commonly,plans offer accident coverage,which assists in managing costs associated with unexpected injuries,such as fractures or ingestion of foreign objects. This type of coverage is crucial for pets, especially those with curious natures, as accidents can happen anywhere and at any time. Another primary option is illness coverage, which takes care of veterinary expenses related to diagnosed health problems ranging from skin infections to chronic diseases like diabetes.

Additional coverage variants include wellness plans, which are designed to encourage proactive pet health care. These frequently enough cover routine veterinary check-ups, vaccinations, flea and tick prevention, and even dental cleanings. Investing in a wellness plan can lead to significant savings in preventive care, promoting a healthier life for your pet while potentially catching diseases early. On the other hand, pet owners should also explore options such as hereditary and congenital conditions coverage, which might potentially be essential for purebred pets predisposed to certain genetic illnesses.It’s vital to check if these conditions are part of the coverage, as many standard policies may not include them.

Some pet insurance providers offer customizable plans, allowing owners to select coverage limits and deductibles that best fit their financial situation. Here’s a simple overview of common coverage limits you may encounter:

| Coverage Type | Typical Limits | notes |

|---|---|---|

| Accident Coverage | $5,000 – Unlimited | Best for unexpected health emergencies. |

| Illness Coverage | $5,000 – Unlimited | Covers diagnosed health conditions. |

| Wellness plans | $250 – $600/year | Encourages regular health checks. |

| Hereditary Conditions | Varies | Crucial for breeds with genetic predispositions. |

Each of these coverage options comes with its own set of benefits and potential drawbacks, which can vary substantially between pet insurance providers. It’s essential to research thoroughly and possibly speak with a representative to clarify any questions or concerns. By understanding what each coverage type entails, pet owners can make informed decisions that not only cater to their pet’s current health needs but also prepare them for future challenges, ensuring a happy and healthy life for their cherished companions.

How to Choose the Right Pet Insurance Plan for Your Needs

Choosing the right pet insurance plan can feel overwhelming, yet it’s essential for safeguarding your furry companion’s health and your finances.When evaluating your options, consider coverage types, which typically include accidents, illnesses, routine care, and wellness plans. Depending on your pet’s specific needs, like pre-existing conditions or breed-specific concerns, you may want to prioritize different types of coverage.Research what each provider covers and identify any exclusions that may apply to your pet, as this can significantly affect your financial plan in case of an emergency.

Another critical factor to examine is cost versus benefits.while it may be tempting to go for the cheapest option, it’s important to gauge the substantiality of the coverage offered. Tables can be a great way to visually compare various plans. Below is a simple comparison that highlights key elements you should look for:

| Insurance Provider | Monthly Premium | Deductibles | Reimbursement Percentage |

|---|---|---|---|

| Provider A | $30 | $200 | 80% |

| Provider B | $25 | $250 | 70% |

| Provider C | $35 | $150 | 90% |

Lastly, don’t overlook the importance of reading customer reviews and testimonials.Insight from fellow pet owners can provide context that statistics alone cannot.Look for feedback on claims processing, customer service quality, and overall satisfaction with the claims experience. A company’s responsiveness when handling claims can make a significant difference in your overall experience as a policyholder. In your decision-making process, balance the feedback with your pet’s healthcare needs, budget constraints, and the reputation of the insurance provider to find a plan that will serve you well in the long run.

Real-Life Scenarios: When pet Insurance Saves the Day

Imagine this: you’re in the middle of a busy workday when you receive a call from your pet sitter. Your beloved Labrador, Max, has decided to eat something he shouldn’t have—perhaps a whole pack of gum left unattended on the table. The next thing you know, you’re rushing him to the vet to treat a potential case of hypoglycemia, a situation that coudl cost upwards of $1,500. If you have pet insurance, your heart can rate a little slower as you know that a significant portion of that unexpected expense may be covered. This is just one scenario where pet insurance can serve as a lifesaver.

In another instance, let’s look at Bella, a playful kitten who develops complications from a urinary tract infection. Initially, the symptoms were mild, but within a few days, it escalated to a serious issue requiring hospitalization and surgery. The total bill totaled around $3,000. For a pet owner without insurance, this can lead to heart-wrenching decisions about how to finance their pet’s care. Thankfully, Bella’s owner opted for a comprehensive pet insurance policy that not only covered the surgery but also included follow-up treatments and medications. This not only alleviated the financial burden but also ensured that bella received the best possible care without delay.

While some might view pet insurance as an unnecessary expense, consider this: data shows that 1 in 3 pets will require emergency care at some point in their lives. For many pet owners, the peace of mind that comes from knowing they are protected against unexpected veterinary costs can drastically reduce the anxiety associated with pet ownership. Below is a simple comparison of average veterinary costs versus potential premiums:

| Condition | Average Cost | Monthly Insurance Premium |

|---|---|---|

| Routine Check-Up | $45 – $100 | $20 – $50 |

| Urinary Blockage (Surgery) | $1,500 – $3,000 | $20 – $50 |

| fractured Bone (Treatment) | $1,000 - $5,000 | $20 – $50 |

| Emergency Care Visit | $800 – $2,000 | $20 – $50 |

these real-life scenarios highlight the invaluable role of pet insurance, providing not only financial support but also enabling pet owners to make decisions based on what’s best for their furry friends rather than their wallets. With the right coverage, pet owners can focus on their pets’ recovery and well-being, ensuring that they never have to ask themselves if they can afford the necessary care. When you consider the sheer unpredictability of life with pets, the argument for pet insurance becomes increasingly compelling in protecting both their health and your financial peace of mind.

Tips for Maximizing Your Pet Insurance Experience

To truly benefit from your pet insurance policy, it’s crucial to understand the fine details. Start by thoroughly reviewing your policy to ensure you are aware of the coverage limits, exclusions, and waiting periods. Familiarize yourself with the terms and conditions so there are no surprises when you need to file a claim.Additionally,consider utilizing a wellness plan,if available,to cover routine veterinary care and preventive treatments,which can minimize out-of-pocket expenses. By being proactive and knowledgeable about your policy, you can make the most informed decisions for your furry friend’s health.

Another effective strategy is to keep detailed records of your pet’s health and vet visits. Documenting all medical treatments, vaccination updates, and even behavioral changes can help streamline the claims process.Make sure to save receipts and invoices,as these will be important when it’s time to file a claim. You might find it beneficial to create a simple table to organize this information:

| Date | Service Provided | Cost | Vet’s Name |

|---|---|---|---|

| 01/15/2023 | Annual Vaccination | $85 | Dr. smith |

| 03/20/2023 | Dental Cleaning | $250 | Dr. Johnson |

Lastly,don’t hesitate to communicate regularly with your insurance provider. Make queries about any changes in your policy, discounts that could apply to you, or options for customizing your plan as your pet ages or their health needs change.Consider setting reminders for yourself to review your coverage annually and adjust if necessary. It’s also a good idea to keep an open line of interaction with your veterinarian. They can provide crucial insights into the type of coverage you may need as your pet grows. By actively managing both your policy and your pet’s healthcare, you can ensure that you’re making the most of what your pet insurance has to offer.

Q&A

Q&A: is Pet Insurance Worth It? What Every Pet Owner should Know

Q1: What is pet insurance, and how does it work?

A1: Pet insurance is a policy that helps cover the veterinary costs associated with your pet’s healthcare. Much like human health insurance, you pay a monthly premium, and when your pet needs medical attention, you can file a claim to receive reimbursement for eligible expenses.Most plans cover accidents,illnesses,and sometimes preventative care,but the specifics can vary widely between providers.

Q2: What are the primary benefits of having pet insurance?

A2: The most significant advantage of pet insurance is peace of mind. Knowing that you have financial help in case of emergencies can be invaluable. It allows pet owners to focus on providing the best care for their furry friends without the worry of crippling vet bills. Additionally, many policies offer coverage for unexpected treatments that could arise from accidents or serious health issues.

Q3: Are there any downsides to pet insurance?

A3: Yes, there are a few potential downsides. Premiums can add up, and not all policies cover pre-existing conditions. Moreover, some plans may have waiting periods before benefits kick in, and there might be copays, deductibles, or caps on reimbursement that can affect how much you ultimately receive back. It’s essential to read the fine print before committing to a policy.

Q4: How do I know if my pet needs insurance?

A4: consider your pet’s age, breed, and health history. Some breeds are predisposed to certain conditions, and older pets often require more medical care. If you find it challenging to cover unexpected vet expenses or want to ensure the best possible treatment is within reach, pet insurance may be a wise choice.It’s also worth assessing your financial situation and how comfortable you feel with potential unexpected costs.

Q5: What should I look for in a pet insurance policy?

A5: Key factors to consider include the coverage offered (accident, illness, and preventative care), limits on payout, deductibles, and the claims process. Assess the exclusions carefully to ensure that the policy aligns with your pet’s needs. Customer reviews and the insurer’s reputation for processing claims can also provide insight into the quality of service you can expect.

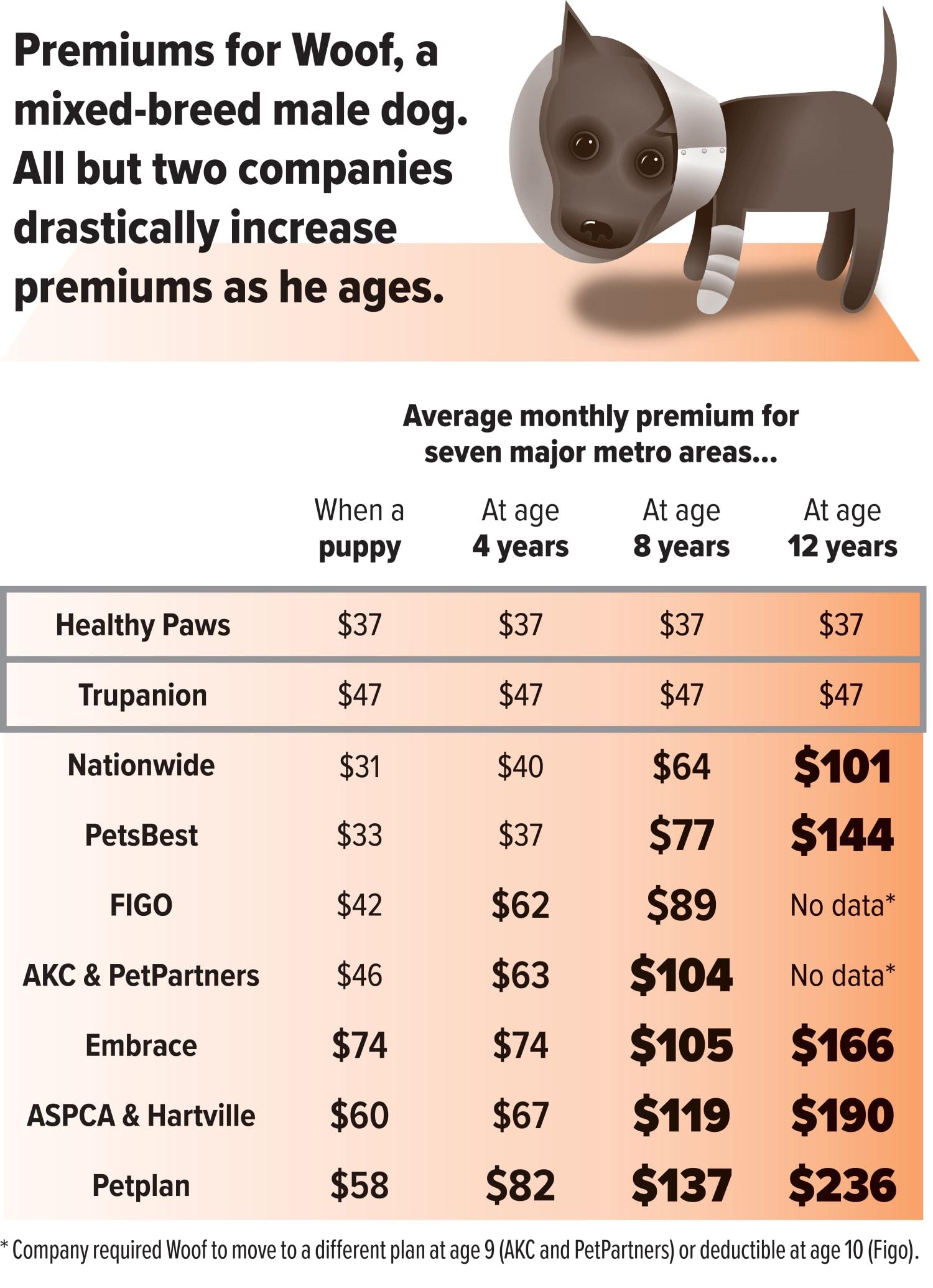

Q6: How much does pet insurance typically cost?

A6: The cost of pet insurance varies widely based on your pet’s age, breed, health, and the coverage options you choose. On average, monthly premiums can range from $20 to $80 or more.It’s wise to get quotes from multiple providers and consider different levels of coverage to find a policy that fits your budget.

Q7: Can I save money without pet insurance?

A7: Some pet owners prefer to set aside a monthly amount into a savings account designated for pet emergencies. This can work well if you have a healthy pet and feel confident you can manage those unexpected costs. however, be aware that significant injuries or illnesses can quickly deplete savings, making insurance an appealing backup for many.

Q8: Are there specific instances when pet insurance is especially beneficial?

A8: Yes! Pet insurance can be particularly favorable for young pets (who might experience accidents or early illnesses), for those with hereditary conditions (like certain dog breeds predisposed to hip dysplasia), and older animals who may encounter more complex health issues.

Q9: How can I make the most of my pet insurance policy?

A9: To maximize your pet insurance benefits, always be proactive about your pet’s health. Regular check-ups and vaccinations can prevent many issues and might be included in your policy. Additionally, maintain all vet records and submit claims promptly to ensure you receive your reimbursements without hassle.

Q10: is pet insurance worth it?

A10: Ultimately, whether pet insurance is worth it depends on your individual circumstances and preferences. Assess your financial comfort with unplanned veterinary expenses, evaluate your pet’s potential health risks, and carefully review insurance options to make an informed decision.If it brings you peace of mind and protects your furry family member,it may very well be a valuable investment.

In Summary

In the grand tapestry of pet ownership, the decision to invest in pet insurance can often feel like a daunting thread to weave. As we’ve explored, the value of pet insurance hinges on individual circumstances, the health history of your furry friend, and the unpredictability of life itself. Ultimately, it’s about weighing peace of mind against potential costs, and what feels right for you and your beloved companion.

As you stand at this crossroads, armed with knowledge and clarity, remember that every pet owner’s journey is unique. Whether you choose to embrace the security of insurance or navigate the waters of veterinary expenses on your own, the most important thing is the love and care you provide to your pet. After all, the bond you share is the most valuable policy of all. May your choices lead to a lifetime filled with joy, health, and wagging tails. Happy pet parenting!