In a world where our furry friends are increasingly seen as beloved family members, the importance of protecting their well-being has never been clearer.Pet ownership has surged in recent years, prompting a growing number of devoted pet parents to consider the unthinkable: what if their cherished companions faced unexpected health challenges? As veterinary costs continue to rise and advances in pet healthcare become more complex, pet insurance has emerged as a safety net, offering peace of mind amid uncertainty. In this article, we’ll explore the reasons behind the surge in pet insurance adoption, the benefits it provides, and why investing in a policy for your pet might be one of the best decisions you make for their future—and yours. Whether you’re a long-time pet owner or pondering the addition of a four-legged freind to your household,understanding pet insurance is essential to ensuring a lifetime of love and care. Join us as we delve into the world of pet insurance and discover how it can serve as the ultimate safeguard for the companions who bring us so much joy.

The Rising Trend of Pet Insurance Among Owners

the growing interest in pet insurance is a reflection of the changing attitudes towards pet ownership and the importance we place on our furry friends. As veterinary care becomes more advanced and, consequently, more expensive, pet owners are realizing that having insurance can be a financial lifesaver during unexpected health crises. With the average cost of an emergency visit skyrocketing, many owners find themselves caught off-guard and concerned about their ability to provide necessary care for their pets.

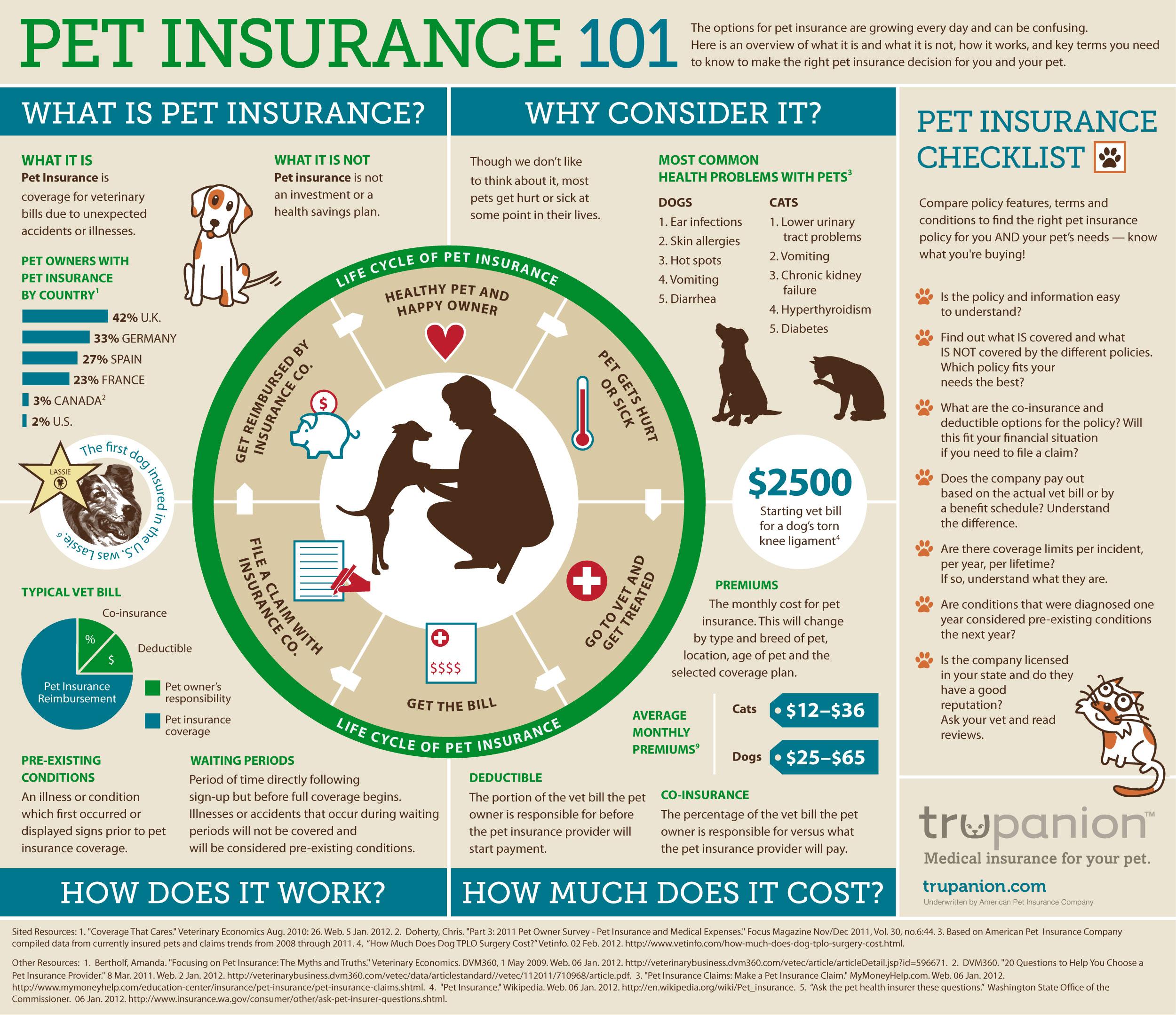

Understanding the benefits of pet insurance can definitely help clarify why its popularity is soaring. Pet insurance not only offers peace of mind but also allows pet owners to make decisions based on their pet’s health needs rather than their financial constraints. Consider the following key advantages:

- Access to High-Quality Care: Insurance can help cover specialized treatments and surgery that may otherwise be unaffordable.

- Predictable Expenses: Many plans allow for predictable budgeting with monthly premiums, reducing the uncertainty of veterinary costs.

- Preventive Care Coverage: Some policies also include wellness plans, which can cover routine check-ups and vaccinations.

Moreover, the variety of pet insurance plans now available makes it easier for owners to find a policy that fits their budget and their pet’s specific needs. Policies can differ widely in terms of coverage options, deductibles, and premiums, allowing owners to choose based on their priorities. A simple table can definitely help illustrate some common types of coverage:

| Policy Type | Description | Typical Coverage |

|---|---|---|

| Accident-Only | Covers injuries resulting from accidents. | Emergency visits, surgeries, and hospitalization for accidents. |

| Extensive | Covers a wide range of conditions, including illnesses and accidents. | Vet visits, medicines, chronic illnesses, surgeries. |

| Preventive Care | Covers routine care and wellness checks. | Vaccinations, routine exams, flea and tick prevention. |

Understanding the Financial Benefits of Pet Health Coverage

The financial landscape of pet ownership can be unpredictable, especially when it comes to health-related expenses. Just like humans, pets face unexpected illnesses, accidents, and emergencies that can lead to hefty veterinary bills.having pet health coverage not only mitigates these costs but also allows pet owners to focus more on their furry companions’ well-being rather than financial worries. With the growing trend of pet ownership, it’s essential to recognize how insurance can serve as a safety net.

One of the meaningful advantages of pet health coverage is that it provides peace of mind.By investing in insurance, owners can be assured that they won’t have to make hasty decisions under financial pressure when their pet needs urgent care.Here are some key financial benefits:

- cost Savings: Coverage can substantially reduce the out-of-pocket expenses of vet visits or surgeries, which can run into thousands of dollars.

- Budgeting Ease: Monthly premiums help stabilize costs, allowing pet owners to allocate their finances more effectively throughout the year.

- Preventative Care: many plans cover routine check-ups and vaccinations, fostering a proactive approach to pet health that ultimately saves money.

| Type of Pet Insurance | Average Monthly Cost | Estimated Annual Savings |

|---|---|---|

| accident-Only | $10 – $30 | $500 |

| Comprehensive | $30 – $70 | $1000 |

| Wellness Plans | $15 – $50 | $300 |

Additionally, the unexpected can often spiral into overwhelming circumstances; hence, having insurance sets a foundation for financial responsibility in pet care. Insurance ensures that choices regarding treatment are not solely based on affordability but rather on providing the best care possible. By countering high costs incurred from surgeries, emergency visits, and ongoing treatments, effective pet health coverage ensures that pets receive appropriate and timely medical attention, thereby extending their quality of life.

Common Misconceptions About Pet Insurance Explained

When it comes to understanding pet insurance, numerous myths and misconceptions can cloud the decision-making process for pet owners. one prevalent misconception is that pet insurance is needless if you already have a healthy pet. The truth is that accidents and illnesses can occur unexpectedly, often leading to large medical expenses. Being proactive with insurance can provide peace of mind and financial security should an urgent situation arise, regardless of your pet’s current health status.

Another common misconception is that all pet insurance plans are the same or that they cover everything.In reality,policies can vary dramatically in terms of coverage options,exclusions,and premiums. As a notable example, one plan may cover routine care such as vaccinations and dental cleanings, while another might only include emergency services. Understanding the specific terms of each policy is crucial to avoid unforeseen out-of-pocket expenses.Here’s a simple comparison table of different types of coverage:

| Coverage Type | Description | Typical Costs |

|---|---|---|

| Accident-Only | Covers injuries resulting from accidents | Low monthly premium |

| Accident and Illness | Covers accidents and a range of illnesses | Moderate monthly premium |

| Wellness Plans | Covers routine care and preventive services | Add-on to other plans |

Lastly, many people believe that pet insurance will simply not be financially beneficial over time, as they expect their pets to remain healthy. However, even one emergency or chronic illness can lead to thousands of dollars in veterinary bills. Pet insurance can ultimately save owners a significant amount in these situations. It’s essential to compare costs versus potential savings if a major health event occurs. By viewing insurance as an investment in your pet’s health – rather than just another expense – the benefits become clear. Remember, it’s better to prepare for the unexpected, ensuring that your beloved companion receives the best care possible without overwhelming financial strain.

choosing the Right Policy: What to Look For

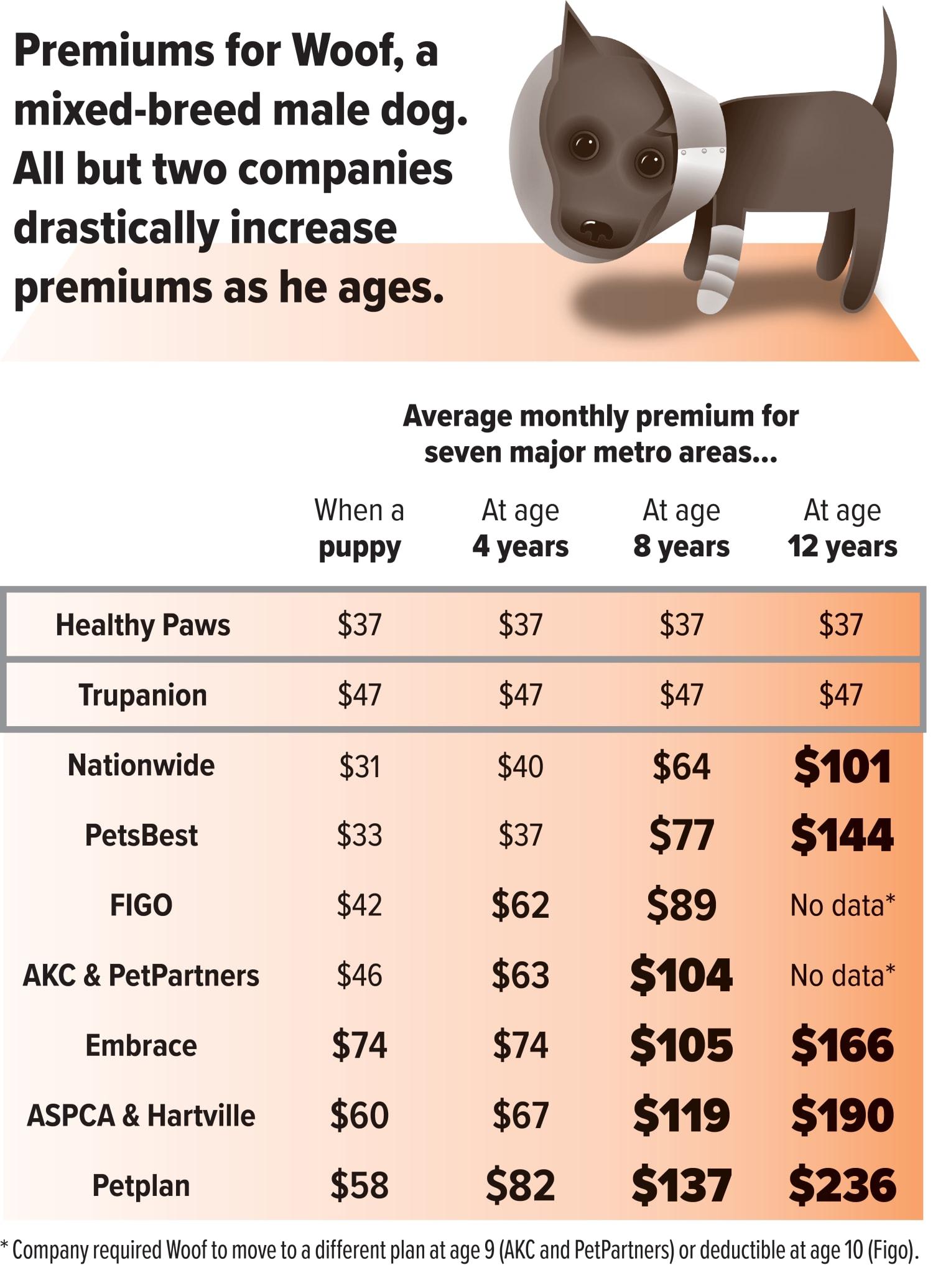

When it comes to selecting a pet insurance policy, it’s essential to dig deeper than just the monthly premium. Not all policies are created equal; some offer comprehensive coverage while others may leave you wanting. Look for a plan that covers crucial aspects such as accidents, illnesses, and routine care. the best policies will provide a range of choices depending on your pet’s needs, which can save you significant amounts in unexpected vet bills.

Consider the deductible and reimbursement rates as primary factors in your decision-making process. A lower deductible typically means higher monthly payments, but might potentially be worth it if your pet is prone to health issues. Additionally, look for policies that offer high reimbursement levels, ideally around 80% to 90%, ensuring you get a fair return on your vet expenditures. Understanding how much you’ll actually receive back from a claim is crucial, as it can significantly impact your financial planning.

Lastly, evaluate the network of veterinarians covered under each policy. Some insurers have preferred networks which can limit your options, while others provide broader access to various clinics. This versatility is notably vital if you have a specific veterinarian you trust or if you travel frequently enough with your pet. Additionally, read customer reviews and ask fellow pet owners about their experiences with different companies, as real-world insights can be invaluable in making the right choice.

Real-Life Scenarios Where Pet insurance Saves the Day

Consider the story of Bella, a spirited Golden Retriever who loved nothing more than frolicking in the park. One day, while chasing a squirrel, she took a tumble and injured her leg. Her owner, Sarah, was devastated. Thankfully, Bella was covered by a comprehensive pet insurance policy. The costs of diagnosis, x-rays, and the necessary surgery would have been overwhelming, but thanks to her insurance, Sarah only had to cover a small deductible. This incident not only highlighted the importance of being financially prepared for unforeseen accidents but also allowed Bella to quickly return to her playful self without the financial stress looming over Sarah.

Then there’s the case of Max, a mischievous cat known for his climbing antics. One evening, after a daring leap onto a high shelf, Max fell and ended up with a fractured collarbone. Fortunately, his owner, Tom, had the foresight to invest in pet insurance.the initial shock of an emergency vet visit was alleviated when Tom discovered that most of the treatment costs were handled by the insurance. Not only did Max receive immediate and necessary care, but Tom was also able to focus on his pet’s recovery without worrying about how to pay for the large bill that would have followed the incident.

Lastly, let’s not forget about Lizzie, a playful Bulldog with a penchant for chewing everything in sight. One curious day, she mistook a children’s toy for a chewable delight and ended up needing emergency surgery to remove it. Her owner, Amy, was panicked not only about Lizzie’s health but also about the financial implications of the procedure. Thanks to her decision to take out an insurance policy,Amy was spared the burden of a hefty bill. The emotional relief of knowing she could provide the best care for Lizzie while managing costs made all the difference during a very worrying time. Being able to focus solely on her dog’s recovery, rather than financial strain, is a gift that every pet owner wishes to have during an emergency.

Taking the First Steps to Insure Your Furry Friend

Choosing to insure your pet is a significant step toward safeguarding their health and happiness. First, it’s essential to research various insurance providers to find a policy that suits both your pet’s needs and your budget. Each company offers different plans with unique coverage options, so take the time to compare them based on premium costs, deductibles, and coverage limits. Make sure to consider what is included in the policy, such as whether it covers routine check-ups, emergency care, or hereditary conditions.

Once you identify a few suitable options, assess them using a checklist that highlights the critical features you require. This can include:

- Lifetime coverage: Ensures ongoing health issues are covered throughout your pet’s life.

- Comprehensive accident coverage: Protects against accidental injuries.

- Specific breed considerations: accounts for hereditary health risks associated with certain breeds.

Additionally, read customer reviews and testimonials to get an idea of the provider’s service quality. understanding how claims are processed and the overall satisfaction of current policyholders can give you critical insight into whether a specific company is right for you and your furry friend.

As you narrow down your options, consider seeking recommendations from your veterinarian or fellow pet owners. They can offer valuable insights based on their experiences, which can guide you towards well-regarded insurers. When you feel confident in your choice, take the next step and apply for a policy. Keep in mind important factors such as the waiting period before coverage begins, and don’t hesitate to ask questions before finalizing your plan. Ultimately, investing in pet insurance is a proactive way to ensure that when unexpected medical needs arise, you are prepared to provide the best possible care without excessive financial stress.

Q&A

Q&A: Why more Pet Owners Are Buying Insurance — And You Should Too

Q1: What is pet insurance and why has it become more popular among pet owners?

A1: Pet insurance is a type of coverage that helps offset veterinary costs for your furry friends. Over the years, the rising cost of veterinary care—due to advanced medical technologies and treatments—has led many pet owners to consider insurance as a financial safety net.With an increasing awareness of pet health and well-being, more owners are seeking peace of mind, knowing they can provide the best possible care without the looming anxiety of unexpected expenses.

Q2: What are the main benefits of having pet insurance?

A2: The primary benefits of pet insurance include financial protection against high veterinary bills, access to a wider range of treatment options, and the ability to prioritize your pet’s health without hesitation. Insurance can cover a variety of services, from routine check-ups and vaccinations to emergency surgeries, allowing pet owners to make decisions based on their pet’s needs rather than their budget.

Q3: Are there different types of pet insurance policies, and what should owners look for?

A3: Yes, there are several types of pet insurance policies including accident-only coverage, comprehensive coverage (which includes accidents and illnesses), and wellness plans for routine care. pet owners should look for policies that align with their pet’s specific needs,such as age,breed,and health history. Key factors to consider include coverage limits, deductibles, reimbursement percentages, and any exclusions related to pre-existing conditions.

Q4: What misconceptions might pet owners have about pet insurance?

A4: A common misconception is that pet insurance isn’t worth the investment because many owners believe they can manage costs themselves. Others think it’s only for older or sick pets. In reality, enrolling a pet at a young age often leads to lower premiums and helps safeguard against future health issues.Additionally, many owners fail to recognize that accidents or sudden illnesses can happen to any pet, regardless of their age or health status.

Q5: How can pet owners decide if pet insurance is right for their individual situation?

A5: Pet owners should assess their financial situation,their pet’s health history,and their willingness to pay for unexpected expenses. Conducting a cost-benefit analysis can also help—considering the average annual veterinary expenses versus the cost of premiums. Speaking with a veterinarian about typical health issues for specific breeds can offer valuable insights as well.Ultimately, every pet owner knows their situation best, and choosing insurance is a personal decision.

Q6: What advice do you have for newcomers considering pet insurance?

A6: Start by researching different providers and reading policy fine print carefully. Compare plans and reviews to find one that suits your pet’s needs and your budget. Don’t hesitate to ask questions about coverage details, the claims process, and customer service experiences. Remember, the goal is to ensure your pet receives the best care possible while providing financial peace of mind for you as an owner.

Q7: How can more people be encouraged to purchase pet insurance?

A7: Raising awareness through educational initiatives is key. Engaging pet communities, sharing testimonials, and utilizing social media to showcase real-life stories of pet owners who benefited from insurance can create a positive narrative. Additionally, incorporating pet insurance discussions during routine veterinary visits could help demystify the process and provide valuable insights directly from trusted caregivers.

In embracing pet insurance,you’re not just protecting your furry family members; you’re also contributing to a more responsible and informed pet ownership culture. So if you haven’t explored your options yet, now may be the time to consider how you can provide the best care for your beloved pet!

Wrapping Up

In a world where our furry friends are cherished members of the family, the rise in pet insurance is more than just a trend; it’s a responsible choice that reflects our deep commitment to their well-being. As we’ve explored, the unpredictable nature of health issues and the rising cost of veterinary care can turn the joy of pet ownership into a daunting financial burden. By investing in pet insurance, you’re not only safeguarding your pet’s health but also securing peace of mind for yourself.as you consider your options, remember that pet insurance can offer protection against the unexpected, allowing you to focus on what truly matters: the love and companionship your pet brings into your life. With various plans available tailored to different needs and budgets,finding the right coverage has never been more accessible.

So, if you haven’t already, now might just be the perfect time to explore how pet insurance can fit into your life. After all, securing your pet’s future is a gift that comes with not only protection but also the freedom to enjoy every moment together, worry-free. it’s not just about insurance; it’s about ensuring that your pet receives the best care possible, today and always.