in an ever-evolving world where the bond between humans and their pets strengthens daily,the idea of securing a furry friend’s health and well-being has taken center stage. As we step into 2025, the landscape of pet care is transforming, and so too are the options available to pet owners. Among these,pet insurance emerges as a vital resource for safeguarding our loyal companions against unforeseen medical challenges. While the decision to invest in pet insurance can seem daunting, understanding its myriad benefits can illuminate its pivotal role in modern pet ownership. In this article, we delve into the top seven advantages of getting pet insurance in 2025, exploring how it not only eases financial burdens but also fosters peace of mind, allowing pet parents to focus on what truly matters: the happiness and health of their beloved pets.

Understanding the Evolving Landscape of Pet Healthcare Costs

the veterinary industry is in a constant state of flux, influenced by advancements in technology, shifts in consumer demand, and the financial realities of pet ownership.As pet owners become more aware of the diverse treatment options available for their furry companions, healthcare costs have risen correspondingly. These costs encompass everything from routine check-ups and vaccinations to specialized treatments and emergency care. Understanding this evolving landscape is crucial for pet owners as they make informed decisions about their pets’ health and financial security.

One of the primary factors driving the increase in pet healthcare costs is the high level of innovation in veterinary medicine. With new diagnostic tools, cutting-edge surgical techniques, and advanced treatment options, pet owners now have access to a level of care that rivals human healthcare. Though, this greater availability frequently enough comes with a higher price tag. Moreover, as pets live longer due to improved healthcare, chronic conditions that require ongoing management are becoming more prevalent.This reality necessitates a robust financial plan to address potential healthcare expenses.

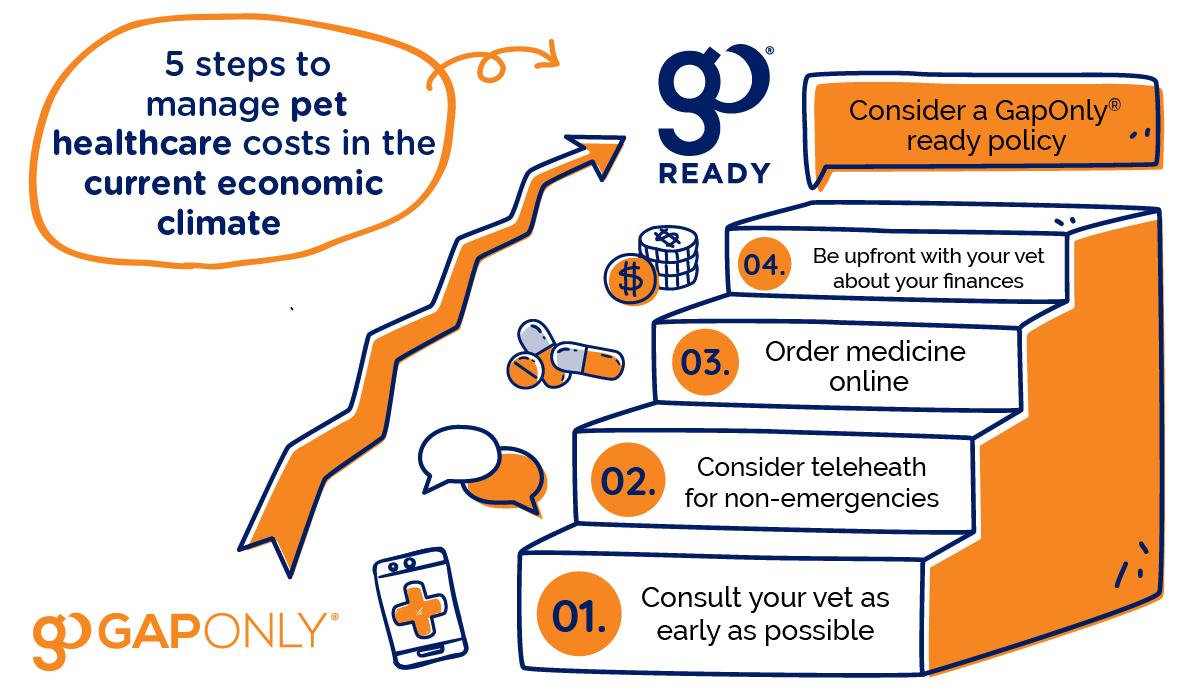

In light of these trends,many pet owners are increasingly recognizing the importance of pet insurance as a safeguard against the unpredictable nature of healthcare costs. With pet insurance,owners can alleviate some of the financial burdens associated with unexpected illnesses and accidents. Key benefits include:

- Cost Management: Helps mitigate the stress of sudden,high veterinary bills.

- Comprehensive Coverage: Frequently enough includes wellness visits,emergencies,and even choice therapies.

- Peace of Mind: Ensures that money doesn’t become a barrier to getting necessary care.

- Customization: Offers plans that can be tailored to specific needs and budgets.

- Improved Access to Specialists: Insurance allows for referrals to specialists without hesitation.

Comprehensive coverage for Unexpected emergencies

When faced with unexpected emergencies, having comprehensive insurance coverage for your pet can be a lifesaver—both emotionally and financially. Veterinary costs can skyrocket in emergencies, making it crucial to be prepared.A pet insurance plan designed for unforeseen events helps alleviate the burden, allowing pet owners to focus on what truly matters: their furry friends. Imagine a sudden illness or an accident requiring immediate treatment; insurance ensures that the necessary care is accessible without hesitation.

Even though preventative care is essential, it’s the unpredicted incidents that frequently enough cause the most anxiety for pet owners. Emergencies can range from accidents,such as a dog being hit by a car,to sudden health conditions like pancreatitis requiring urgent care. Comprehensive pet insurance typically covers a wide array of unexpected events, enabling pet owners to receive treatment options and surgical procedures without compromising their financial stability. This means that pet owners can make informed decisions without the stress of considering costs each step of the way.

Additionally, many pet insurance plans come equipped with features that extend beyond basic coverage. These may include:

- 24/7 access to veterinary advice: Most plans offer round-the-clock assistance to help guide you through emergencies.

- Coverage for alternative therapies: Some insurance options include holistic treatments, such as acupuncture or physical therapy, which can be beneficial during recovery.

- No waiting periods: Certain policies provide immediate coverage, allowing you to act swiftly in emergencies.

In the face of unpredictable circumstances, these features can not only expedite care but also foster peace of mind for pet owners who want to ensure their companions receive the best treatment possible.

Peace of Mind for Pet Owners and Financial Stability

For pet owners,the emotional bond with their furry companions is invaluable. However, this relationship often comes with financial uncertainties, especially when unexpected health issues arise. Pet insurance offers a pathway to achieve peace of mind by ensuring that the costs associated with veterinary care do not lead to overwhelming financial strain. By having a safety net in place, pet owners can focus more on their pets’ well-being rather than worrying about how to afford necessary treatments. The freedom to make health decisions without the burden of cost constraints can substantially enhance the overall experiance of pet ownership.

Moreover, pet insurance contributes to financial stability by allowing pet owners to budget more effectively for their pet care expenses. With a fixed monthly premium, owners can predict their financial obligations, making it easier to manage household finances. This proactive approach helps to plan for unexpected incidents without derailing financial goals such as saving for a home, retirement, or emergencies. The combination of predictable costs and the ability to seek top-notch veterinary care is a compelling reason to consider pet insurance.

Furthermore, many pet insurance policies include wellness plans that cover routine care, such as vaccinations, dental cleanings, and even behavioral training. This not only promotes preventive health care but also allows pet owners to invest in their pets’ overall quality of life. By taking advantage of comprehensive coverage, owners can avoid the trap of escalating costs that often accompanies untreated health conditions. Below is a concise overview of the impact that pet insurance can have on financial planning:

| Expense Type | Without Insurance | With Pet Insurance |

|---|---|---|

| Routine Check-ups | Up to $300/year | Covered under wellness plan |

| Emergency Visits | $1,000 or more | Typically a deductible plus co-pay |

| Medication Costs | Varies, can exceed $500 | Reimbursed with claims |

| Specialist Consultations | Up to $2,000 | Covered after deductible |

the dual benefit of peace of mind and financial stability is a meaningful advantage for pet owners who choose to invest in pet insurance. This strategic decision creates a more enjoyable and less stressful pet ownership experience by minimizing financial anxiety and maximizing care options. Ultimately, knowing you can provide the best care possible without crippling your finances can truly transform the way you interact and bond with your pet.

Access to a Wider Range of Veterinary Services

When you invest in pet insurance, you unlock access to a broader range of veterinary services that may have previously been out of reach due to budget constraints. Many pet owners find themselves faced with tough decisions when it comes to their furry companions’ health. With an insurance plan in place, you can confidently explore various treatment options without the financial burden looming over your head. This ensures that your pets receive the best possible care when they need it most.

Additionally, pet insurance often covers an extensive list of treatments and services, from routine exams to specialized care. This includes:

- Emergency services: Coverage for unexpected accidents and illnesses.

- Preventative care: Vaccinations, dental cleanings, and annual wellness exams.

- Chronic condition management: Ongoing treatments for conditions like diabetes or arthritis.

- Specialty care: Access to specialized veterinary services,including oncology or cardiology.

This enhanced access means that you can not only seek routine check-ups but also consult with specialists for comprehensive treatment plans. With pet insurance, it becomes easier to follow your veterinarian’s recommendations for advanced diagnostics such as MRI and CT scans or even surgical procedures that may have seemed financially daunting. having insurance lets you prioritize the health and well-being of your pets without hesitation, ensuring they receive optimal care tailored to their unique needs.

Preventive Care and Well-being Incentives

investing in pet insurance is not just about preparing for the unexpected; it’s also a proactive step towards ensuring the long-term wellness of your furry friends. Many insurance plans now offer preventive care options that cover routine checks, vaccinations, and screenings. These services can enhance your pet’s quality of life by identifying potential health issues before they escalate into serious problems. Regular visits to the veterinarian with the support of insurance can lead to early diagnosis and treatment, saving both lives and money in the long run.

Moreover, pet insurance frequently enough comes with well-being incentives that reward you for maintaining your pet’s health. Some providers offer discounts or cashback for completing wellness visits, vaccinations, or other preventive services. This approach encourages pet owners to engage in regular care practices that contribute to their pets’ longevity and overall happiness. As an example, you may receive financial incentives for participating in pet wellness programs or for purchasing healthy food and supplements. Such features not only promote the well-being of your pet but also make pet ownership more affordable and rewarding.

comprehensive pet insurance policies can provide access to an array of additional resources for pet owners, such as educational materials and online consultations with veterinarians. These resources empower you to make informed decisions about your pet’s health and nutrition. By being proactive with preventive care benefits, you can develop a well-rounded approach to your pet’s health, ensuring they lead a fulfilling and vibrant life. The combination of routine care and the fiscal benefits of insurance creates a safety net that many pet owners find invaluable in navigating the responsibilities of pet parenthood.

Choosing the Right Pet Insurance Plan for Your Needs

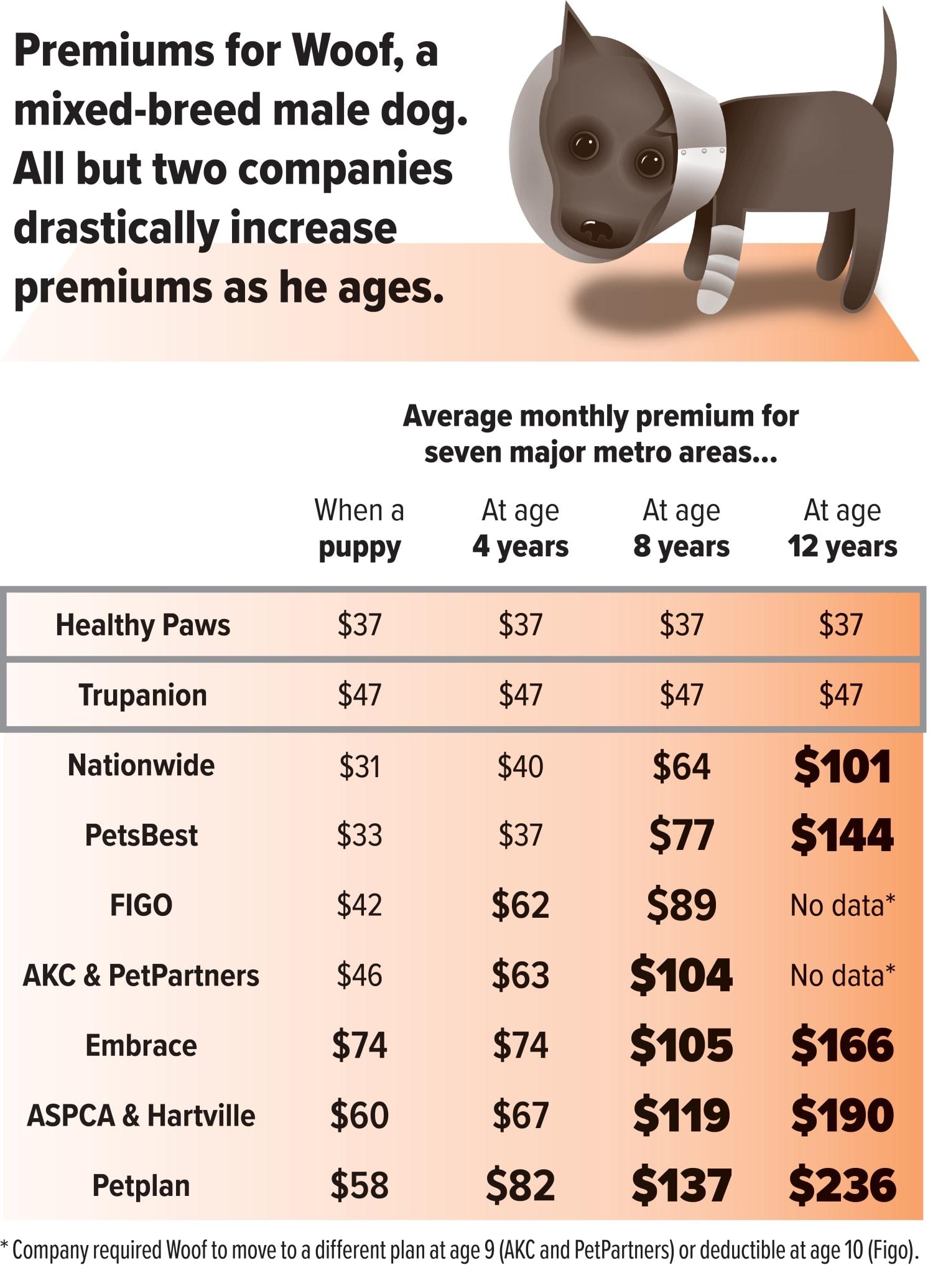

Selecting the perfect pet insurance plan can feel overwhelming,but understanding your specific needs can help streamline the process. Start by assessing your pet’s health history and lifestyle. If your furry friend has pre-existing conditions, it may limit your options, so make sure to choose a policy that offers coverage for such situations. Similarly, consider the breed and age of your pet; some breeds are predisposed to certain health issues, which can influence your choice of plan. Additionally, evaluate how frequently enough you visit the vet—if your pet requires regular check-ups or has chronic conditions, a plan with a lower deductible and higher coverage limits might potentially be more beneficial.

Look for plans that offer flexible coverage options to tailor your policy to your needs. Many providers allow you to select from a variety of coverage levels, so you can choose the right balance between premium costs and out-of-pocket expenses. Some plans cover only accidents, while others include wellness care—such as vaccinations and dental care—so think about what is most important for your pet’s health. Compare the coverage details amongst diffrent providers, focusing on the following key factors:

- Annual limits: Ensure the plan doesn’t cap essential reimbursements that you might need over a year.

- Waiting Periods: Be aware of any waiting periods before coverage begins.

- Exclusions: understand what is not covered under the plan.

- Reimbursement Rates: check the percentage of your veterinary bills that will be reimbursed.

It’s also wise to consult customer reviews and testimonials regarding potential insurance providers, as these can offer insight into the reliability of their claims process and customer service. Read through various forums and ratings to see how other pet owners have fared when making claims. Lastly, don’t hesitate to ask your veterinarian for recommendations—they often have firsthand experience with insurers and can guide you towards reputable options. Keep in mind that investing time in research now can save you headaches and unexpected costs in the future, ensuring that you and your pet enjoy peace of mind regarding their health care.

Q&A

Q&A: Top 7 Benefits of Getting Pet Insurance in 2025

Q1: Why should pet owners consider getting pet insurance in 2025?

A1: In 2025,as veterinary costs continue to rise alongside advancements in pet healthcare,pet insurance provides a safety net for unexpected expenses. It helps ensure that your furry companions receive the best care possible without the burden of hefty out-of-pocket costs.

Q2: How does pet insurance help in emergency situations?

A2: Pet insurance can be a lifesaver during emergencies, covering critical treatments and procedures that may arise unexpectedly. This means pet owners can focus on their pet’s well-being rather than worrying about how to finance urgent medical care.

Q3: Are there specific ailments or conditions that pet insurance covers more comprehensively?

A3: Most comprehensive pet insurance plans cover a wide range of conditions, including accidents, illnesses, and some hereditary conditions. In 2025,many plans have also started to include coverage for chronic conditions and preventive care,which can save owners significant amounts in treatment costs.

Q4: What financial benefits do pet owners gain from investing in pet insurance?

A4: Pet insurance can significantly reduce the financial strain of unexpected veterinary bills. By paying a predictable monthly premium, pet owners can avoid crippling expenses that arise from emergency surgeries or long-term treatments, making budgeting easier and more manageable.

Q5: Does having pet insurance give access to a wider network of veterinary services?

A5: Yes, many pet insurance providers partner with an extensive network of veterinary professionals and specialists. This means pet owners have greater flexibility and access to a variety of high-quality services, ensuring their pets receive the best care without the worry of excessive costs.

Q6: Can pet insurance contribute to preventive care?

A6: Absolutely! Many modern pet insurance plans in 2025 include options for wellness and preventive care, such as vaccinations, routine check-ups, and dental cleanings.This proactive approach not only keeps pets healthier but also helps identify potential health issues before they become serious.

Q7: How can pet owners choose the right insurance plan for their pets?

A7: When selecting a pet insurance plan, pet owners should consider factors like coverage options, breed-specific exclusions, waiting periods, deductibles, and policy limits. It’s essential to read reviews and compare different plans to find one that fits both the pet’s needs and the owner’s budget.Don’t hesitate to ask questions to clarify any uncertainties!

—

By understanding these benefits and considerations, pet owners in 2025 can make informed decisions that enhance the health and happiness of their beloved companions.

To Wrap It Up

as pet ownership continues to rise in 2025, the importance of securing pet insurance cannot be overstated. The benefits outlined in this article highlight not only the financial relief that insurance can provide in times of unexpected medical emergencies but also the peace of mind that comes from knowing your beloved companion is protected. From comprehensive coverage options to the ability to choose your own veterinarian, pet insurance proves to be a valuable investment in the health and happiness of your furry friends. As you embark on this journey of responsible pet ownership, consider how a policy tailored to your pet’s needs can enhance both your lives. After all, their well-being is worth every consideration, and with the right insurance in place, you can focus more on the moments that truly matter—those priceless experiences shared with your four-legged family members.