When it comes to our furry companions, ensuring their health and happiness is a top priority for many pet owners. However, the costs of veterinary care can quickly add up, leaving even the most devoted pet parent feeling financially strained. This is where pet insurance enters the picture, offering a safety net that can protect against unexpected expenses. But with a plethora of providers vying for your attention, how do you choose the one that truly meets your needs? In this article, we delve into the best pet insurance providers available today, comparing their coverage options, benefits, and customer satisfaction. Whether you’re the proud owner of a playful puppy or a wise old cat, our extensive guide will help you navigate the complexities of pet insurance, ensuring that you make an informed decision for your beloved companion. Join us as we explore which one is right for you and discover how you can secure peace of mind for both you and your pet.

Understanding Pet Insurance Basics and Benefits

Pet insurance can be a lifeline for pet owners, providing peace of mind in the face of unexpected veterinary expenses.It operates similarly to health insurance for humans, covering a range of medical services for your furry family members. By paying a monthly premium, you can shield yourself from hefty bills that stem from accidents, illnesses, or routine care. It’s essential to recognize that not all policies are created equal, and understanding the terms can be pivotal in making the right choice for your pet.

When considering pet insurance, it’s crucial to be aware of the various types of coverage available. Policies typically fall into three primary categories:

- Accident-Only Plans: These plans cover injuries resulting from accidents, such as fractures or ingesting foreign objects.

- Complete Care Plans: These comprehensive options often cover accidents, illnesses, and may also include preventive care like vaccinations and wellness check-ups.

- Lifetime Plans: Offering coverage throughout your pet’s life for chronic conditions, these plans can be ideal for pets prone to long-term health issues.

Additionally, understanding key components of pet insurance will empower you to make informed decisions. Consider pivotal factors such as:

| Factor | Description |

|---|---|

| Deductible: | The amount you pay out-of-pocket before the insurance begins to cover expenses. |

| Reimbursement Rate: | The percentage of the total cost covered by the insurance after the deductible is met. |

| Annual Limit: | The maximum amount an insurer will pay per year for covered conditions. |

Having a clear understanding of these fundamental aspects ensures that you select a plan tailored to your pet’s needs. Remember, the goal of pet insurance is to alleviate the financial burden of unexpected veterinary care, allowing you to focus on what truly matters—keeping your beloved pet healthy and happy.

Comparing Coverage options: What to Look For

When diving into the world of pet insurance,it’s essential to assess coverage options that best align with your pet’s specific needs and your financial capabilities. Each provider offers its set of choices, so understanding the details can prevent unwelcome surprises when a vet visit arises. Start by examining the types of coverage offered, which can generally be categorized into three primary areas:

- Accident-Only Coverage: Ideal for those who want basic protection against unforeseen accidents.

- Comprehensive Coverage: Covers accidents,illnesses,and frequently enough additional services like wellness visits and preventive care.

- Wellness Plans: Focuses primarily on routine care, including vaccinations and annual check-ups.

Another crucial factor to consider is the deductible and reimbursement levels. Insurers may present diffrent deductible options, which can significantly affect your premium and out-of-pocket expenses.Here’s how these aspects generally break down:

| Deductible Type | Description | Impact on Premium |

|---|---|---|

| Annual Deductible | Fixed amount to be paid yearly before coverage kicks in. | Higher deductible typically lowers the premium. |

| Per Incident Deductible | Applies each time your pet needs care for a new issue. | Can lead to higher overall costs for multiple incidents. |

| Percentage Reimbursement | The percentage of the costs paid back after the deductible is met. | Higher percentage means higher premium, but less out-of-pocket. |

evaluate the exclusions and waiting periods associated with each policy.Some providers impose specific exclusions, such as pre-existing conditions or certain hereditary issues, which can significantly affect the overall usefulness of the policy. Waiting periods—time frames during which you cannot make a claim—can vary between providers and must be factored into your decision-making process. As you compare plans, keep an eye out for:

- Pre-existing Conditions: Understand how your chosen provider handles these conditions.

- Hereditary Conditions: Some plans will cover ailments common in certain breeds, while others won’t.

- Waiting Periods: Look for those that offer shorter wait times to access coverage, particularly for urgent care.

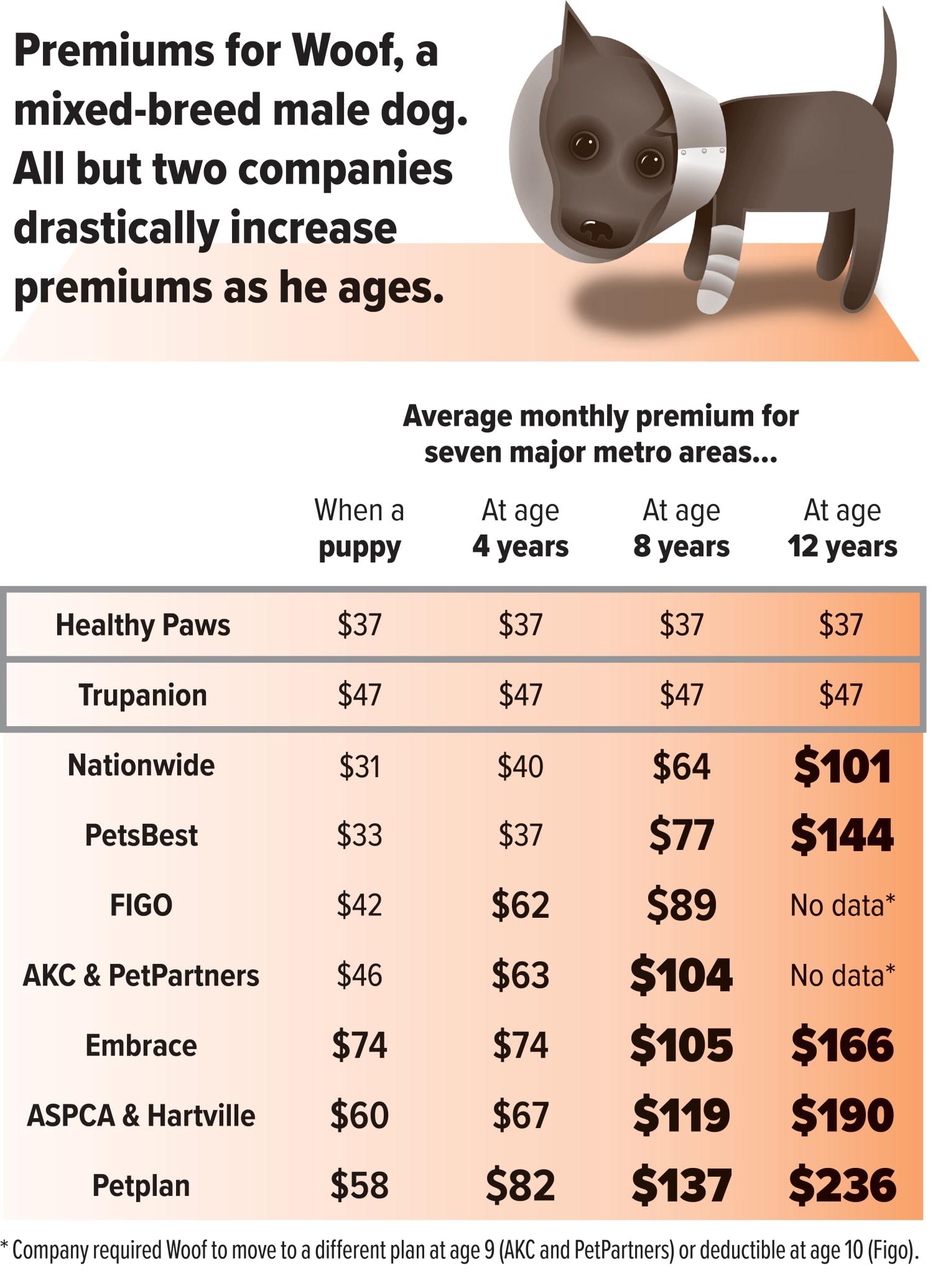

Evaluating Cost and Premiums: Finding Your Budget Fit

When it comes to choosing the right pet insurance plan, understanding costs and premiums is crucial. various factors come into play when calculating these expenses, including the age and breed of your pet, the type of coverage you opt for, and any pre-existing conditions that may apply. Pet insurance premiums can vary widely from one provider to another,so it’s essential to conduct thorough research to find a plan that aligns with your financial situation without sacrificing your pet’s needs.

To tailor your insurance choices effectively, consider the following elements:

- Deductibles: Assess whether a higher deductible paired with lower premiums works best for your budgeting style, or if lower deductibles with slightly higher monthly payments provide peace of mind.

- Coverage Limits: Ensure you comprehend the annual and lifetime limits imposed by your chosen policy, as these directly affect out-of-pocket expenses in case of a medical emergency.

- Co-Pays: Understand your co-pay percentages, especially for specific treatments or medications, to have a clear picture of what your final costs will be when faced with an unexpected vet visit.

To help visualize how different plans might stack up against one another, here’s a simple comparison of average premiums with varying levels of coverage:

| Premium Type | Monthly Cost | Annual Deductible | Coverage Limit |

|---|---|---|---|

| Basic Plan | $30 | $500 | $5,000 |

| Standard Plan | $40 | $300 | $10,000 |

| Comprehensive Plan | $60 | $100 | Unlimited |

Ultimately, the key to finding a budget-amiable pet insurance policy is balancing cost with the quality of coverage.It’s vital not only to look at premiums but also to consider factors like customer service,claim processing times,and the ease of understanding policy details. Many providers even offer customizable plans, allowing you to find a perfect fit for your financial and coverage needs, ensuring that you’re not left with surprises when it comes to your pet’s well-being.

Claims Process and Customer Service: Ensuring a Smooth Experience

When selecting a pet insurance provider, one of the critical factors to consider is the efficiency of their claims process. A streamlined claims experience can make a meaningful difference during stressful times, particularly when your furry friend needs medical care. Most reputable pet insurance companies offer both online and mobile app options for claim submissions, which can ease the burden.look for providers that allow you to submit claims digitally, track the status of your claims, and receive payments directly into your bank account, thus ensuring the entire process is more manageable and less anxiety-inducing.

Customer service is equally vital when it comes to managing your pet insurance. Speedy and responsive support can help clarify policy details, navigate complex claims, and address any concerns you may have. Many providers offer 24/7 customer support through various channels such as:

- Phone support: Speak directly to an agent for immediate assistance.

- Live chat: Use the chat feature on the website or app for quick inquiries.

- Email support: Send detailed questions and receive thoughtful responses.

- Social media: Reach out via platforms like Twitter and Facebook for prompt replies.

To further assist in evaluating the customer service quality across different providers, it can be helpful to reference consumer satisfaction ratings. Many autonomous organizations and pet insurance comparison sites provide feedback on the overall customer experience, with particular focus on:

| Provider | Customer Satisfaction Rating | Average claim Processing Time |

|---|---|---|

| Provider A | 4.8/5 | 5 days |

| Provider B | 4.5/5 | 7 days |

| Provider C | 4.0/5 | 10 days |

| Provider D | 4.9/5 | 4 days |

Ultimately, a good claims process and responsive customer service can greatly enhance your experience with pet insurance. As you compare providers, consider not just the coverage details and pricing, but also how quickly and easily they can assist you during a claim. A seamless experience can reduce your stress and ensure you focus on what truly matters—caring for your beloved pet.

Analyzing Customer Reviews and Satisfaction ratings

Understanding customer reviews and satisfaction ratings is crucial for any potential pet insurance buyer. These insights not only help in gauging the quality of service offered by various providers but also shed light on the experiences of fellow pet owners. When analyzing these reviews,consider the following key aspects:

- Claims Process: Many customers highlight the effectiveness and ease of the claims process. Look for providers that have straightforward procedures and prompt reimbursements,as long waits can lead to frustration,especially in critical situations.

- Customer Support: Positive experiences with customer support teams are frequently mentioned in reviews. Effective communication, helpfulness, and knowledge of the staff can enhance the overall customer experience and peace of mind.

- Coverage Options: Pet owners often discuss the adequacy of coverage plans. Review how well each provider meets various needs, whether for routine care, accidents, or chronic illnesses. The breadth of options can greatly impact customer satisfaction.

To give a clearer picture, we can analyze ratings from multiple sources. Below, we present a simple table of average customer ratings across three popular pet insurance providers. This will help you visualize how these companies stack up against one another:

| Provider | Customer Rating (out of 5) | percentage of positive Reviews |

|---|---|---|

| Provider A | 4.5 | 85% |

| Provider B | 3.9 | 75% |

| Provider C | 4.8 | 90% |

Furthermore, it’s significant to not only rely on overall ratings but also delve into specific testimonials. Many customers share detailed accounts of their experiences, providing nuanced views that can help others make informed decisions. positive feedback frequently enough centers around the claims experience, while negative reviews may mention unexpected exclusions or coverage lapses. Reading a diverse range of testimonials from various platforms can definitely help create a holistic view of each provider’s strengths and weaknesses.

Recommendations Based on Pet Types and Specific Needs

When selecting a pet insurance provider, it’s crucial to align your choice with your pet’s specific needs and type. Dogs often come with distinct health concerns based on their breed, age, and lifestyle. As a notable exmaple, larger breeds like Great Danes or Rottweilers are prone to conditions such as hip dysplasia, while smaller breeds like Chihuahuas may face dental issues. Thus,consider providers that offer customizable plans with options for preventive care—like routine dental cleanings or breed-specific health coverage. Some recommended insurers that cater well to dogs include:

- Healthy Paws: Known for comprehensive coverage and no upper age limit.

- Embrace Pet Insurance: Offers wellness rewards for routine care.

- Petplan: Covers a wide range of hereditary conditions.

Cats have their own set of quirks and care requirements,often leading to different health issues compared to dogs. Conditions like chronic kidney disease and hyperthyroidism are common in older cats. When looking for pet insurance for felines, it’s essential to choose one that encompasses both accidents and illnesses along with preventive care management. for cats, consider these providers:

- Figo Pet Insurance: Great for comprehensive coverage and flexible plan options.

- Nationwide: Offers an extensive range of plans, including coverage for exotic pets.

- ASPCA Pet Health insurance: Good for affordable plans with extensive coverage.

For owners of exotic pets like reptiles, birds, or small mammals, finding suitable insurance can be more challenging due to fewer available options. However, some insurers specialize in coverage tailored for these unique types. It’s important to ensure your provider covers specific conditions and appropriate care, which can differ significantly from traditional pets. Noteworthy companies to consider for exotic pets include:

| Provider | Coverage Type | Notes |

|---|---|---|

| PetPremium | Accidents & Illnesses | Includes coverage for reptiles and birds |

| Exotic Pet Insurance | comprehensive | Tailored plans for various exotic species |

| Nationwide | Accidents & Wellness | Also covers small mammals |

Q&A

Q1: What is pet insurance and why is it important?

A1: Pet insurance is a type of policy designed to mitigate the financial burden of veterinary care. It helps cover the costs of unexpected medical expenses due to accidents or illnesses. given the rising costs of veterinary treatment, having a reliable pet insurance policy can offer peace of mind and allow pet owners to focus on their furry companions’ health rather than their bank balance.

Q2: How do I choose the best pet insurance provider for my needs?

A2: To find the ideal pet insurance provider, start by assessing your specific needs: consider your pet’s age, breed, and pre-existing health conditions. Look for a provider that offers comprehensive coverage, flexible plans, and a transparent claims process. Also, evaluate customer reviews, coverage limits, deductibles, and waiting periods to ensure that the policy aligns with your expectations.

Q3: What types of coverage can I expect from pet insurance providers?

A3: Most pet insurance providers offer several types of coverage, including accident-only plans, which cover injuries from accidents, and comprehensive plans that cover accidents and illnesses. Some also offer wellness plans that include routine care like vaccinations and annual check-ups.Be sure to read the fine print, as what’s included can vary significantly from one provider to another.

Q4: Are there any common exclusions I should be aware of?

A4: Yes, many pet insurance policies come with common exclusions. Pre-existing conditions are typically not covered, meaning any health issues present before the policy starts won’t be eligible for claims. Other exclusions may include breed-specific conditions, certain hereditary conditions, or treatments like cosmetic surgeries. Always review the policy details to be fully informed.

Q5: How do premium costs vary between different providers?

A5: Premium costs can vary widely based on several factors, including your pet’s age, breed, and health status, and also the type of coverage you select. Providers also consider geographic location and reimbursement options. It’s wise to compare quotes from multiple insurers and see what’s included in each plan to assess which offers the best value for your budget.

Q6: What should I do if my pet has a pre-existing condition?

A6: If your pet has a pre-existing condition, it’s crucial to research which companies offer the best options for ongoing care. Some insurers will cover treatment for conditions that have been resolved for a certain period. You can also look for providers that offer coverage for conditions that may develop after the policy takes effect, which can provide added security for your pet.

Q7: How do claims process and waiting periods work?

A7: The claims process generally involves submitting your vet’s invoice along with a claim form to your insurance provider. Most insurers offer an online portal or app for easy submission. regarding waiting periods,these are the times between when your policy starts and when coverage kicks in,typically lasting from a few days to several weeks,depending on the type of coverage. Familiarize yourself with these details as they can impact your ability to utilize the insurance.

Q8: Once I sign up, is my rate locked in?

A8: Generally, your rate will not be locked in for the life of your pet. Pet insurance premiums can increase annually based on factors such as your pet’s age, the cost of veterinary care, and the insurer’s overall claims experience. Keep an eye on how your rates change each year, and be sure to reassess your options during the renewal period.

Q9: Can pet insurance save me money in the long run?

A9: While pet insurance involves regular premium payments,it can save you significant sums during critical moments. by covering unexpected health issues or emergencies, pet insurance can prevent out-of-pocket costs from becoming overwhelming. By comparing different plans and carefully considering your pet’s healthcare needs, you can find a policy that balances affordability and comprehensive coverage.

Q10: What resources can help me compare pet insurance providers?

A10: To effectively compare providers, you can utilize online comparison tools, read consumer reviews, and consult forums or pet care websites. Many websites offer side-by-side comparisons of coverage options, customer satisfaction ratings, and pricing. Local veterinarians may also provide recommendations based on their experiences with different insurance companies and the claims process.—

This Q&A structure aims to clarify the complexities of pet insurance while guiding readers through critically important considerations in their quest to find the right provider for their beloved pets.

The Conclusion

As we navigate the world of pet ownership, ensuring our furry companions are protected against unforeseen medical expenses becomes a paramount concern. The right pet insurance can be a game-changer, offering peace of mind in times of need. By diving into the diverse options and comparing the leading providers, we hope this article has illuminated the myriad of choices available to you.

Ultimately, the best pet insurance provider hinges on your unique circumstances, preferences, and the specific needs of your beloved pet. Whether you prioritize comprehensive coverage, budget-friendly plans, or exceptional customer service, we encourage you to take the time to assess what truly matters most to you.

As you embark on this journey of safeguarding your pet’s health and well-being, remember that informed decisions lay the foundation for happier—and healthier—tails. Thank you for joining us on this exploration, and may you find the perfect policy that aligns seamlessly with both your needs and your pet’s vibrant life. Happy insuring!