As pet ownership continues to flourish,so does the necessity for responsible caregiving that extends beyond regular vet visits adn nutritious meals. One crucial aspect many pet parents are increasingly considering is pet insurance—an investment designed to protect both furry companions and their owners from unexpected health expenses. But as 2025 unfolds, many potential policyholders find themselves grappling with a pivotal question: How much does pet insurance actually cost? in this complete price breakdown, we will explore the factors influencing premiums, compare different plans, and provide insights that can help pet owners make informed decisions tailored to their pets’ unique needs. Whether you’re a seasoned pet parent or a new adopter, understanding the financial landscape of pet insurance is essential in safeguarding your four-legged family members. Join us as we delve into the realm of pet insurance costs and uncover what you can expect in the year ahead.

Understanding the Factors That Influence Pet Insurance Costs

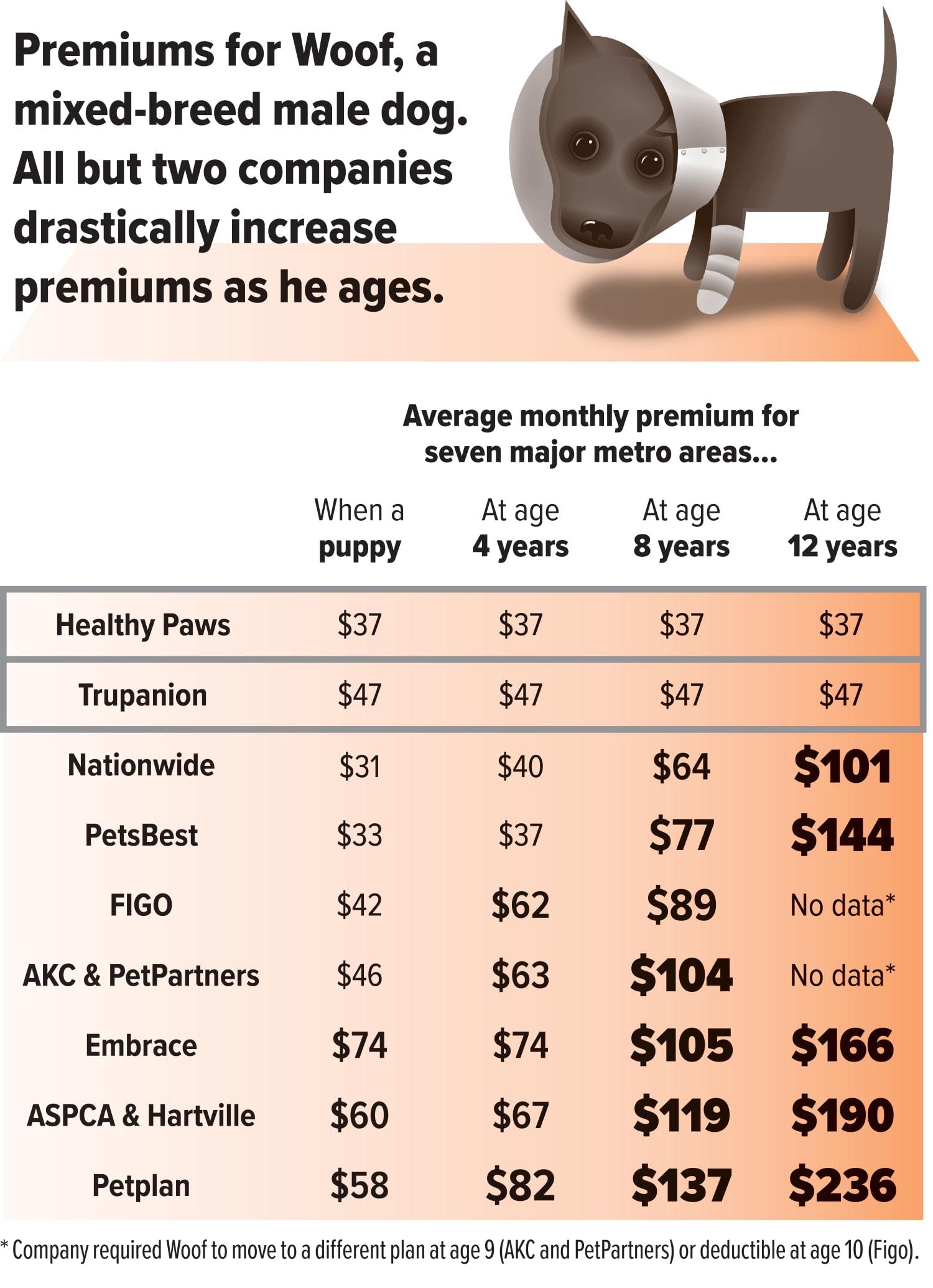

When considering pet insurance,various factors play a crucial role in determining the overall costs. Age is a significant factor; typically, younger pets are less expensive to insure than older ones, as they’re generally healthier and less prone to chronic conditions. As pets age,they become more susceptible to various health issues,leading to higher premiums. Similarly, the breed of your pet can dramatically influence insurance costs. Purebreds are more likely to encounter breed-specific health problems, which can lead to increased insurance costs compared to mixed-breed pets.

Another critical factor is the type of coverage selected.Pet insurance can range from basic accident-only plans to comprehensive policies that cover a variety of health issues, including routine care, preventive treatments, and alternative medicine. Choosing a plan that matches your pet’s specific needs will not only affect your monthly premiums but also out-of-pocket expenses during a medical emergency. Additionally, deductibles, co-pays, and coverage limits vary considerably across insurance providers, requiring a careful review of policy details to understand how these components will affect your overall cost.

Location also plays a vital role in determining how much you’ll pay for pet insurance. The cost of veterinary care varies greatly from one region to another; areas with higher living costs typically have more expensive vet services, resulting in higher insurance premiums. It’s essential to evaluate local veterinarian prices and compare them with what different insurance providers offer in terms of coverage and pricing. For a more comprehensive understanding, consider the following key considerations that can affect your pet insurance costs:

| Factors | Impact on Costs |

|---|---|

| Age of Pet | Older pets typically incur higher premiums |

| Breed Characteristics | Specific breeds may be prone to costly health issues |

| Type of Plan | More comprehensive plans are generally more expensive |

| Geographic Location | Costs of vet services vary by region |

Comparing Premiums Across Different Pet Types and Breeds

When it comes to determining the cost of pet insurance,one of the most significant factors is the type and breed of the animal. Premiums can vary widely depending on the pet’s specific characteristics and needs. Generally, larger breeds or those prone to hereditary conditions may attract higher premiums due to the increased risk associated with treating their potential health issues. For instance, breeds like Great Danes and German Shepherds often come with hefty insurance rates compared to smaller, less problematic breeds like French Bulldogs or Beagles.

Furthermore, the differences in premiums extend beyond just the size and breed. Multiple other criteria also impact the final insurance quotes.Some of these include:

- Age: Older pets tend to have higher premiums due to increased risks of health issues.

- Pre-existing Conditions: Pets with prior health problems might not be eligible for some coverage, affecting limitations and premiums.

- Geographical Location: Veterinary costs vary geographically; thus, the location of the pet owner plays a substantial role.

- Insurance Providers: Different providers offer varied premiums and coverage options, which can dramatically influence price.

| Pet Type | Average monthly Premium (USD) | Sample Breeds |

|---|---|---|

| Dog | $50-$100 | Golden Retriever,Bulldog,Dachshund |

| cat | $30-$60 | Persian,Maine Coon,Siamese |

| Exotic Pets | $20-$50 | Parrots,Ferrets,reptiles |

| Small Mammals | $10-$30 | Hamsters,Guinea pigs,Rabbits |

As observed,pet insurance premiums can range widely even within the same category,making it essential for pet owners to do thorough research. For example, a healthy Labrador retriever might have a lower premium than a French bulldog, despite both being popular breeds. Owners of more exotic pets like reptiles may find their premiums significantly lower, not only due to lower health risks but also due to lesser veterinary needs compared to dogs and cats. As pet health care continues to evolve, understanding these variables is pivotal in budgeting for comprehensive coverage.

Analyzing Coverage Options: What Does Your Policy Really Include?

When evaluating pet insurance,a crucial step is to delve into the intricacies of what your policy truly covers.Many pet owners find themselves overwhelmed by the myriad of terms and conditions, often missing out on vital details that could have significant implications. Thus, it is indeed essential to thoroughly examine the following components of your coverage:

- Accident and Illness Coverage: Most standard policies encompass the costs associated with unexpected accidents and a variety of illnesses, including minor ailments and serious diseases.

- Routine Care Add-Ons: Many insurers offer options for routine care that can cover preventive services such as vaccinations, dental cleanings, and annual check-ups. These add-ons can enhance your policy significantly.

- Exclusions and Limitations: Always pay close attention to what is excluded from your policy. This could include pre-existing conditions, specific breed-related issues, or conditions that occur in older pets.

furthermore, understanding the nuances of deductibles, copayments, and coverage limits is vital to grasp how costs will work in practice. policies can vary widely, with some featuring:

- Annual Limits: Some plans impose caps on payouts for each year, which could affect your pet’s long-term treatment.

- Per-Condition Limits: Certain insurers may limit the total amount they will reimburse for a specific condition, creating a financial burden in the event of chronic illnesses.

- lifetime Limits: Look out for lifetime caps, where the total payout for your pet’s life (or per condition) is capped, which can be a critical consideration for pets with ongoing health issues.

The cost of pet insurance varies widely based on these factors. As you conduct your research, consider the following table that outlines average monthly premiums for different types of pets in 2025:

| Pet Type | Average Monthly Premium |

|---|---|

| Dog (Small Breed) | $40 |

| dog (Large Breed) | $70 |

| Cat | $30 |

| Exotic Pets | $50 |

Understanding these aspects of pet insurance will aid in making an informed decision — one that not only fits your budget but also ensures that your furry friend receives the care they deserve. By discerning what is included in your policy and what additional options may be necessary, you can better navigate the sometimes puzzling world of pet insurance and find the perfect plan tailored to your needs.

The Impact of Deductibles and Co-Payments on Your Overall Expenses

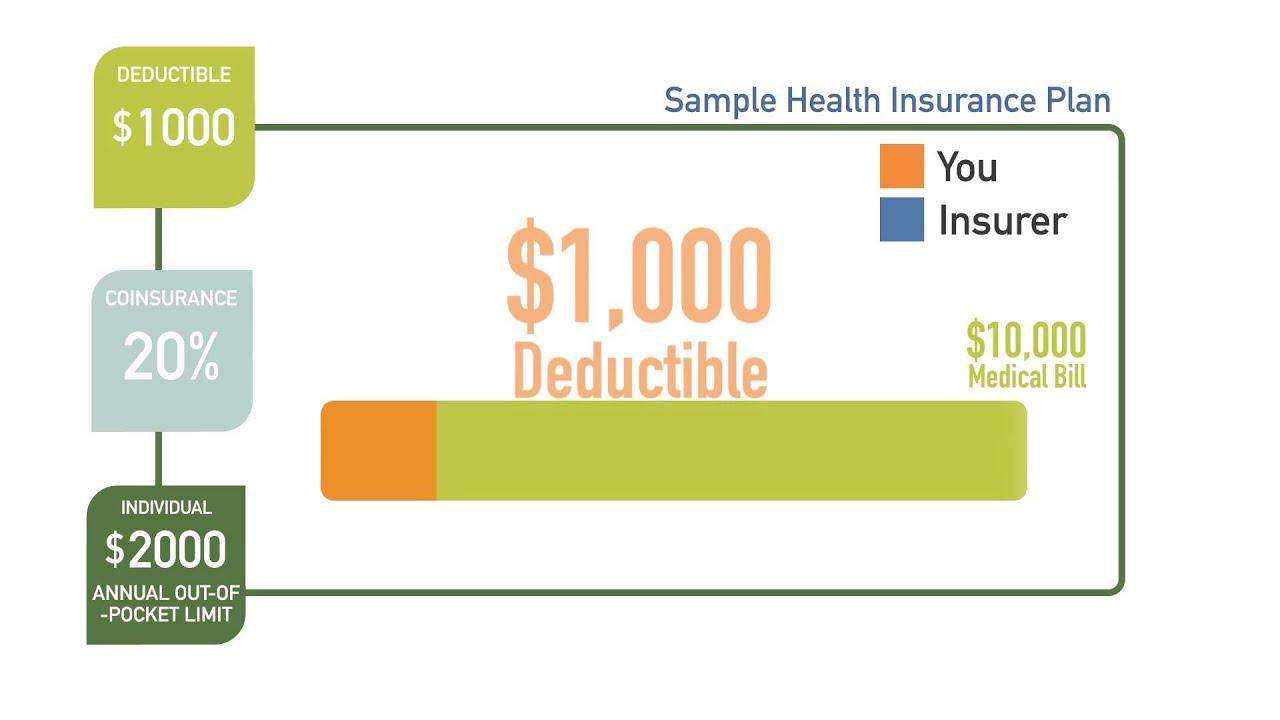

Understanding how deductibles and co-payments work is crucial for managing your pet insurance costs effectively. Deductibles refer to the amount you must pay out-of-pocket for veterinary services before your insurance provider begins to cover the expenses. As an example, if your pet requires a significant medical procedure costing $2,000 and you have a deductible of $500, you will first need to pay the deductible amount before your insurance kicks in. This initial outlay can be a critical factor in your overall budget planning for pet healthcare.

Co-payments, on the other hand, represent the percentage of the veterinary costs that you are responsible for after meeting your deductible. For example, if after meeting the $500 deductible, your insurance covers 80% of the remaining costs, you would then be liable for the remaining 20%. Over time, these co-payments can accumulate, especially if your pet frequently requires medical attention. Its essential to consider how different plans structure these payments, as more affordable premiums may come with higher co-payments or deductibles, affecting your total out-of-pocket expenses significantly.

To illustrate the cumulative impact of deductibles and co-payments on your expenses,consider the following hypothetical breakdown. Let’s say a dog needs several treatments throughout the year:

| Treatment Type | Cost | Deductible Paid | Insurance Coverage | Co-Payment | Total out-of-Pocket Cost |

|---|---|---|---|---|---|

| Check-up | $150 | $0 | 0% | 100% | $150 |

| Emergency visit | $1,500 | $500 | 80% | 20% | $500 + $200 = $700 |

| Surgery | $3,000 | $0 | 70% | 30% | $900 |

This example showcases how your total expenditure can vary based on your chosen deductible and co-payment structure. While a lower premium might be enticing, understanding how these costs add up is essential for long-term financial planning for your pet’s health. By analyzing your pet’s health needs and choosing a plan that aligns with your budget, you can better manage the costs associated with sudden veterinary expenses that come with pet ownership.

A Closer Look at Regional Price Variations in Pet Insurance

The landscape of pet insurance costs in the United States is significantly shaped by geographic differences. Urban areas typically exhibit higher prices compared to rural regions. This is frequently enough attributed to the cost of living in densely populated locales,where veterinary services tend to be pricier. As an example,pet owners in metropolitan centers like New York City and San francisco may find themselves paying 20% to 40% more in premiums compared to those in smaller towns. Additionally, the availability and density of veterinary clinics and specialists in urban settings can contribute to increased demand, further inflating insurance costs.

another factor influencing regional price variations is the prevalence of specific pet breeds, illnesses, and local regulations. In regions where certain breeds are popular, insurance providers may adjust their pricing models accordingly. As an example, areas with a high population of brachycephalic breeds, known to suffer from respiratory issues, might experience higher insurance premiums. Similarly, states that have enacted laws requiring pet insurance for certain species or breeds may see a shift in pricing structures. This creates a unique market tailored to regional pet ownership trends and veterinary concerns.

| Region | Average Monthly Premium | Common Health Issues |

|---|---|---|

| New york | $80 | Allergies, Dental Issues |

| Texas | $60 | Obesity, Heartworm |

| California | $75 | Skin Conditions, Cancer |

| Florida | $70 | Obesity, Heatstroke |

| Illinois | $65 | Arthritis, Diabetes |

Ultimately, understanding regional price variations in pet insurance can empower pet owners to negotiate better rates and choose the right plan for their furry friends. Local insurance agents often possess valuable insights into specific risks and common health problems within a given area, which can help owners make informed decisions. By analyzing local demographics, available veterinary services, and prevalent health issues, it’s possible to navigate the complexities of pet insurance and find a policy that minimizes costs while maximizing coverage.

Tips for Selecting the Best Pet Insurance Plan for Your Budget

When diving into the world of pet insurance, financial considerations often surface first. Start by assessing your budget, and identify how much you can comfortably allocate each month. Make sure to factor in not just the premium but also potential deductibles and co-pays. It’s crucial to choose a plan that won’t stretch your finances too thin, especially during unexpected veterinary visits. Consider setting aside a seperate fund for emergencies,which can offer peace of mind and lessen the reliance solely on insurance policies.

Next, compare multiple providers and plans. Not all pet insurance companies are created equal, and prices can vary widely for similar coverage options. Look for companies that offer customizable plans, allowing you to select coverage levels and deductibles that align with your financial capabilities. Reading customer reviews can provide insights into claims handling and customer service, helping you gauge reliability. don’t hesitate to ask questions directly to providers, ensuring that you thoroughly understand what each plan covers and any exclusions that may surprise you later.

always keep an eye out for additional savings opportunities. Many providers offer discounts for multi-pet households or memberships in certain organizations. Some even provide incentives for preventative care, such as vaccinations or regular check-ups. Consider enrolling in a plan that offers a wellness package if you anticipate high veterinary expenses. A quick table below outlines some common discounts you may find across various providers:

| Discount Type | Potential Savings |

|---|---|

| Multi-Pet Discount | 10-15% |

| Annual Membership Savings | 5-10% |

| Preventative Care Benefits | Varies |

Q&A

Q&A: How Much does Pet Insurance Cost? A 2025 Price Breakdown

Q1: What factors influence the cost of pet insurance in 2025?

A: the cost of pet insurance in 2025 is influenced by various factors,including the type of pet,its breed,age,and the location where you live.Typically, younger pets and breeds that are predisposed to specific health issues might incur higher premiums. Additionally, the chosen coverage level, including wellness and preventive care packages, will also play a significant role in determining the final cost.

Q2: What is the average monthly cost of pet insurance in 2025?

A: As of 2025,the average monthly cost of pet insurance tends to range from $30 to $70 for cats and $40 to $100 for dogs,depending on the aforementioned factors. Big dogs or those with known health risks may fall on the higher end of this spectrum, while smaller, generally healthy pets might cost less.

Q3: Are there different types of coverage options available in 2025?

A: Absolutely! In 2025, pet owners have access to a variety of insurance plans. The main types include accident-only policies, which cover incidents like injuries and unexpected accidents; comprehensive plans that include accidents and illnesses; and wellness plans focused on preventive care, covering routine check-ups and vaccinations. The choice of coverage can significantly affect your monthly premiums.

Q4: How does the deductible affect pet insurance costs?

A: The deductible is a key element of your pet insurance policy, impacting both your out-of-pocket expenses and your premium. A higher deductible may lower your monthly premium, but it will mean higher costs when filing a claim. Conversely, a lower deductible results in higher monthly premiums but less out-of-pocket expense during a veterinary visit.It’s essential to find a balance that suits both your budget and your pet’s needs.

Q5: Is pet insurance worth it in 2025?

A: Evaluating whether pet insurance is worth it depends on your pet’s health, your financial situation, and personal preferences. Many pet owners find peace of mind in having coverage, notably for unexpected emergency situations that can result in expensive veterinary bills. Though, if you have the means to handle routine and emergency visits without insurance, you might opt to forgo it. Weighing the potential costs against the benefits is critical for making an informed decision.

Q6: How does one find the best pet insurance plan for their pet in 2025?

A: To find the best pet insurance plan, shop around and compare prices and coverage options from various providers. Look for reviews, ask fellow pet owners for recommendations, and consider the specific needs of your pet, such as breed-specific conditions. Make sure to read the fine print to understand exclusions and limitations and also consider utilizing online comparison tools to streamline your search.

Q7: Are there any trends in pet insurance pricing expected in 2025 and beyond?

A: In 2025, we’re observing a slight increase in pet insurance premiums, aligning with the rising costs of veterinary care and advanced medical treatments. trends also show a growing awareness among pet owners leading to more comprehensive policies as they seek to provide the best care for their furry companions. As technology progresses, we may also see more personalized insurance options tailored to individual pets’ health histories and needs.

Q8: What advice would you give to someone considering pet insurance for the first time?

A: Start by assessing your pet’s health risks and evaluate your budget for both routine and emergency veterinary care. Consider discussing your options with a trusted veterinary professional to gain insights into common health issues for your pet’s breed. Take your time in comparing policies, don’t hesitate to ask questions, and ensure you understand what each plan covers before making a decision. And remember: investing in your pet’s health is an investment in their happiness and wellbeing!

To Wrap It Up

as we navigate the ever-evolving world of pet ownership and the importance of safeguarding our furry companions, understanding the costs associated with pet insurance is crucial. In 2025, we’ve seen a spectrum of options designed to cater to diverse budgets and needs, enabling pet parents to choose policies tailored to their lifestyle and financial situation.From basic coverage offering peace of mind to comprehensive plans that account for every conceivable scenario, the investment in pet insurance can ensure that the love, care, and companionship we offer our pets remains unwavering, even in times of uncertainty. As you consider the best path forward for you and your beloved animal, remember that weighing the benefits against the costs can lead to a happier, healthier future for both you and your four-legged family member. Whether you’re a new pet parent or a seasoned guardian, the journey of selecting the right insurance plan is just one of many steps you’ll take to ensure that the bond you share flourishes for years to come.