In a world where our furry friends are often considered family, the prospect of their health and well-being can weigh heavily on pet owners’ minds. As loving guardians, we go above and beyond to ensure they live happy, healthy lives, but what happens when emergencies arise? For manny, the choice between pet insurance and establishing an emergency savings fund can seem daunting. Both options present unique advantages and potential drawbacks, leaving pet owners in a dilemma about which path to choose. in this article, we will explore the strengths and weaknesses of pet insurance and emergency savings, helping you make an informed decision tailored to your needs and the well-being of your beloved companion. Whether you are a new pet parent or a seasoned owner, understanding these two crucial aspects of pet care can pave the way for a more secure and confident approach to managing unforeseen health issues.

Understanding Pet Insurance Basics and Coverage Options

When considering the options for safeguarding your furry family member’s health, it’s essential to grasp the core components of pet insurance. One of the most basic aspects is understanding the various types of plans available. Generally, pet insurance can be divided into three major categories: accident-only coverage, complete coverage, and wellness plans. Each of these categories offers different levels of protection and features to meet the specific needs of your pet and your financial situation.

Accident-only coverage primarily focuses on unexpected incidents, such as fractures or ingestion of foreign objects. This type can be more affordable but may leave pet owners vulnerable to high costs associated with chronic illnesses or routine care. On the other hand, comprehensive coverage is more inclusive, allowing for claims related to both accidents and illnesses.This option frequently enough includes a broader range of services, covering things like diagnostic testing, surgery, and even medications. Lastly, wellness plans, while often considered add-ons, help mitigate the costs of preventive care including vaccinations, dental checks, and annual examinations, ensuring your pet receives proactive healthcare.

| Coverage type | Protection Offered | Typical costs |

|---|---|---|

| Accident-Only | Accidental injuries | Low monthly premium |

| Comprehensive | Accidents & illnesses | Medium to high premium |

| Wellness Plan | Preventive & routine care | Affordable add-on |

Having a thorough understanding of the deductibles, co-pays, and coverage limits associated with each plan is crucial as well. Deductibles refer to the amount you must pay out-of-pocket before the insurance kicks in,and they can vary widely between policies. Co-pays are the fixed amounts you’ll pay for specific services after you’ve met your deductible. Coverage limits dictate the maximum amount the insurance provider will pay annually or per incident. By comparing these elements across different plans, pet owners can make an informed decision tailored to their budget and their pet’s health needs.

Evaluating the Role of Emergency Savings in Pet Care

When it comes to pet care, emergency savings serve as a crucial safety net that complements pet insurance. While pet insurance can cover many unforeseen medical expenses, establishing an emergency savings fund empowers pet owners to manage costs that may fall outside the coverage scope. For instance, routine vet visits, preventive treatments, and certain medications may not be fully covered by an insurance policy. Having emergency savings on hand allows pet parents to address these expenses promptly without compromising their pet’s health.

Establishing a robust emergency fund entails making calculated decisions, especially regarding the typical expenses pet owners might face. The following are some key considered factors when building an emergency savings fund:

- Typical Medical Emergencies: From unexpected surgeries to accidents, these can quickly drain finances.

- Routine Care: Vaccinations and regular check-ups are vital in ensuring the long-term health of pets.

- Unexpected Changes: Moving, job loss, or other life events can impact your pet’s wellbeing, necessitating additional funds.

| Expense Type | Potential Cost | Emergency fund Coverage |

|---|---|---|

| Emergency Surgery | $1,500 – $5,000 | Yes |

| Routine Check-up | $50 – $150 | Yes |

| Medication | $20 – $400 | Yes |

| Hospitalization | $2,000 - $8,000 | Depends on insurance |

Ultimately, having a dedicated emergency savings fund can work synergistically with pet insurance to safeguard your finances.While insurance can mitigate the larger expenses, an emergency fund can handle the more frequent, smaller costs that arise. This approach not only ensures that your pet receives the necessary care but also provides peace of mind, knowing that both expected and unexpected expenses can be managed efficiently. Ultimately, the combination of both strategies may offer the most comprehensive financial strategy for responsible pet ownership.

Comparing Costs: Pet Insurance Premiums versus Savings Contributions

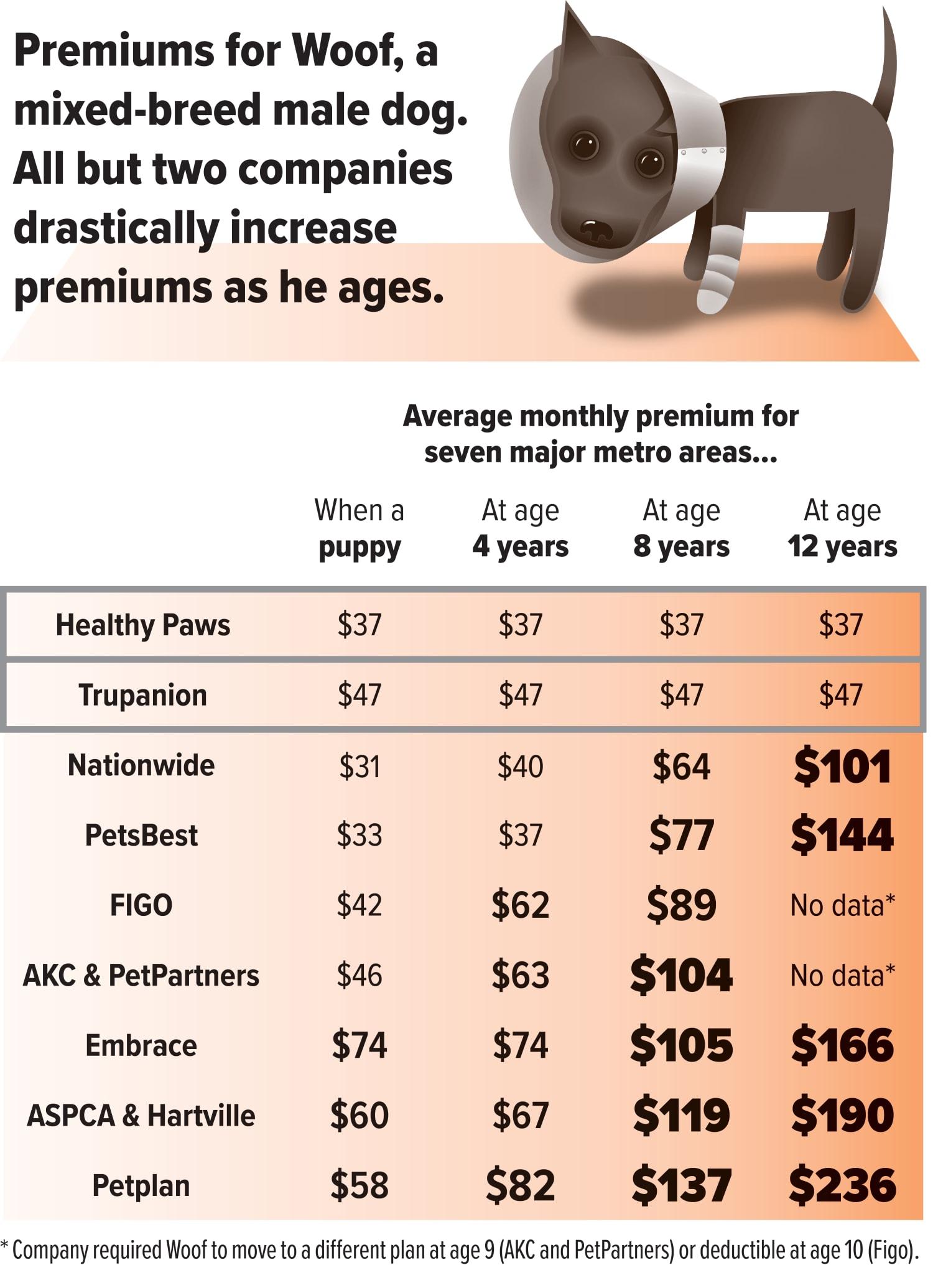

When weighing the options between pet insurance premiums and emergency savings contributions, it can be useful to break down the costs associated with each choice. Pet insurance typically requires a monthly or annual premium, frequently enough varying based on factors like your pet’s breed, age, and overall health. While the allure of insurance lies in its potential to cover unexpected vet bills, the reality is that pet owners need to be prepared for a range of costs, including deductible amounts, co-pays, and exclusions. Additionally, policies may vary substantially in terms of coverage for pre-existing conditions or specific treatments.

On the other hand, opting for an emergency savings account means putting aside a set amount of money each month specifically for your pet’s health needs. This approach offers the advantage of full control over your funds; you can tailor your savings contributions to the level of risk you perceive. Such as, if your pet is generally healthy, you might decide to save a moderate amount each month, while pet owners with older animals or those prone to health issues may choose to contribute more aggressively. Consider the following aspects when deciding:

- adaptability: Savings accounts can be adjusted as needed; if your financial situation changes, you can easily modify your contributions.

- no Hidden Costs: Unlike insurance policies that may have hidden fees or exclusions, a direct savings account only involves your initial deposit.

- Interest Accumulation: Depending on your savings vehicle, your funds could earn interest, growing your emergency pot over time.

Here’s a simplified comparison to help illustrate how the two options stack up on a basic cost level:

| Cost Factor | Pet insurance | Emergency Savings |

|---|---|---|

| Monthly Contribution | $30 – $100 | $50 |

| Annual Cost | $360 – $1200 | $600 |

| Risk of High Vet Bills | Shared across premiums | Fully borne by owner |

| Average Claim Payout | $3,000 – $7,000*** | N/A |

While insurance may seem like a safety net with potential high returns in case of emergencies, some pet owners discover they might pay more over time than if they had chosen to save independently. it’s also crucial to consider the possibility that not all emergencies yield a high vet bill. In reality, many pet owners may find themselves making routine trips to the vet that, while vital, don’t break the bank. Calculating the average costs for regular check-ups, vaccinations, and minor emergencies can provide clearer insights into long-term financial planning, allowing owners to tailor their approach based on personal circumstances and their pets’ needs.

Assessing risk Factors and peace of Mind for Pet Owners

When considering the well-being of our furry companions, pet owners must navigate the complexities of financial preparedness. Pet insurance can serve as a safety net against unexpected medical expenses, but understanding the risk factors associated with pet health is crucial in determining its value. Various factors, such as breed predisposition to certain illnesses, age, and lifestyle, influence the likelihood of a pet needing medical attention. such as, brachycephalic breeds often face respiratory issues, while older pets might require more frequent veterinary visits. By assessing these risk factors individually, owners can better evaluate the merits of insuring their pets with a plan that specifically covers their needs.

Conversely, maintaining an emergency savings fund is a strategy that offers agility in handling unforeseen veterinary costs. This approach allows pet owners to retain full control over their finances,without insurance premiums that may or may not translate into benefits during a planned visit. Costs associated with various treatments can vary widely, influenced by factors such as location, procedure complexity, and veterinary care standards. A well-structured savings plan would ideally reflect these dynamics, allowing you to prepare for fluctuating costs without the entanglements of insurance bureaucracy. To quantify this aspect, consider the following table demonstrating average pet emergency costs:

| Veterinary Procedure | Approximate Cost ($) |

|---|---|

| Vaccination | 50 - 100 |

| Surgery (Minor) | 200 – 700 |

| Surgery (Major) | 1,000 – 5,000 |

| Emergency Visit | 300 – 1,200 |

Deciding between pet insurance and emergency savings also hinges on the comfort level of the pet owner regarding financial risk. Insurance provides a sense of security, distributing the risk of perhaps high medical expenses over time. However,with this peace of mind comes the duty of understanding policy details,such as waiting periods,exclusions,and premium increases. Conversely, relying on an emergency fund may give pet owners the flexibility to adapt their savings to match their pet’s ongoing health needs better, but it might come with the anxiety of potentially depleting funds in the face of a crisis. Ultimately, the choice between these options revolves around evaluating personal financial health, risk tolerance, and the specific circumstances surrounding each beloved pet.

Making Informed Decisions: Tailoring Your Approach to Pet Health Expenses

When considering the financial aspects of pet ownership,understanding how to manage health expenses is crucial. Many pet owners grapple with the decision of whether to invest in pet insurance or to allocate funds into an emergency savings account.Each option has its unique advantages and disadvantages,and the best choice frequently enough depends on your individual circumstances,including your pet’s health,age,and specific needs.

Pet Insurance offers a peace of mind that can be invaluable during unforeseen circumstances. It can cover a range of incidents, from routine check-ups and vaccinations to unexpected surgeries and emergencies. When evaluating pet insurance, consider these benefits:

- Comprehensive Coverage: Many policies cover a variety of health issues, which can alleviate financial stress when facing unexpected emergencies.

- Predictable Costs: Monthly premiums can help you prepare for pet health expenses, making budgeting easier.

- Access to Better Veterinary Care: With insurance, you may be more likely to pursue advanced procedures that you might otherwise avoid due to costs.

However, pet insurance is not without its complexities and potential drawbacks. Policy exclusions, deductibles, and claims processes can be daunting. Pet owners often find themselves navigating the fine print to ensure that they’re adequately covered. In contrast, an emergency savings account provides liquid assets that directly address pet-related expenses. Some benefits of developing an emergency savings plan include:

- Flexibility: You can use these funds at your discretion, whether for routine visits or sudden emergencies.

- No Hidden Fees: Unlike insurance premiums, there are no unexpected costs associated with accessing your own savings.

- Full control: You can determine how much money to set aside based on your pet’s unique needs and your financial situation.

To give a clearer picture of your potential costs, the table below illustrates the annual expenses owners might expect depending on their choice between pet insurance and an emergency savings account:

| Expense Type | Pet Insurance (Annual Cost) | Emergency Savings (Annual Set Aside) |

|---|---|---|

| Routine Vet visits | $300 – $600 | $400 |

| Emergency Care | $1,000 – $3,000* | $800 |

| Medications | Varies by policy | $200 |

| Routine Care (e.g., Vaccinations) | Covered, up to policy limits | $150 |

*Costs can significantly vary based on your location and your pet’s condition.Each option requires thoughtful assessment, as both routes can contribute to your pet’s health and your financial stability. Assess factors such as your pet’s specific medical history, your budget, and your willingness to navigate the complex landscape of pet care finance. Whether you ultimately choose insurance or a dedicated savings account,the key is to ensure you have a robust plan in place to safeguard against unexpected vet costs.

Long-Term Financial Planning for Pet Owners: A Balanced Strategy

When it comes to financial planning for your furry companions, pet owners face an important decision: should they opt for pet insurance or build an emergency savings fund? Both options have their merits, and understanding how they can fit into a long-term financial strategy is crucial for ensuring the well-being of your pets while maintaining your financial health.

Pet insurance is designed to alleviate the financial burden during unexpected health emergencies. By paying a monthly premium, pet owners can access a variety of benefits, including:

- Comprehensive Coverage: Many plans cover accidents, illnesses, and even preventive care, depending on the policy.

- fixed Costs: Monthly premiums allow pet owners to budget for their pets’ health without the fear of unexpected vet bills.

- Peace of Mind: Knowing you have insurance can reduce the stress of making swift financial decisions during emergencies.

On the other hand, establishing an emergency savings fund offers a more flexible approach to pet care expenses. With a dedicated savings account, pet owners can prepare for potential costs associated with veterinary visits, surgeries, or medications. Consider these advantages:

- Control Over Funds: Unlike insurance, you can decide how much to contribute and when to use your savings for vet care.

- No Waiting periods: Access to your funds is immediate,ensuring you can respond quickly without waiting for insurance claims to be processed.

- Tailored Approach: You can adjust your savings strategy based on your pet’s breed,age,health condition,and lifestyle,providing personalized financial planning.

Choosing between the two largely depends on your financial situation and personal preferences. You might find that a hybrid approach, utilizing both pet insurance and emergency savings, offers the most balanced strategy. To evaluate this, you can consider a simple comparison:

| Criteria | Pet Insurance | Emergency Savings |

|---|---|---|

| Monthly Costs | Varies by plan | Flexible contributions |

| Claim process | may require paperwork | Immediate access |

| Coverage Scope | Varies by policy | Pet care costs only |

| Peace of Mind | High | Mixed, depending on savings |

Ultimately, your decision could be influenced by factors such as your financial stability, the health of your pets, and the specific risks associated with your pet’s breed or lifestyle.Conducting a comprehensive evaluation of your current financial position will help you determine whether to invest in pet insurance, bolster your emergency savings, or combine both methods for a resilient and holistic financial strategy to safeguard your beloved companions.

Q&A

Q&A: Pet Insurance vs. Emergency Savings: Which Is better?

Q1: What is pet insurance,and how does it work?

A1: Pet insurance is a financial product designed to cover veterinary costs for your furry friends. When you purchase a policy, you pay a monthly premium, and in return, the insurance company helps cover the costs of unexpected medical expenses, such as accidents, injuries, or illnesses. Most policies have a deductible that you’ll need to meet before the coverage kicks in, and it’s crucial to understand what is covered—some plans include wellness visits, while others focus solely on emergencies.

Q2: What are the benefits of having pet insurance?

A2: One of the main benefits of pet insurance is peace of mind.It alleviates the financial burden during an emergency, allowing you to focus on your pet’s health rather than the cost of care. Some plans also encourage preventive care, which can help catch health issues early. Additionally, pet insurance can provide a safety net for expensive treatments that might otherwise be inaccessible.

Q3: What is an emergency savings fund for pets, and how does it work?

A3: An emergency savings fund is a dedicated savings account set aside specifically for your pet’s unexpected medical expenses. You contribute to this fund regularly, allowing you to accumulate money that can be accessed in case of emergencies. The key is to ensure this fund is separate from your regular savings and easily reachable for vet visits.

Q4: What are the advantages of having an emergency savings fund rather of pet insurance?

A4: An emergency savings fund provides flexibility—you control the funds and can use them for any pet-related costs, not just emergencies. It also eliminates monthly premiums and deductibles associated with insurance. If your pet stays healthy, you won’t face the “wasted” premium expenses. Additionally, you won’t have to deal with potential claim denials, which some pet owners may experience with insurance.

Q5: What are the drawbacks of each option?

A5: The disadvantage of pet insurance is that policies can vary widely, with some requiring higher premiums or covering less than expected. Additionally, if your pet develops a chronic condition, future coverage might be affected due to exclusions. For emergency savings, the challenge lies in discipline—consistently contributing to the fund can be tough, and if you face important vet bills early on, the savings may not be considerable enough to cover them.

Q6: Is there a middle ground between pet insurance and emergency savings?

A6: Absolutely! Some pet owners choose a hybrid approach,investing in a basic pet insurance policy (to cover major expenses) while also building an emergency savings fund. This combination allows them to benefit from the advantages of both options—securing financial help for major issues while having speedy access to funds for smaller,unexpected costs.

Q7: How do I decide which option is better for me and my pet?

A7: The choice between pet insurance and an emergency savings fund largely depends on your financial situation, your pet’s health history, and your comfort level with risk. Consider how much you spend on vet bills, the types of treatments commonly needed for your pet, and your ability to save consistently. It might be helpful to consult with a financial advisor or fellow pet owners to weigh the pros and cons based on your unique circumstances.

Q8: Can my pet’s breed influence my decision?

A8: Yes, some breeds are predisposed to specific health issues, making insurance more appealing for those pets. If you have a breed known for high medical costs, investing in pet insurance may provide better financial protection. Conversely, if your pet is generally healthy or a mixed breed with fewer known health issues, an emergency savings fund might suffice.

Q9: What should I consider before purchasing pet insurance or establishing an emergency fund?

A9: Before making a decision, assess your financial health and your pet’s current and potential future needs. Research different insurance providers and plans to understand coverage, exclusions, and claim processes. For emergency savings, calculate a realistic savings goal that would cover at least three to six months’ worth of potential vet costs. Whichever path you choose, prepare for the possibilities, prioritizing your pet’s health and well-being.

Insights and Conclusions

the debate between pet insurance and emergency savings is one that every pet owner must navigate with care. Each option offers its own set of advantages, tailored to different lifestyles and financial situations.While pet insurance provides a safety net for unexpected medical expenses, emergency savings ensure you have immediate access to funds when the unexpected arises. Ultimately, the right choice depends on your personal preferences, your pet’s health history, and your financial philosophy.By weighing the pros and cons of both, you can tailor a strategy that not only secures your pet’s health but also aligns with your financial goals. Remember, in the ever-evolving world of pet care, preparedness is the best freind of peace of mind.Whatever path you choose, may it lead to a happier, healthier life for your beloved companion.