When it comes to welcoming a furry friend into your home, the joy they bring is unparalleled. However, along with wagging tails and gentle purrs comes a responsibility that extends beyond belly rubs and playtime. Just like humans, pets can face unexpected health challenges, and being prepared for the unforeseen can make all the difference. Enter pet insurance—a safety net designed to help pet owners navigate the complexities of veterinary care and ensure that their beloved companions receive the best possible treatment, no matter the cost. In this comprehensive guide,we will explore the ins and outs of pet insurance,from understanding the different types of plans available to tips on selecting the perfect policy for your unique pet. Whether you’re considering coverage for a playful puppy or a wise old cat,our ultimate guide will illuminate the path to making informed decisions,giving you peace of mind while your pet enjoys a happy,healthy life by your side.

Understanding Pet Insurance Basics

Pet insurance can seem overwhelming at first glance, but understanding its fundamentals can make the decision-making process much smoother. At its core, pet insurance is a policy that covers various medical expenses for your furry friend, similar to health insurance for humans. It typically involves a monthly premium, a deductible, and coverage percentages that dictate how much of a claim the insurer will pay. As you navigate the options available, keep in mind that not all plans are created equal, and knowing what is included or excluded is essential to making an informed choice.

When evaluating pet insurance plans, you’ll come across various types of coverage.Accident-only plans provide basic protection against unforeseen incidents,making them an economical choice for pet owners on a budget. On the other hand, comprehensive plans cover a broader range of medical needs, from routine check-ups to emergency surgeries. Consider the following factors when choosing a plan:

- Type of coverage: Determine if you want accident-only, illness, or comprehensive coverage.

- Exclusions: Review what is not covered, such as pre-existing conditions or certain breeds.

- Limits: Check if there are annual limits on claims or lifetime coverage caps.

To illustrate the differences between popular pet insurance plans, the following table outlines key features of three leading providers:

| provider | Type of Plan | Deductible Options | Coverage Percentage | Unique Feature |

|---|---|---|---|---|

| Provider A | Accident & Illness | $250, $500 | 80%, 90% | No upper age limit |

| Provider B | Accident Only | $100, $250 | 70% | Low monthly premiums |

| Provider C | Comprehensive | $0, $200 | 90% | Wellness add-on available |

Ultimately, the decision on pet insurance depends on the unique needs of both you and your pet. Factors such as your petS age, breed, existing health conditions, and even your financial capacity should guide your choice. It’s worth emphasizing that pet insurance is not a “one-size-fits-all” situation. by carefully analyzing the available policies and how they align with your pet’s specific requirements, you’ll make a sound choice that ensures your loved companion receives the best possible care without imposing an emotional or financial burden on you.

Evaluating Coverage Options for Your Furry Friend

When considering the best pet insurance for your beloved animal companion, it’s crucial to thoroughly evaluate the various coverage options available. each pet insurance plan can differ considerably in terms of what it covers, from routine check-ups to major surgeries. Start by identifying your pet’s unique needs based on age, breed, and health history. This evaluation will help you determine if you need a policy with comprehensive coverage or if a more basic plan might suffice.

Pet insurance commonly falls into several categories, including:

- Accident-Only Plans: These cover injuries resulting from accidents, making them a budget-friendly option for those looking for straightforward protection.

- Illness Plans: These policies cover a range of illnesses but can vary widely on specifics, so be sure to check what’s included.

- Comprehensive Plans: Offering coverage for both accidents and illnesses, these plans often include wellness checks and preventive care, making them ideal for proactive pet owners.

In addition to coverage types, pay attention to other essential factors such as:

| Factor | description |

|---|---|

| Deductibles | The amount you must pay out-of-pocket before coverage kicks in. Compare different plans to see which offers the most suitable deductible for your budget. |

| reimbursement Levels | The percentage of eligible expenses the insurer will cover after the deductible is met. Higher reimbursement levels frequently enough come with higher premiums. |

| Exclusions | Review policy exclusions carefully to avoid surprises. Common exclusions involve pre-existing conditions or certain breed-specific issues. |

taking the time to assess these factors not only helps in choosing the right coverage for your pet but also ensures that you’re prepared financially for unexpected vet visits. Additionally, considering customer reviews and ratings for specific plans can provide insight into the experiences of other pet owners, guiding you in making an informed decision. Always remember: investing in pet insurance is about safeguarding the well-being of your furry friend and providing peace of mind for yourself.

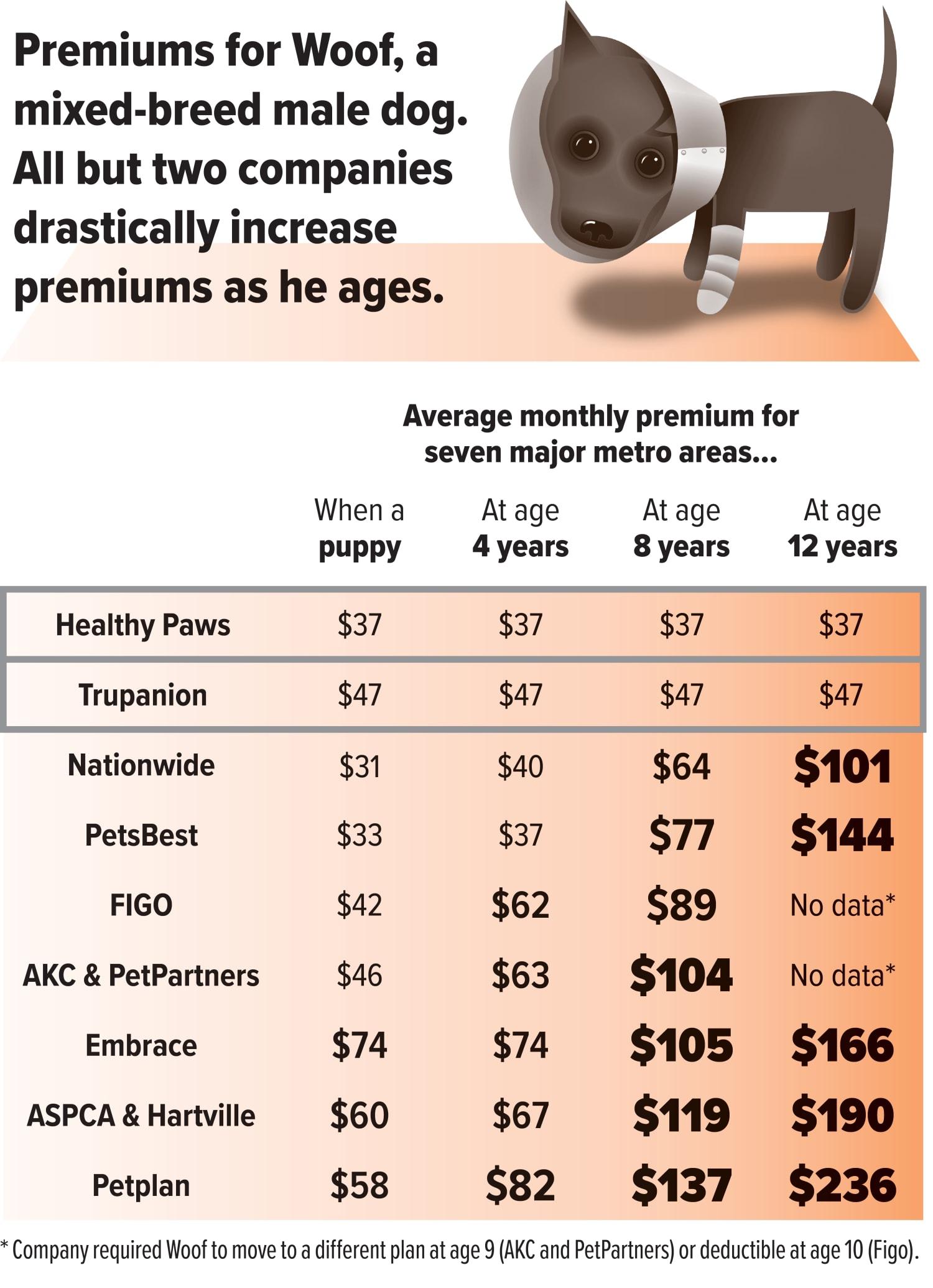

Comparing Costs and Premiums Effectively

When evaluating pet insurance plans,understanding the relationship between costs and premiums is crucial for making an informed decision. Premiums can vary significantly from one insurer to another, and it’s essential to weigh these costs against the benefits offered by each policy. Begin by identifying the types of coverage you need and looking closely at the associated costs. Costs usually depend on various factors,including your pet’s breed,age,and health condition,which can affect both the premium and any potential out-of-pocket expenses related to care.

To make an effective comparison, consider creating a comparison table showcasing key elements of each policy. This table should include features such as coverage limits, deductibles, copayment percentages, and exclusions. Here’s an example of how to structure and summarize this information:

| Insurance Provider | Monthly Premium | Annual Deductible | Coverage Limit | Copayment |

|---|---|---|---|---|

| Petsafe | $30 | $250 | $10,000 | 20% |

| Fido Insurance | $35 | $200 | $15,000 | 15% |

| Paws Plus | $28 | $300 | $5,000 | 25% |

Another effective strategy is to assess the value versus cost. A lower premium may seem appealing at first glance, but if it comes with a high deductible and limited coverage, you may end up spending more in the long run. Assess your pet’s health history and lifestyle; a more comprehensive plan may provide better long-term financial security despite a higher initial investment. It is indeed also vital to consider any potential discounts for multi-pet households, loyal customers, or annual payment options, as these can further help manage costs without sacrificing coverage.

Deciphering Policy Exclusions and Limitations

When exploring pet insurance, it’s crucial to understand how exclusions and limitations can impact your coverage. Most insurance policies have specific stipulations that define what is not covered, often leading to confusion among pet owners. These exclusions are detailed in the terms and conditions, and can vary significantly from one insurer to another. here are some common types of policy exclusions:

- Pre-existing conditions: Most insurers will not cover any medical issues your pet had prior to the start of the policy.

- Age restrictions: Some policies may limit coverage for older pets or impose higher premiums.

- Specific breeds: Certain breeds might potentially be excluded from coverage due to their predisposition to hereditary conditions.

- Wellness and preventive care: Routine care, such as vaccinations or spaying/neutering, might be excluded unless specifically included in a wellness plan.

Limitations often refer to the maximum benefits,coverage caps,or specific conditions under which certain claims can be made. Understanding these limitations is key to choosing a plan that truly meets your pet’s needs. Insurers may impose annual maximums on payouts for certain types of treatment or lifetime limits for specific conditions. These can affect the overall affordability of your policy in the face of extensive veterinary care. Here’s what to look for regarding limitations:

| Coverage Type | annual Limit | Lifetime Limit |

|---|---|---|

| Accident Medical Care | $10,000 | No limit |

| Illness Coverage | $5,000 | $50,000 |

| Behavioral Therapy | $2,000 | No limit |

When reviewing a pet insurance policy,always pay attention to the fine print discussing exclusions and limitations. They serve as a frame of reference for what you should expect from the insurer in terms of coverage. Additionally, some companies may offer customizable options or riders that could address certain exclusions for an additional cost. Weighing these factors carefully will empower you to make an informed decision that best protects your furry companion, ensuring that you are not caught off guard when unexpected medical situations arise.

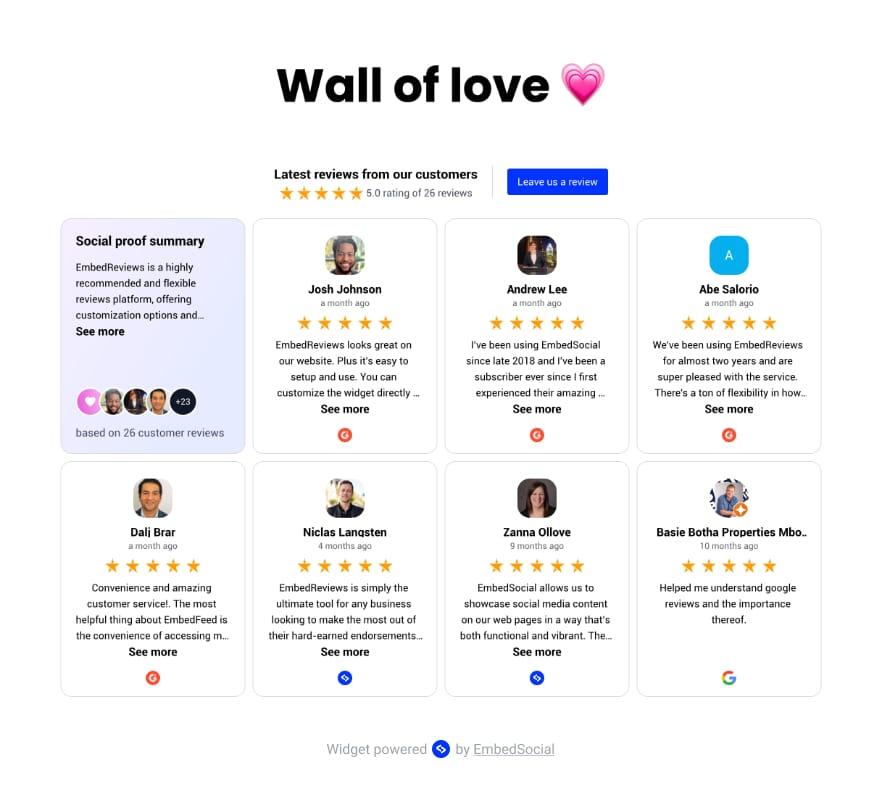

Assessing Customer Reviews and Reputation

When evaluating potential pet insurance plans, it’s essential to dive into the wealth of information provided by customer reviews and testimonials. These firsthand accounts offer invaluable insights into the experiences of other pet owners, illuminating the pros and cons of various policies. By consulting reviews, you’ll not only gauge the overall satisfaction of existing customers but also uncover the nuances of how different companies handle claims, customer service, and policy coverage. Look for reviews on reputable platforms to ensure you’re getting a balanced perspective.

As you sift thru customer feedback, pay close attention to recurring themes that surface across multiple reviews.for instance, if many users commend a particular provider for its quick claims processing and responsive customer support, it’s a strong indication of that company’s reliability. Conversely, if you notice frequent complaints about hidden fees or delayed reimbursements, take these red flags seriously. A few things to consider while assessing these reviews include:

- Polarized Feedback: Look for a mix of both positive and negative reviews to get a well-rounded view.

- Specific Experiences: Reviews that provide detailed accounts of specific incidents are often more insightful.

- Response to Complaints: Evaluate how the insurer responds to negative feedback; a proactive approach can indicate a company that values customer satisfaction.

Another aspect worth investigating is the company’s overall reputation within the insurance industry. Utilizing resources such as customer ratings, awards, and industry accolades can serve as indicators of trustworthiness. Consider creating a simple comparison table for easy reference:

| Insurance Provider | Average Rating | Common Complaints | Highlights |

|---|---|---|---|

| PetGuard | 4.5/5 | Limited coverage options | Excellent customer service |

| FidoInsurance | 3.8/5 | Lengthy claims process | Flexible plans available |

| WhiskersPolicy | 4.0/5 | High premiums | Comprehensive coverage |

don’t hesitate to reach out to fellow pet owners or communities dedicated to pet care. Online groups and forums can be treasure troves of information, providing you with real-world insights that may not surface in formal reviews. Engaging in discussions not only helps clarify your questions but also allows you to gather a range of opinions. Ultimately, assessing customer reviews and the reputation of pet insurance plans grants you the knowledge needed to make an informed choice, ensuring your beloved pet receives the care they deserve when it matters most.

Making an informed Decision for Your Pet’s Health

When it comes to selecting the right pet insurance plan, it’s crucial to equip yourself with adequate information to ensure your beloved companion receives the best care possible. Evaluating your options should start with understanding the different types of coverage available. Most pet insurance plans can be categorized into the following types:

- Accident-only Plans: Covers injuries from accidents, such as broken bones or wounds.

- Illness Plans: Offers coverage for a variety of illnesses, from infections to chronic conditions.

- Comprehensive Plans: Includes both accidents and illnesses, often the most popular choice among pet owners.

- Wellness Add-ons: Provides coverage for routine care like vaccinations and check-ups.

Next, consider the exclusions and limitations associated with different policies. Each insurance provider has its own set of rules regarding pre-existing conditions, breed-specific issues, and waiting periods. Familiarize yourself with these details to avoid unpleasant surprises when your pet needs care. Here are some common exclusions you might encounter:

- Pre-existing conditions

- Cosmetic procedures

- Behavioral therapies

- Dental care

it’s essential to weigh the costs versus benefits of the available plans. Comparing premiums, deductibles, and reimbursement percentages can help you determine which plan best aligns with your budget and your pet’s health needs. Utilize a simple table to summarize and compare different policies:

| Insurance Provider | Monthly Premium | deductible | Reimbursement Rate |

|---|---|---|---|

| Provider A | $35 | $250 | 80% |

| Provider B | $50 | $200 | 90% |

| Provider C | $25 | $300 | 70% |

By gathering information from diverse sources, discussing with fellow pet owners, and even consulting your veterinarian, you can arrive at an informed decision that not only addresses your pet’s current healthcare needs but also anticipates future health challenges. Ultimately, the right pet insurance plan lets you focus on providing the love and support your furry friends deserve, without the added stress of financial uncertainty in times of need.

Q&A

Q&A: The Ultimate Guide to Choosing the Best Pet Insurance Plan

Q: What is pet insurance, and why is it critically important?

A: Pet insurance is a policy designed to cover certain veterinary costs for your furry friends. it acts as a safety net to help you manage unexpected medical expenses that arise from accidents, illnesses, or chronic conditions. Just like human health insurance, it helps ensure that your pet receives the medical care they need without breaking the bank.

Q: What types of pet insurance plans are available?

A: There are generally three main types of pet insurance plans: accident-only coverage, comprehensive coverage, and wellness plans. Accident-only covers unforeseen injuries, while comprehensive plans cover both accidents and illnesses. Wellness plans, on the other hand, focus on preventive care, including vaccinations and routine check-ups, but usually don’t cover illnesses or accidents.

Q: How do I determine what coverage my pet needs?

A: Evaluating your pet’s breed, age, and existing health conditions is crucial. Some breeds are predisposed to certain illnesses, and older pets may require more frequent vet visits. Think about your lifestyle too; if you travel frequently enough or have an active pet, comprehensive coverage might be more beneficial.

Q: What factors should I consider when comparing different insurance providers?

A: Start by examining the policy’s coverage limits, deductibles, co-pays, and exclusions. Consider customer reviews and the provider’s reputation for claim processing. Additionally,assess whether they have 24/7 customer support and a network of trusted veterinarians.This information will help you identify which provider aligns with your needs.

Q: Are there any common exclusions I should be aware of?

A: Yes, many pet insurance policies exclude certain conditions such as pre-existing conditions, dental care, or breed-specific ailments. additionally, routine preventive care is often not covered under comprehensive plans. Always read the fine print to ensure you’re clear about what’s included and excluded.

Q: How can I save on pet insurance costs?

A: To save on premiums, consider opting for a higher deductible or exploring multi-pet discounts if you have more than one furry friend. Some companies also offer discounts for annual payments versus monthly payments. Lastly, shop around and don’t hesitate to negotiate or seek promotional deals!

Q: When is the best time to get pet insurance?

A: It’s best to seek insurance while your pet is young and healthy, as this often leads to lower premiums and better coverage options.However, it’s never too late to insure your pet! Just be prepared to navigate potential exclusions for pre-existing conditions.

Q: What steps should I take if I need to file a claim?

A: To file a claim, start by gathering all necessary vet records and receipts. Submit your claim as instructed by your provider, typically through an online portal or via mail. Be diligent about keeping copies of everything submitted and follow up to ensure your claim is being processed.

Q: Can pet insurance help with costs associated with ongoing conditions?

A: Yes, many comprehensive plans cover ongoing conditions after an initial waiting period. However, some conditions may be classified as pre-existing, so it’s crucial to understand how your provider defines these terms. Visit your vet regularly, as having documented care can help with your claims.

Q: Is it really worth getting pet insurance?

A: While it may seem like an additional expense, pet insurance can save you meaningful money in the event of a serious illness or injury. Many pet owners find peace of mind knowing they can provide the best possible care for their pets without the financial burden of high vet bills. It’s a personal choice that weighs the value of coverage against your budget and your pet’s health needs.

Choosing the right pet insurance plan doesn’t have to be daunting! With the right questions and considerations,you can find a policy that offers both peace of mind and protection for your cherished companion.

Wrapping Up

As you embark on the journey of selecting the perfect pet insurance plan,remember that your choices today can significantly impact your furry friend’s health and your peace of mind tomorrow.With the right policy in place, you can focus on what truly matters—nurturing the bond you share with your pet. By weighing the options,understanding the jargon,and aligning the coverage with your needs,you’re well-equipped to make an informed decision.

Whether it’s covering routine check-ups, unexpected illnesses, or the occasional mischievous mishap, a thoughtfully chosen pet insurance plan is an investment in your pet’s future. So take a moment to reflect, explore the options, and give your beloved companion the care they deserve. here’s to happy tails and healthy lives!