What Are Medicare Advantage Plans?

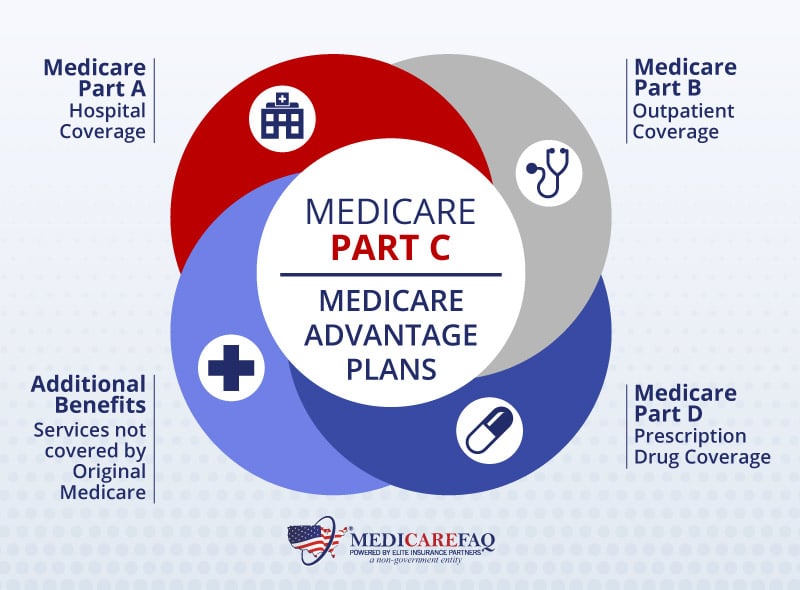

Medicare Advantage Plans (MA Plans or Part C) are health insurance plans offered by private companies that contract with the Centers for Medicare & Medicaid Services (CMS). These companies are required to offer at least the same level of coverage as Original Medicare (Part A for hospital care and Part B for outpatient care). Most Medicare Advantage Plans go beyond this, bundling in additional features such as:

-

Prescription drug coverage (Part D)

-

Dental care

-

Vision services

-

Hearing aids

-

Fitness and wellness programs

Many plans function like HMOs or PPOs, which means you may need to use in-network providers and obtain prior authorizations for specific services or procedures.

A major feature that distinguishes Medicare Advantage from Original Medicare is the annual out-of-pocket (OOP) maximum. This means there’s a cap on how much you’ll spend each year for covered services, which provides critical protection against catastrophic medical expenses.

Why Medicare Advantage Plans Matter in 2025

As of 2025, Medicare Advantage continues to be a preferred choice for many retirees. The year brings several updates and trends that make MA Plans more relevant than ever.

1. Growth in Zero-Premium Options

In 2025, nearly 67% of Medicare Advantage Prescription Drug (MA-PD) plans will offer $0 monthly premiums beyond the standard Part B premium. This makes high-value coverage more accessible, especially for individuals on a fixed income.

2. Annual Out-of-Pocket Maximums for Financial Protection

Original Medicare lacks a spending cap, meaning you could face unlimited costs for ongoing treatment. In contrast, Medicare Advantage Plans set an OOP limit, which helps you budget and prevents healthcare-related financial strain.

For 2025, the maximum OOP limit for in-network services is expected to remain around $8,850, though many plans offer even lower caps.

3. Enhanced Quality of Life Through Added Benefits

Most plans include valuable extras such as:

-

Routine dental cleanings and procedures

-

Vision exams and glasses

-

Hearing aids and screenings

-

Gym memberships or wellness programs (like SilverSneakers)

These benefits are not covered under Original Medicare and can make a significant difference in overall well-being.

4. Resilience of Core Benefits

While some supplemental services like over-the-counter (OTC) product allowances, transportation, or meal delivery may see reductions, a 2023 KFF report confirms that essential benefits — including dental, vision, and hearing — remain widely available and valued by enrollees.

Common Challenges with Medicare Advantage

Medicare Advantage has much to offer, but it’s not without drawbacks. Understanding the limitations can help you make a more balanced decision.

1. Limited Provider Networks

Unlike Original Medicare, which allows you to see any doctor who accepts Medicare, most MA plans use network-based systems. You might need to:

-

Choose a Primary Care Provider (PCP)

-

Get referrals to see specialists

-

Use in-network facilities to receive full benefits

This can restrict your freedom of choice, particularly in rural areas with fewer participating providers.

2. Benefit Reductions and Plan Changes

While most plans continue offering popular extras, some are cutting back on:

-

Transportation assistance

-

OTC product stipends

-

Post-discharge meal delivery

It’s crucial to review benefit details annually to avoid surprises.

3. Changing Availability by Region

Each year, some plans may exit your service area, merge with others, or be discontinued. If your plan is no longer available, you’ll need to select a new one during the Annual Enrollment Period (AEP) or, in some cases, a Special Enrollment Period (SEP).

4. Year-to-Year Variability

Drug formularies, premiums, copays, and network providers can all change annually. Failing to read your Annual Notice of Change (ANOC) could result in higher costs or reduced coverage for the services and medications you rely on.

Smart Strategies to Choose the Right Medicare Advantage Plan

Choosing the right plan requires more than picking one with the lowest premium. Follow these steps to make an informed choice:

1. Evaluate Your Health Needs

Ask yourself:

-

Do you take multiple prescriptions?

-

Do you visit specialists regularly?

-

Do you anticipate surgeries or procedures in the coming year?

Choose a plan that matches your healthcare usage patterns and preferred doctors or hospitals.

2. Use Online Tools and Local Support

The Medicare Plan Finder on Medicare.gov is a reliable resource for comparing plans in your zip code. You can filter based on:

-

Monthly premiums

-

Estimated drug costs

-

Star ratings

-

Provider networks

Also consider reaching out to your local State Health Insurance Assistance Program (SHIP) for free, personalized guidance.

3. Understand Total Costs — Not Just Premiums

Don’t just focus on the monthly premium. Also consider:

-

Deductibles

-

Copays and coinsurance

-

Annual OOP maximum

This full-cost view helps you avoid underestimating your true financial exposure.

4. Review the ANOC Every Fall

Every fall, plans send out the Annual Notice of Change, detailing updates to costs, benefits, and drug coverage for the coming year. Review this carefully to determine if your current plan still meets your needs.

5. Look into New Payment Options for Medications

Starting in 2025, a new policy allows monthly installment payments for expensive drugs through Part D and Medicare Advantage plans. This monthly drug payment option is especially helpful for individuals managing chronic conditions with high-cost treatments.

6. Explore Support for Caregivers

If you’re caring for someone with dementia or a severe chronic illness, new federal programs like GUIDE (Guiding an Improved Dementia Experience) may offer support, including:

-

Care coordination

-

Educational resources

-

Up to $2,500/year in caregiver compensation

Cost and Accessibility Comparison

Here’s how Medicare Advantage stacks up against other Medicare coverage options:

| Plan Type | Monthly Premium (2025) | Advantages | Disadvantages |

|---|---|---|---|

| Medicare Advantage (MA-PD) | Avg. ~$17 | Low cost, OOP limits, bundled extras | Network restrictions, benefit variability |

| Original Medicare + Medigap | Part B + $109–$509 | Nationwide access, minimal copays | Higher cost, separate Part D plan needed |

| Basic MA plans (few extras) | $0–$10 | Very low premiums | Fewer perks like OTC, fitness, transportation |

Financial Assistance Options for Low-Income Seniors

If you’re struggling to afford coverage, several programs can help:

-

Extra Help (Low-Income Subsidy): Assists with Part D costs, including premiums and copays.

-

Medicare Savings Programs (MSPs): May pay for Part B premiums and other costs.

-

State Pharmaceutical Assistance Programs (SPAPs): Available in some states to help with drug costs.

-

Special Enrollment Periods (SEPs): Offered to individuals who qualify due to income, disability, or life changes.

Frequently Asked Questions (FAQs)

1. What is a Medicare Advantage Plan?

A Medicare Advantage Plan is a private insurance alternative to Original Medicare that combines Parts A and B, often includes Part D, and provides added benefits like dental and vision coverage.

2. Who should consider enrolling in a Medicare Advantage Plan?

Anyone looking for integrated coverage, lower upfront costs, and extra benefits — especially if they’re comfortable with provider networks and plan limitations.

3. Are there extra monthly costs?

Many Medicare Advantage plans do not charge additional monthly premiums beyond the standard Part B premium. In 2025, 67% of MA-PD plans are projected to offer $0 premiums.

4. Are supplemental benefits being reduced in 2025?

Some extra services, such as OTC allowances or meal delivery, may be scaled back. However, core benefits like dental, vision, and hearing remain widely available.

5. Can I switch plans outside the Annual Enrollment Period?

Yes, in specific cases like moving, losing other coverage, or becoming eligible for Medicaid, you can qualify for a Special Enrollment Period (SEP).

6. What is the new monthly drug payment option?

Beginning in 2025, enrollees can spread out their high-cost prescription expenses into monthly payments, reducing immediate out-of-pocket burdens.

Conclusion: Is Medicare Advantage Right for You in 2025?

Medicare Advantage Plans continue to evolve, offering attractive coverage choices with a focus on affordability and comprehensive benefits. While they may not suit everyone — particularly those who value provider flexibility — they can be an excellent solution for people looking to cap their annual medical spending while receiving extras not included in Original Medicare.

By reviewing your needs, comparing plans annually, and staying informed about policy changes, you can take charge of your healthcare coverage with confidence. For 2025 and beyond, Medicare Advantage offers the potential for personalized, cost-effective, and integrated care — if you choose wisely.