As beloved members of our families, pets bring us joy, companionship, and sometimes, unexpected challenges. Yet, just like any family member, they can face health issues that may require costly veterinary care. Enter pet insurance—a safety net for pet parents looking to mitigate those unanticipated expenses. tho,as appealing as the idea may sound,navigating the intricacies of what pet insurance actually covers can frequently enough feel like venturing into uncharted territory. From routine check-ups to emergency surgeries, the fine print can leave many pet owners puzzled. in this article, we’ll unpack the essential elements of pet insurance, illuminating what policies typically include, what exclusions may surprise you, and how to choose the right coverage for your furry friend. Don’t let the complexities of pet insurance catch you off guard—let’s dig deeper into the protection that awaits!

Understanding the Basics of pet Insurance Coverage

When considering pet insurance, it’s essential to know what types of coverage are typically available. pet insurance policies generally fall into two main categories: accident and illness coverage and wellness coverage. Accident and illness coverage protects your pet from unexpected veterinary bills arising from accidents, injuries, and illnesses.this includes conditions like broken bones, infections, and chronic diseases. Conversely, wellness coverage, sometimes offered as an add-on, takes care of routine expenses such as vaccinations, annual check-ups, and preventative medications. By understanding these categories, pet owners can better tailor thier insurance to meet their pet’s specific needs.

The specifics of what each policy covers can vary considerably between providers. Commonly included conditions in accident and illness coverage are:

- Emergency care: This includes visits to emergency animal clinics for urgent health issues.

- Diagnostic testing: Coverage for blood tests,X-rays,MRIs,and similar diagnostic procedures.

- Surgeries: Protection for both major and minor surgeries, ranging from spaying/neutering to more complex operations.

- Medications: Coverage for prescribed medicines following an injury or illness.

Wellness plans can also be quite customizable, catering to a pet’s age and specific health needs. Common inclusions in wellness plans often feature:

- Routine vaccinations: Essential to protect against various contagious diseases.

- Dental cleanings: Procedures that help maintain proper oral health.

- Flea and tick prevention: Treatments aimed at preventing infestations.

- Annual wellness exams: Thorough check-ups to keep your pet in optimal health.

It’s important to thoroughly read the fine print of any pet insurance policy to understand exclusions,waiting periods,and limits. Most policies will have specific exclusions for pre-existing conditions, and some may impose breed-specific limitations. To help illustrate the differences in coverage options among various pet insurance providers, here’s a summary comparison:

| Insurance Provider | Accident & Illness Coverage | Wellness Coverage | Age Restrictions |

|---|---|---|---|

| Provider A | Yes | Available as add-on | no restrictions |

| Provider B | Yes | Included | Must be under 10 years |

| Provider C | Yes | Available as add-on | No restrictions |

choosing the right pet insurance involves understanding the various coverage options available and assessing them against your pet’s unique healthcare needs. By thoroughly researching and comparing different policies, you can make informed decisions that not only safeguard your furry friend’s health but also ensure peace of mind when navigating veterinary costs. Don’t forget to consider factors like customer reviews, claim processes, and overall value when selecting the ideal plan for your pet.

Common Health Issues and Their Coverage Options

Understanding the nuances of pet health insurance coverage can feel overwhelming, but being aware of common health issues and their respective coverage options can significantly ease that burden. Many providers concentrate on accident-related incidents, which can include conditions such as broken bones, lacerations, or trauma from a vehicle. These incidents are frequently enough straightforward to claim under typical plans. However, you shoudl also pay attention to how various conditions are categorized. As a notable example, issues arising from hereditary and congenital diseases might potentially be either partially covered or excluded altogether, depending on the policy.

Additionally, chronic conditions—such as diabetes, arthritis, and allergies—can be particularly challenging in terms of insurance coverage. While many pet insurance plans will cover initial treatment and diagnosis, ongoing expenses, including medication and follow-up visits, might not be available under all plans. Some providers include an annual limit on care for chronic conditions, while others will meet these costs comprehensively if the pet is enrolled before the onset of the illness. It’s crucial to read the fine print regarding these conditions to avoid unexpected out-of-pocket expenses.

Preventative care is another area where pet owners frequently enough find discrepancies in coverages.Many policies offer optional add-ons for routine veterinary care, such as vaccinations, dental cleanings, and annual check-ups. You may encounter plans that provide a comprehensive wellness package, whereas others may leave you paying for these services independently. To clarify, let’s take a look at a comparison table outlining common coverage options:

| Health Issue | Typical Coverage | possible Exclusions |

|---|---|---|

| Accident-related incidents | Full coverage for emergency care | Pre-existing conditions |

| Chronic conditions | Initial diagnosis and treatment | Ongoing treatments and medication |

| Preventative care | Optional add-on coverage | basic policies may exclude it |

Limitations and Exclusions: What you need to Know

When considering pet insurance,it’s essential to understand the limitations and exclusions that may come into play. Most policies have specific conditions, which can significantly affect what you end up paying for. First and foremost, many insurers will exclude pre-existing conditions, meaning any health issues your pet had before the policy began will not be covered. this can be frustrating, particularly for adopted pets whose medical histories might not be entirely known.

Another common limitation revolves around waiting periods. After purchasing a policy, you’ll likely encounter a gap before coverage kicks in. This waiting period can vary between insurers and policies, commonly lasting anywhere from a few days to several weeks.During this time, any issues or illnesses that arise are typically not eligible for reimbursement. Thus, it’s crucial to plan accordingly and understand when your insurance will start protecting your furry family member.

Additionally, many pet insurance policies have limits on benefit payouts and exclusions on specific treatments, such as cosmetic procedures or breed-specific conditions. Here’s a quick look at classifications that frequently enough create confusion:

| Coverage Type | Details | Common Exclusions |

|---|---|---|

| Accidents | usually covered with few exceptions. | Intentionally caused injuries. |

| Illnesses | Most illnesses are covered. | Pre-existing conditions, non-infectious diseases. |

| Routine Care | May require additional coverage | Grooming, vaccinations (unless included in a wellness plan). |

| Hereditary Conditions | Varies based on the breed. | Conditions common in specific breeds. |

Understanding these limitations and exclusions will help you make informed decisions about pet insurance. Before committing to a specific plan, it’s beneficial to thoroughly read the policy details, as they can contain surprises that may affect your decision or financial planning. knowing the specifics of what is and isn’t included can save you stress and unexpected expenses while ensuring that your beloved pet receives the care they need.

Preventive Care: Is It Included in Your Plan?

When selecting a pet insurance plan, one of the key factors to consider is whether preventive care is included. Not all policies cover routine check-ups, vaccinations, and other essential services that help maintain your pet’s health. These preventive measures can significantly reduce the risk of more serious and costly health issues down the line, so it’s vital to understand what your specific plan offers.

Many pet owners frequently enough overlook the importance of preventive care in their insurance coverage. This might encompass a variety of services, including:

- Annual wellness exams: Regular check-ups to catch potential health concerns early.

- Vaccinations: Immunizations that safeguard against common diseases.

- Dental cleanings: Professional oral care to prevent dental diseases.

- Flea and tick prevention: Treatments to keep common pests at bay.

- Dietary consultations: guidance on nutrition for overall health.

By including preventive care in your plan, you not only ensure your pet’s health but can also save on out-of-pocket expenses. Many insurance providers offer various levels of coverage, so it’s essential to ask the right questions. Understanding the specifics of your policy can prevent unexpected costs and help you make the most informed decisions regarding your companion’s health.

To illustrate how preventive care can vary across different insurance plans,consider the following table comparing common offerings:

| Insurance Plan | Annual exam | Vaccinations | Dental care | Flea & Tick Treatment |

|---|---|---|---|---|

| Plan A | Covered | Covered | Optional Add-on | Not Covered |

| Plan B | Covered | Covered | Covered | Covered |

| plan C | Not Covered | Optional Add-on | Not Covered | Covered |

As seen in the comparison,coverage for preventive care can fluctuate greatly. Some plans might require additional fees for specific services, while others provide comprehensive packages that ease the financial burden of routine pet care. To ensure your furry friend stays healthy, be proactive in reviewing various plans and their benefits. Aim to choose a plan that aligns with your pet’s unique needs for the best preventative care experiance.

Comparing Policy types: Accident-Only vs. Comprehensive Coverage

When it comes to selecting pet insurance, pet owners often find themselves weighing their options between accident-only policies and comprehensive coverage. Each type of policy offers distinct advantages and limitations, appealing to different needs and budgets. An accident-only policy is precisely what it sounds like: it covers veterinary expenses arising from accidents, such as fractures, lacerations, or ingestion of foreign objects. This could possibly save pet owners meaningful costs in emergency situations,providing peace of mind during unpredictable moments.However, it does leave a significant gap when it comes to routine care or illnesses, leaving pet owners to cover those expenses out-of-pocket.

Conversely, comprehensive coverage is a more extensive option that includes both accidents and a wide array of health issues. This type of policy often covers all of the following:

- Illnesses: Coughs, infections, chronic diseases, etc.

- Preventive Care: Vaccinations, annual check-ups, flea and tick prevention.

- Specialist Treatments: Surgery, acupuncture, physical therapy.

- behavioral Therapy: Coverage for consultations with animal behaviorists.

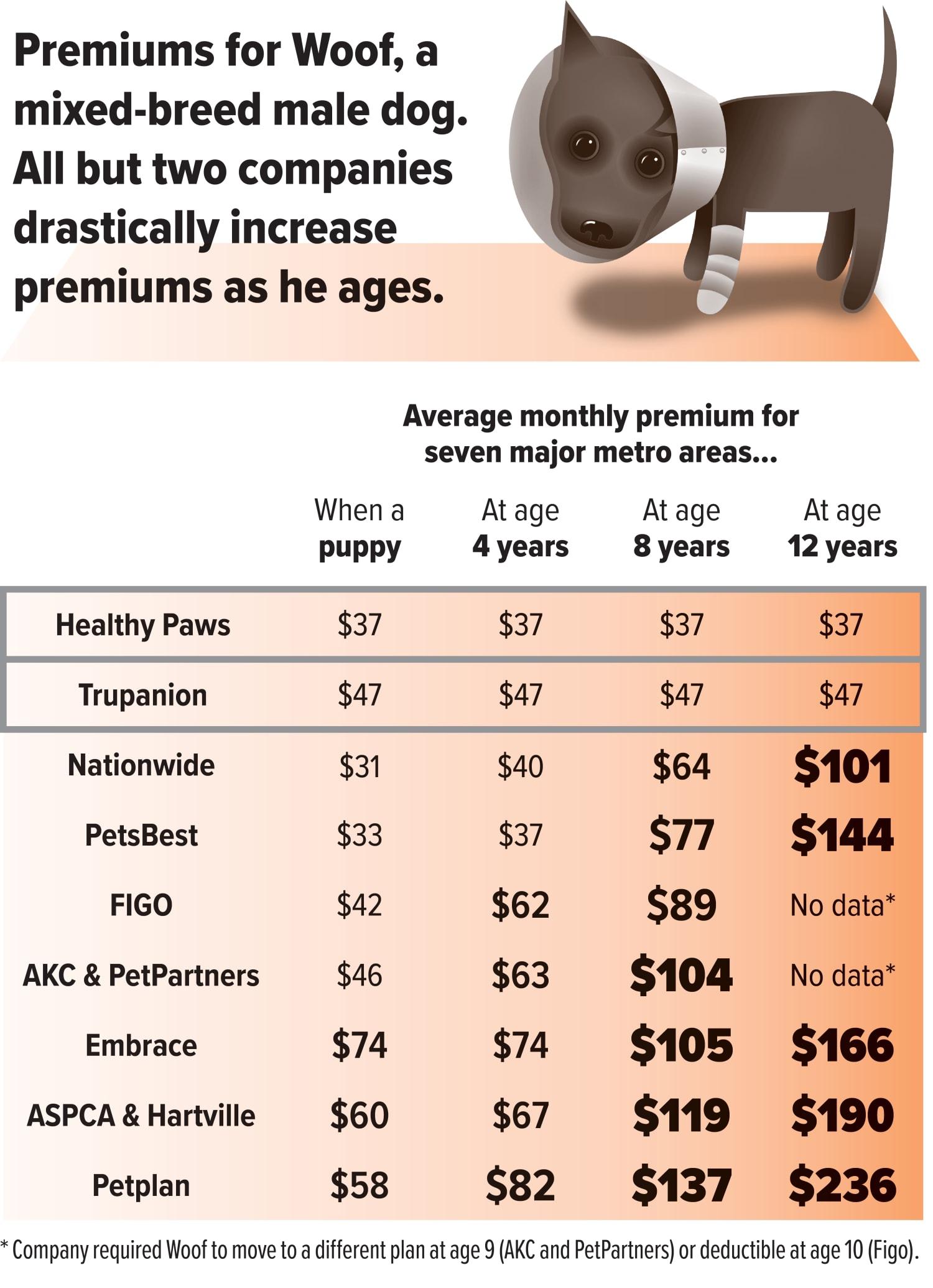

Such protection can make a significant difference in managing long-term health costs, ensuring that pet owners do not face devastating financial decisions when their furry friends require treatment for health concerns. However, it’s essential to recognize that with increased coverage typically comes higher premiums, which can be a concern for some pet owners.

For those trying to make a decision, evaluating personal priorities and financial considerations is crucial. A pet insurance comparison table can illustrate the differences between these two options succinctly:

| Policy Type | Covered Services | Average Premium Cost | Ideal For |

|---|---|---|---|

| Accident-Only | Emergency care for accidents | $10 – $40/month | Budget-conscious owners |

| Comprehensive | All accidents, illnesses, preventive care | $30 – $100/month | Owners seeking extensive coverage |

selecting the right type of pet insurance ultimately depends on your pet’s lifestyle and health history, and also your financial ability to handle veterinary expenses. Carefully considering these factors will lead you to the coverage that offers you the greatest peace of mind while ensuring your beloved pet receives the care they deserve.

Making Informed Choices: Tips for Selecting the Right Policy

Choosing the perfect pet insurance policy can feel like navigating a labyrinth,especially with the plethora of options available.take a moment to assess the specific needs of your furry friend. Consider their age, breed, and any pre-existing conditions. Consulting your veterinarian can provide insights into potential health issues that your pet might face as they age. This facts will guide you in selecting a policy that comprehensively covers the necessary treatments and emergencies that may arise.

next, delve into the specifics of what each policy offers. Look for coverage related to:

- Accident and Illness – Essential for unexpected mishaps and sickness.

- Routine Care – Includes vaccinations, check-ups, and preventive treatments.

- Congenital and Hereditary Conditions – Important for breeds predisposed to certain health problems.

- Choice Therapies – Coverage for holistic treatments like acupuncture or chiropractic care.

Make sure to understand the exclusions and limitations of each policy. Some might not cover specific conditions or may have waiting periods before coverage begins. A detailed comparison will ensure you’re not left with unforeseen gaps in protection.

| Policy Feature | Importance |

|---|---|

| Deductibles | Affects out-of-pocket costs before coverage kicks in. |

| Reimbursement Levels | Determines how much you’ll be reimbursed for claims. |

| Annual Limits | Sets a cap on how much the insurer will pay each year. |

| Network Restrictions | Impacts which veterinarians you can see for coverage. |

don’t overlook the importance of customer service and claim processing. Look for reviews and testimonials from other pet owners regarding their experiences with claims. A policy might seem appealing on paper but finding a company that responds quickly and effectively when you need to file a claim is equally essential. Some insurers even offer mobile apps to streamline claims and customer support, making it easier to manage your pet’s needs on the go.

Q&A

Q&A: What Does Pet Insurance Really Cover? Don’t Be surprised!

Q: What is pet insurance, and why should I consider getting it for my furry friend?

A: Pet insurance is a policy designed to help cover veterinary expenses for your pet. Just like health insurance for humans,it can alleviate the financial burden of unexpected medical treatments. If your pet faces an accident or serious illness, having insurance can save you from hefty bills and provide peace of mind.

Q: What types of coverage can I expect from a typical pet insurance policy?

A: Most pet insurance policies cover a range of treatments,including accidents,illnesses,surgeries,diagnostic tests,hospitalization,and medications. Some plans also offer preventative care, covering routine check-ups, vaccinations, and flea and tick treatments, either as part of the policy or as an add-on.

Q: Are there different plans offering varying levels of coverage?

A: Absolutely! Pet insurance comes in various plans tailored to your needs. Core plans usually cover accidents and illnesses, while higher-tier plans might include everything from dental care to alternative therapies. It’s essential to read the fine print and understand what each plan specifically includes.

Q: Does pet insurance cover pre-existing conditions?

A: Generally,no. Most pet insurance providers exclude pre-existing conditions from coverage. This means if your pet has a medical issue before you purchase insurance, any future treatments related to that condition may not be covered. Some companies might cover curable conditions after a waiting period, so it’s wise to ask!

Q: Are there any waiting periods before my coverage kicks in?

A: Yes, most pet insurance policies have waiting periods before coverage begins. This means that if your pet needs treatment during this time,the costs will be out of pocket. Common waiting periods range from a few days to a few weeks, depending on the type of coverage.

Q: Can I choose my veterinarian, or do I have to go to specific providers?

A: In most cases, you can visit any licensed veterinarian with a pet insurance policy. Unlike human health insurance, which often restricts you to certain providers, pet insurance gives you the versatility to choose where to take your pet for care.

Q: How do deductibles and reimbursement work with pet insurance?

A: Deductibles are the amount you must pay out of pocket before your insurance kicks in.After meeting your deductible, you’ll typically receive reimbursement for a percentage of the veterinary costs, often ranging from 70% to 90%. Be sure to clarify these details with your insurance provider to know what you’ll be responsible for financially.

Q: What should I consider before purchasing pet insurance?

A: Consider factors like your pet’s age, breed, and health history, as they can influence policy options and costs. Additionally, assess the coverage limits, deductibles, and premium rates. It’s critically important to compare several providers and read customer reviews to find the best fit for your needs.

Q: is pet insurance worth the investment?

A: That ultimately depends on your individual circumstances. If you’re financially prepared to handle emergencies or your pet has a low risk of developing health issues, you might decide against insurance. Though, many pet owners find that having insurance provides invaluable security and seriously reduces stress during health crises.

Conclusion: Pet insurance can be a perplexing topic, but understanding the nuances of coverage is key to making an informed choice. By asking the right questions, you can ensure you’re well-prepared for whatever comes your pet’s way, without being caught off guard by unexpected expenses.

Closing Remarks

navigating the world of pet insurance can feel like a maze filled with enticing promises and hidden nooks. By understanding what your policy truly covers, you can make informed decisions that best suit your furry companions’ needs. Whether you’re facing unexpected medical bills or planning for routine health care, knowledge is your most powerful tool. Remember, a well-prepared pet parent is a happy pet parent. As you embark on this journey of protection and peace of mind, take the time to read the fine print, ask questions, and choose a plan that aligns with your pet’s unique requirements. After all, your pet depends on you — not just for love and companionship, but also for the safety and care they deserve. So don’t be surprised; be informed, and give your beloved companion the health security they need to thrive. Happy insuring!