Pet Insurance Explained: Coverage, Costs, and What to Expect

In a world where furry companions often become cherished family members, the thought of their health and well-being weighs heavily on pet owners’ minds. Just as we invest in our own health care, a growing number of pet parents are turning to pet insurance as a safeguard against unforeseen medical expenses. But what exactly does pet insurance encompass? With a variety of plans available, understanding the nuances of coverage, potential costs, and the claims process can feel overwhelming.in this article, we’ll demystify pet insurance, breaking down it’s essential components to help you make informed decisions for your beloved animal friends. Whether you’re a first-time pet owner or simply seeking to enhance your current knowledge,join us as we navigate the landscape of pet insurance—equipping you with the insights needed to protect those who rely on you most.

Understanding the Basics of Pet Insurance Coverage

When it comes to pet insurance, understanding the diverse range of coverage options is crucial for responsible pet ownership. Most policies fall into a few primary categories: accident coverage, illness coverage, and wellness coverage.Accident coverage typically includes injuries like fractures, lacerations, or poisonings and can definitely help cover expensive emergency visits. Illness coverage, on the other hand, addresses a broader spectrum of health concerns such as infections, chronic diseases, and cancer treatments. this type of coverage is essential, as it can significantly alleviate financial strain during unexpected health crises.

Wellness plans are often considered an add-on to standard policies and may encompass routine care expenses like vaccinations, annual exams, and preventive treatments. It’s meaningful for pet parents to weigh the costs against the benefits when choosing these additional levels of coverage. When evaluating the various plans available, consider the following factors:

- Deductibles: understand what you need to pay out of pocket before insurance kicks in.

- Reimbursement Rates: Policies often cover a percentage of the total bill, typically ranging between 70% and 90%.

- Exclusions: Review any conditions or treatments that may not be covered by the policy.

Additionally,some pet insurance policies may have specific waiting periods before coverage begins,which can vary by provider and plan type. Understanding these details is important to avoid unexpected gaps in coverage when your pet needs it most. Another essential aspect to consider is whether the policy allows you to see your preferred veterinarian or if it restricts you to a network of pet healthcare providers. Here’s a rapid comparison of typical coverage options:

| Type of Coverage | What It Covers | Common Exclusions |

|---|---|---|

| Accident | Emergency injuries, surgeries | Pre-existing conditions |

| Illness | Chronic diseases, infections | Certain hereditary conditions |

| Wellness | Routine check-ups, vaccinations | emergency care |

Evaluating Different Types of Pet Insurance Plans

When considering pet insurance, it’s essential to understand the different types of plans available. Broadly, pet insurance can be categorized into accident-only plans, comprehensive plans, and wellness plans. Each type serves a specific purpose and can vary widely in terms of coverage and cost.

Accident-only plans offer protection solely for unexpected injuries your pet may encounter. This includes incidents such as broken bones, accidental ingestion of foreign objects, or severe lacerations. While these plans tend to be more affordable than comprehensive coverage, they do come with limitations. It’s crucial to keep in mind that this type does not cover any routine veterinary expenses, illnesses, or pre-existing conditions. Moreover,here’s a quick comparison of the cost implications:

| Type of Plan | Average Monthly Cost | Coverage Includes |

|---|---|---|

| accident-Only | $15 – $30 | Injuries from accidents |

| Comprehensive | $30 – $70 | Illnesses,accidents,and more |

| Wellness | $10 – $35 | Routine care and preventive treatments |

In contrast,comprehensive plans encompass a broader range of services,including both accidents and illnesses. They can cover everything from surgeries and hospitalization to prescription medications and even chronic conditions. If you prefer a more extensive safety net for your pet’s healthcare needs, opting for a comprehensive plan may provide peace of mind, albeit at a higher monthly premium. it’s a wise decision to review what specific incidents and treatments are included to avoid surprises when the need arises.

Lastly, wellness plans focus on preventive care and can include vaccinations, annual check-ups, flea and tick prevention, and dental cleanings. While they typically do not provide coverage for incidents related to accidents or illnesses, they are an excellent option for pet owners looking to maintain their pet’s health proactively. Frequently enough structured as an annual package, these plans provide a predictable cost for routine care, fostering a healthier lifestyle for your furry family member.

Calculating the Cost of Pet Insurance: Factors to Consider

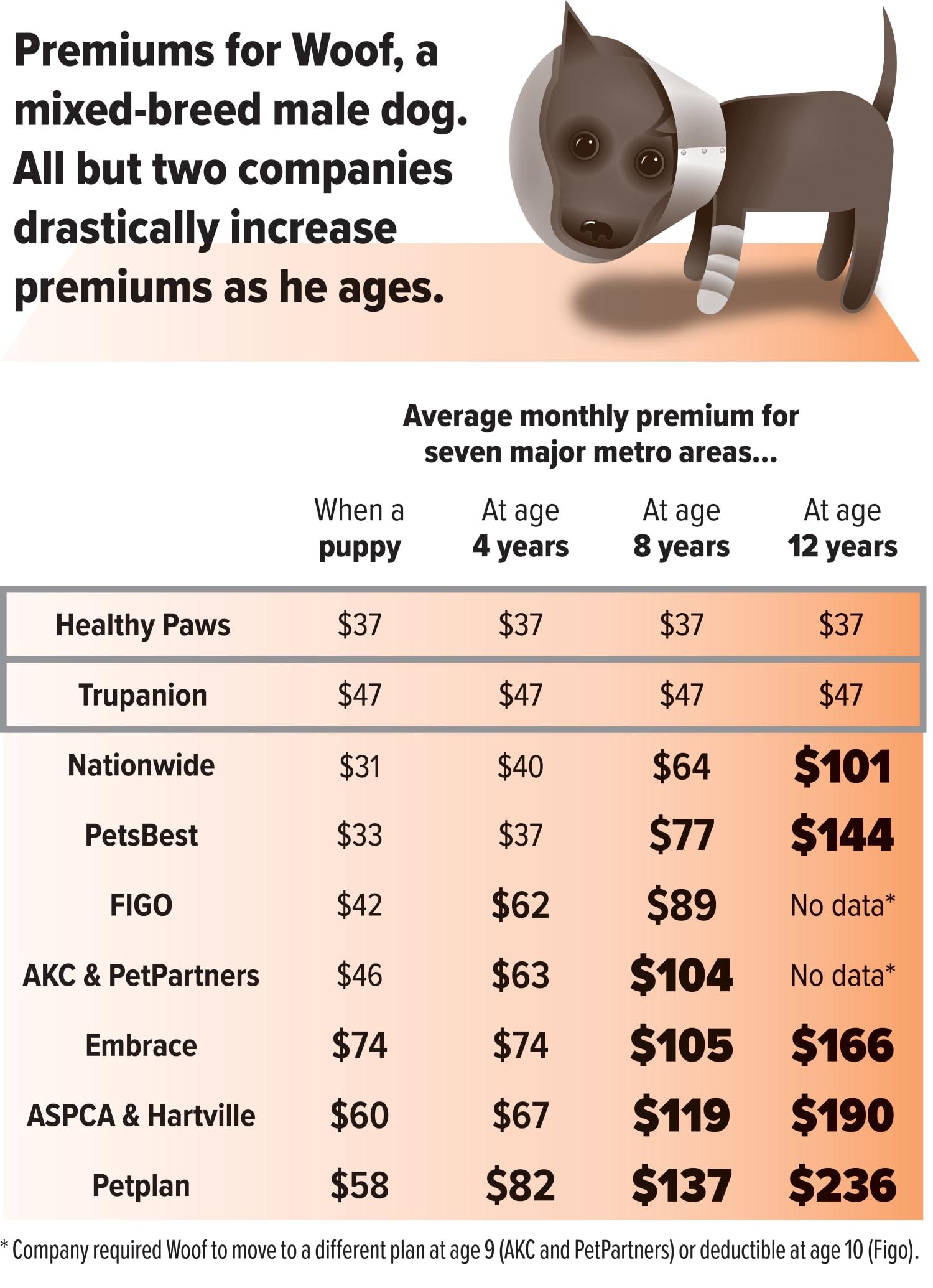

When considering pet insurance, it’s essential to understand the various factors that contribute to the overall cost of coverage. First and foremost, your pet’s age and breed are significant determinants. Generally, older pets may incur higher costs due to an increased likelihood of health issues, while specific breeds might be predisposed to hereditary conditions. For instance, breeds like Bulldogs and Dachshunds often require more medical attention, which can influence insurance premiums.

another crucial element to factor in is the coverage type you select. Pet insurance typically falls into several categories, including accident-only plans, comprehensive coverage, and wellness plans. Accident-only plans tend to be cheaper but cover limited incidents, whereas comprehensive plans provide broader coverage, including illnesses and preventive care. Also, check for any deductibles, copays, and limits associated with various policies. A higher deductible can lower your monthly premium, but it may result in out-of-pocket expenses before the insurance kicks in.

consider the insurance provider’s reputation and customer service. Researching company reviews, claim processing times, and customer satisfaction can offer insight into the overall experiance. Some insurance companies also feature additional benefits like discounts for multiple pets or reduced rates for annual payments versus monthly payments. Comparing plans and providers through online platforms can definitely help you evaluate what fits your needs best and ultimately aid in managing your pet’s healthcare costs efficiently.

What to Look for in a Pet Insurance Policy

When searching for the right pet insurance policy, consider various factors that directly impact the quality of coverage you’ll receive. Coverage types can vary significantly, so it’s crucial to review what each policy includes, particularly in relation to your pet’s specific breed, age, and health conditions. Look for the following critical elements:

- Accident Coverage: Ensures that your pet is covered for unforeseen events, such as injuries from accidents or sudden illnesses.

- Illness Coverage: Protects against a range of diseases and health issues that may arise during your pet’s life.

- Wellness or Preventive Care: Some policies include coverage for regular check-ups, vaccinations, and dental care.

- Hereditary and Congenital Conditions: Verify whether the policy covers conditions that are frequently enough breed-specific.

- Emergency Services: Ensure access to emergency veterinary services, which can be essential for treatment during critical times.

Another critically important aspect to evaluate is the deductibles and reimbursement rates. The deductible is the amount you’ll pay out-of-pocket before your coverage kicks in, while reimbursement rates indicate the percentage of the vet bill that the insurance will cover after the deductible is met. Compare different policies side by side to find an optimal balance between monthly premiums, deductibles, and reimbursement percentages. Consider creating a table to visualize these aspects:

| Policy Provider | Monthly Premium | Annual Deductible | Reimbursement Rate |

|---|---|---|---|

| Provider A | $30 | $250 | 80% |

| Provider B | $25 | $300 | 90% |

| Provider C | $35 | $200 | 70% |

Lastly, the reputation and customer service of the insurance provider shouldn’t be overlooked. Research the provider’s history, customer reviews, and claims process to gauge reliability. Consider these factors:

- Claim Processing timeline: How quickly will claims be processed? A swift response is crucial during stressful times.

- Customer Support Availability: check if assistance is available 24/7 for urgent inquiries or claims.

- Network of Veterinarians: ensure that your plan works with your preferred veterinary clinics, giving you adaptability when seeking care.

- Exclusions and Limitations: Understand the fine print regarding what is explicitly excluded from your policy to avoid unexpected surprises.

Common Exclusions and Limitations to Keep in Mind

When considering pet insurance, it’s essential to understand that not all situations are covered. Most policies come with certain exclusions that can impact your reimbursement when it comes time to file a claim. Commonly excluded items include:

- Pre-existing conditions: Any health issues your pet had before the policy was activated will typically not be covered.

- Routine care: Check-ups, vaccinations, dental care, and flea treatments are usually not included unless you opt for an add-on policy.

- Cosmetic procedures: Services like ear cropping,tail docking,and other elective surgeries are generally excluded from standard coverage.

Another important point to consider are the waiting periods. Most insurance providers enforce a waiting period before coverage kicks in, which varies by company and policy. During this time, any conditions that may arise will not be covered. typical waiting periods can include:

| Type of Coverage | Waiting Period |

|---|---|

| Accident Coverage | Immediate / 0 days |

| Illness Coverage | 14 to 30 days |

| Orthopedic Conditions | 6 months |

Lastly, some insurance policies have limitations on coverage amounts, which can cap how much you can reclaim in a year or per incident. It’s crucial to read the fine print and understand any annual limits or percentage reimbursements that apply. Some policies may offer:

- Annual Coverage Limits: A maximum dollar amount that can be reimbursed in a year.

- Per-Incident Limits: Capping the reimbursement on individual treatments or health events.

- Lifetime Limits: A total cap on how much can be claimed over a pet’s lifespan.

Navigating Claims and Customer Support in Pet Insurance

Understanding the claims process in pet insurance is crucial for pet owners, ensuring that you get the most out of your policy during unexpected veterinary visits. Typically, the process begins when you receive a bill from your veterinarian. After that, you will need to submit a claim through your insurance provider, which usually can be done online or via a mobile app. Ensure you have the following ready for smooth processing:

- Your pet’s policy number

- The veterinarian’s invoice detailing services and treatments

- Any necessary medical records that support the claim

Many insurance companies promise quick turnaround times for claims, often processing them within a week. Still, you should be prepared for the possibility of waiting longer based on complexity or additional information requests. Once approved, your insurer will either reimburse you directly or pay the vet on your behalf, depending on your policy terms. Familiarize yourself with common claim challenges, like:

- Pre-existing conditions: Most policies do not cover existing ailments when you enroll.

- Waiting periods: Specific conditions might have defined waiting periods before coverage kicks in.

- Policy limits: Be aware of any annual or lifetime limits on claims.

Customer support plays a pivotal role in your experience with pet insurance.Since pet health can often lead to urgent situations, having easy access to knowledgeable support staff can make a significant difference. Most providers offer multiple channels for assistance, including:

- 24/7 helplines: Ensure you have immediate answers during emergencies.

- Online chat: Get instant support while navigating through claims or coverage questions.

- Email support: Ideal for non-urgent inquiries, but expect longer response times.

Understanding your insurer’s support offerings can definitely help set your expectations and ease potential frustrations. For a clearer view of what various companies provide, below is a straightforward comparison of customer support features:

| Insurance Company | 24/7 Helpline | Live Chat | email Support |

|---|---|---|---|

| Company A | yes | Yes | Yes |

| Company B | No | No | Yes |

| Company C | Yes | Yes | No |

With this roadmap for navigating claims and customer support, you’ll be well-equipped to handle challenges that arise. Remember that reading through your policy details can clarify any specific requirements and expectations regarding the claims process.Equipped with this knowledge, you’re set to make informed decisions about your pet’s health care and the coverage that’s right for you.

Q&A

Q&A: Pet Insurance Explained: Coverage, Costs, and What to Expect

Q1: what is pet insurance, and why would I need it?

A: Pet insurance is similar to health insurance for humans; it helps cover veterinary costs for your furry friend. It can alleviate the financial burden of unexpected medical expenses, such as surgeries, illnesses, and accidents. If you want peace of mind knowing you can provide the best care without worrying about the cost, pet insurance can be a wise investment.

Q2: What type of coverage can I expect from pet insurance policies?

A: Coverage varies by plan, but most pet insurance policies typically fall into three main categories: accident-only, accident and illness, and comprehensive coverage. Accident-only plans cover injuries—like broken bones or bites—while accident and illness plans include coverage for conditions like allergies or chronic diseases. Comprehensive plans aim to cover it all, including preventive care, which might include vaccinations and check-ups, depending on the insurer.

Q3: Are there any exclusions I should be aware of?

A: Yes, most pet insurance plans have exclusions. Commonly excluded are pre-existing conditions—medical issues that exist before your coverage starts. Additionally, certain breeds may have breed-specific exclusions, and cosmetic procedures, preventive care, or choice therapies may also be left out of the policy. Always read the fine print to understand what is and isn’t covered.

Q4: How much does pet insurance cost?

A: The cost of pet insurance depends on various factors, including your pet’s age, breed, and health status, and also the coverage level you select. On average, monthly premiums can range from $20 to $100. It’s important to shop around and compare policies to find one that fits your budget and meets your pet’s needs.

Q5: What is a deductible, and how does it work?

A: A deductible is the amount you must pay out of pocket before your insurance kicks in to cover eligible expenses. Pet insurance typically offers options for deductibles—higher deductibles lead to lower premiums and vice versa. Once you’ve met your deductible, you’ll usually be responsible for a co-pay, and the insurer pays the rest, which can be anywhere from 70% to 90% of eligible costs.

Q6: How do I file a claim with pet insurance?

A: Filing a claim generally involves three steps: rendering service at the vet, paying the veterinary bill, and submitting a claim to your insurer for reimbursement. Most companies allow claims to be submitted online, via an app, or through conventional mail.Be sure to keep all receipts and provide any required documentation to speed up the review process.

Q7: What happens if I don’t use my pet insurance?

A: Pet insurance operates on a pay-as-you-go model; if you do not use your insurance, you may not receive any refund on premiums paid. However, most pet owners see insurance as a safety net for unexpected health issues rather than a wasted expense. Consider it akin to having a home or car insurance—just because a catastrophe doesn’t happen doesn’t mean you wouldn’t benefit from having coverage.

Q8: When is the best time to get pet insurance for my pet?

A: The best time to get pet insurance is when your pet is young and healthy, as premiums tend to be lower and there are fewer concerns about pre-existing conditions. However, it’s never too late to get coverage—just keep in mind that costs may be higher for older pets, and some medical conditions may not be covered.

Q9: How do I choose the right pet insurance for my needs?

A: Start by assessing your pet’s specific needs—consider factors such as age, breed, and health issues. Then, research different companies, read customer reviews, and compare coverage options, premiums, and customer service ratings.Don’t hesitate to reach out to insurers with questions; a knowledgeable representative can clarify your options and help you make an informed choice.

Q10: Is pet insurance worth the investment?

A: While pet insurance is a personal choice, many pet owners find it to be a valuable investment for ensuring their pets receive necessary medical care without significant financial strain.Weigh the cost of potential veterinary bills against the monthly premium, and consider your economic situation and your pet’s health history to determine what’s right for you.

By understanding the ins and outs of pet insurance, you can make an informed decision that prioritizes your pet’s health and your peace of mind!

To Conclude

As we wrap up our exploration of pet insurance, it’s clear that making an informed decision requires weighing the benefits against the costs while considering the unique needs of your furry family member.Pet insurance offers a safety net, providing peace of mind that can ease the financial burden associated with unexpected veterinary bills.

Remember, every pet is different, and their health needs may vary over time. Regular check-ups, understanding what your policy covers, and evaluating options annually can empower you to make the choices that best suit both your pet’s health and your budget. Whether you choose a comprehensive plan or a more basic one, the key is to ensure that you are prepared for whatever life may throw your way.

investing in pet insurance can be more than just a financial plan; it’s a commitment to your pet’s well-being, allowing you to focus on what truly matters—sharing joy, companionship, and countless adventures with your beloved companion.happy insuring, and may your pet enjoy a long, healthy life!