student Loan Interest Rates in 2025: What’s Changed?

The landscape of student loan interest rates in 2025 has undergone important transformations compared to previous years. This article dives deep into the changes that students and borrowers can expect and what it means for their financial future. Understanding these shifts is crucial for making informed decisions about student loans. Whether you’re currently in school, a recent graduate, or a parent financing education, knowing the latest on interest rates can dramatically impact your budgeting and repayment strategy.

Key Changes in Student Loan Interest Rates for 2025

In 2025,student loan interest rates were influenced by several factors,including economic conditions,federal policy changes,and market demands. Here’s a summary of the significant changes:

| Loan Type | 2024 Interest rate | 2025 Interest Rate | Difference |

|---|---|---|---|

| Federal Undergraduate Loans | 4.99% | 4.99% | No Change |

| Federal Graduate Loans | 6.54% | 6.54% | No Change |

| Federal Parent PLUS Loans | 7.54% | 7.54% | No Change |

| Private Loans Average* | 9.49% | 10.34% | +0.85% |

*Note: Private loan rates vary considerably based on the lender and creditworthiness.

The Impact of Economic Factors

The stability of interest rates on student loans is often tied to broader economic trends. In 2025, several economic factors played a pivotal role:

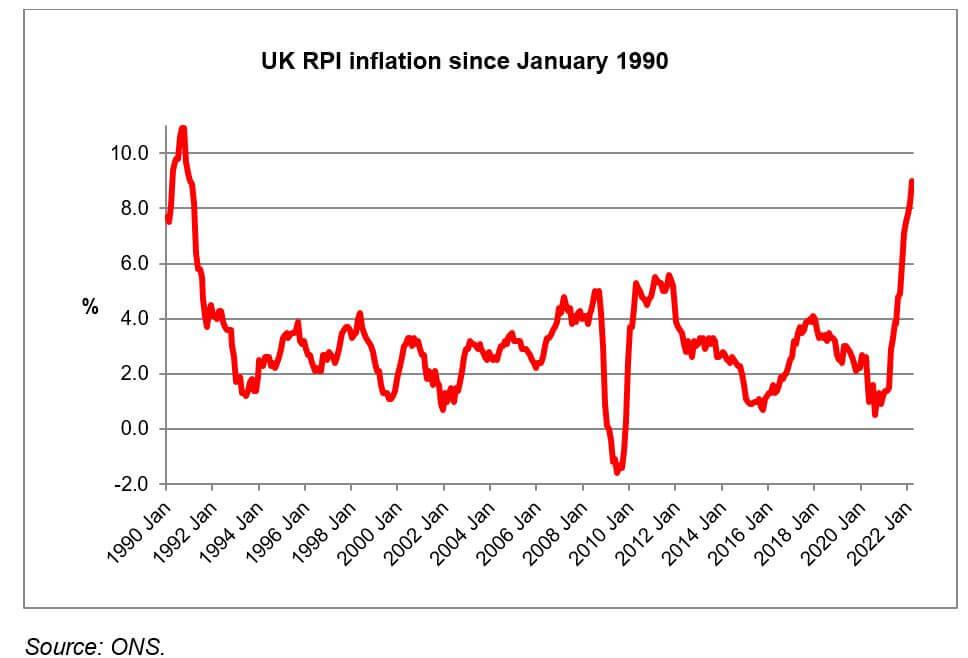

- Inflation Rates: Rising inflation rates have prompted lenders to adjust their rates, notably for private loans.

- Federal Economic Policies: Changes in federal rates and policies in response to economic conditions can stabilize or alter federal student loan interest rates.

- Job Market Trends: A robust job market can indicate better earnings potential for graduates, which may affect loan decisions.

Understanding Different Loan Types

It’s essential for borrowers to recognize the differences between federal and private student loans, especially when it comes to interest rates:

Federal Student Loans

Federal loans typically come with fixed interest rates and robust borrower protections:

- Subsidized Loans: These loans do not accumulate interest while the student is in school.

- Unsubsidized loans: Interest accrues while in school but has fixed rates.

Private student Loans

Private loans often have variable interest rates and are determined by credit scores and other factors:

- Variable Rates: These rates can fluctuate throughout the loan term, perhaps leading to higher long-term costs.

- Credit Requirements: Applicants with better credit scores typically receive lower interest rates.

Benefits of Staying Informed About Interest Rates

Being aware of student loan interest rates allows borrowers to:

- Make informed decisions about borrowing.

- Choose the right loan type for their needs.

- Capitalize on lower rates if refinancing becomes an option.

Practical Tips for Managing Student Loan Costs

to help manage your student loans effectively, consider these practical strategies:

- Know Your Rates: Regularly check the current rates for both federal and private loans.

- Refinance When Possible: Keep an eye on market conditions; refinancing could lower your interest rates.

- Automate Payments: Setting up automatic payments can often lead to interest rate reductions.

- Consider Loan Forgiveness: Look into programs that may forgive a portion of your loans after certain criteria are met.

Case Study: The Real-World Impact of interest Rate Changes

let’s evaluate a typical borrower, Jane, who graduated in 2023 with $30,000 in federal student loans and $20,000 in private loans. Here’s how the changes in interest rates affected her financial journey:

- With fixed federal loan rates of 4.99%, her monthly payments are predictable over the repayment term.

- However, her private loans, now averaging 10.34%, will significantly increase her overall repayment amount.

After researching, Jane decided to refinance her private loans to lock in a lower fixed rate. By doing so, she reduced her monthly payment and total interest paid over the loan’s lifetime.

Frist-Hand Experiance: Navigating 2025 Rates

Many borrowers shared their experiences with student loan interest rates and how they managed their finances in 2025:

“When I realized that rates were shifting upwards, I focused on paying down my higher-interest private loans first. It helped me save in the long run.” – Mark, recent graduate.

Conclusion

The student loan interest rates in 2025 have remained stable for federal loans, but private loans have seen an uptrend. Understanding how these changes can affect your financial planning is paramount. By leveraging strategies like refinancing, knowing your loan options, and keeping abreast of economic trends, borrowers can effectively manage their student loans and minimize their financial burden. Remember, staying informed is your best tool in navigating the landscape of student financing.