Unexpected Vet Bills? Here’s How Pet Insurance Can Help

In the warm embrace of our homes, pets weave themselves into the fabric of our lives, showering us with unconditional love and companionship. Whether it’s the playful pounce of a puppy or the gentle purr of a cat curling up in our laps, their presence brings us immeasurable joy.Though, the reality of pet ownership frequently enough comes with unforeseen expenses, especially when it comes to their health. A sudden illness or an accident can lead to a flurry of unexpected vet bills, leaving many pet owners feeling anxious and financially strained. Enter pet insurance—a safety net designed to cushion these unexpected financial blows. In this article, we’ll explore how pet insurance can ease the burden of unexpected healthcare costs, ensuring that your furry family member is covered when they need it moast. From understanding different policy options to navigating claims, we aim to equip you with the knowledge you need for making informed decisions about your pet’s health and wellbeing. Your beloved companion deserves the best, and with the right insurance plan, you can provide it without breaking the bank.

Understanding the Financial Burden of Unexpected Veterinary Costs

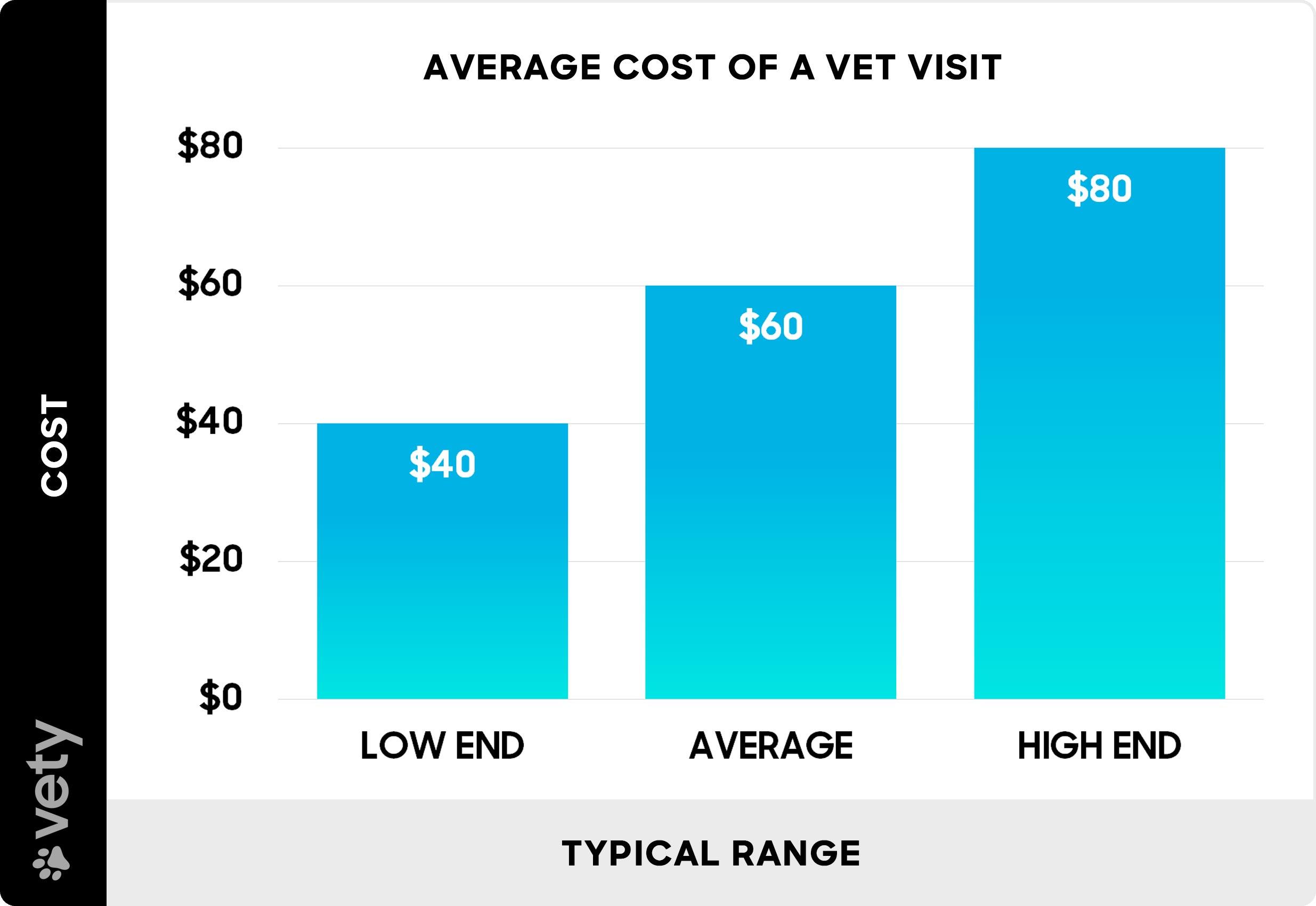

For many pet owners,the love and joy that furry companions bring to our lives are immeasurable. However, alongside the cuddles and games of fetch come some unforeseen financial responsibilities, particularly in the form of unexpected veterinary costs. Even routine visits can sometimes turn into important expenses, and unexpected illnesses or accidents can lead to bills that can make even the most prepared pet owner stop in their tracks. It’s essential to be aware of these potential expenses to ensure the well-being of your beloved pet without breaking the bank.

Common situations that can lead to sudden veterinary expenses include:

- Accidents: Injuries from falls, collisions, or altercations with other animals.

- Illness: Sudden onset of conditions like diabetes, kidney disease, or infections.

- Emergency procedures: Many pets may require surgeries or urgent care that cannot wait for a scheduled appointment.

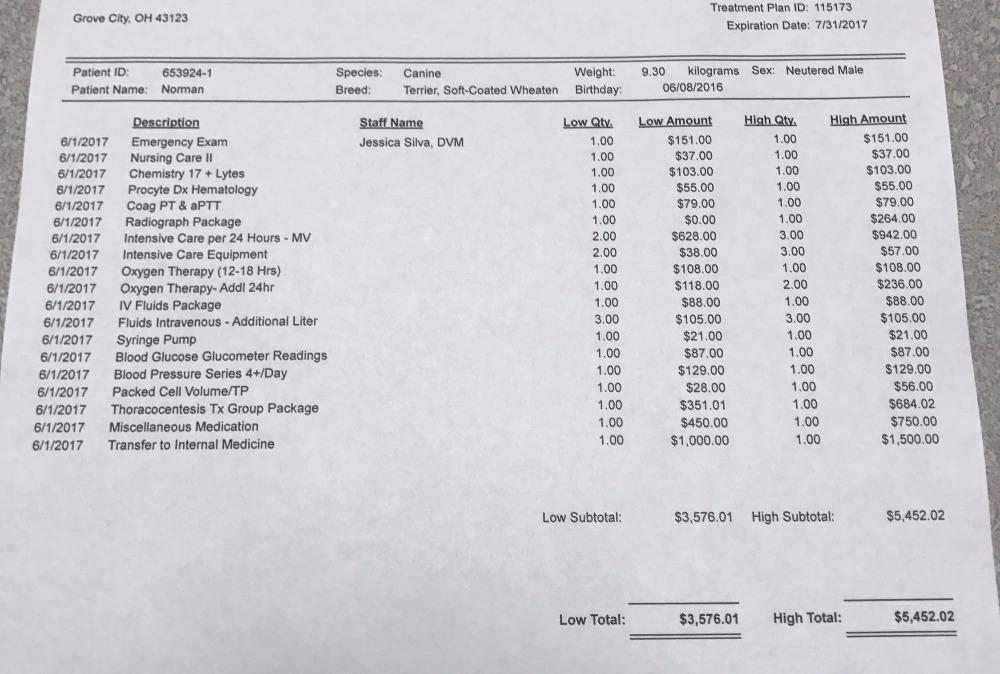

To further illustrate the potential financial impact, consider the following table that summarizes typical veterinary expenses based on common pet health issues:

| Condition | Estimated Cost |

|---|---|

| Accidental Injury | $1,000 – $3,000 |

| Emergency Surgery | $2,500 – $5,000 |

| Chronic Illness Treatment | $500 – $2,000+/year |

| Routine Procedures (including dental work) | $200 – $1,500 |

These expenses can quickly escalate, leaving pet owners feeling anxious and overwhelmed. Fortunately, pet insurance is designed specifically to alleviate some of this financial burden. By opting for a pet insurance policy, you can ensure that when the unexpected occurs, your equipped to handle the costs associated with veterinary care. In essence, pet insurance allows for peace of mind, enabling pet owners to focus on their companion’s recovery rather than worrying about how to afford necessary treatments.

The value of Pet Insurance in Safeguarding Your Pet’s Health

When it comes to keeping our furry friends healthy,proactive measures are essential. Medical expenses for pets can quickly spiral out of control, with unforeseen accidents and illnesses often taking pet owners by surprise. Pet insurance acts as a safety net, allowing you to provide the necessary medical care without the burden of overwhelming costs. By investing in pet insurance, you can focus on your pet’s health rather than your financial constraints.

One of the standout benefits of pet insurance is its ability to cover a wide range of services. Unlike human health insurance, which can have stringent restrictions and intricate processes, most pet insurance plans are designed to be straightforward and flexible. Common elements of coverage include:

- emergency care: Accidents happen, and having coverage allows immediate access to urgent treatments.

- Surgical procedures: Whether it’s a routine spay/neuter or more complex surgeries, insurance can help alleviate costs.

- Chronic conditions: Coverage for ongoing treatments,such as medication for diabetes or allergies,can help keep your pet pleasant.

- Preventative care: Some plans offer options for wellness exams, vaccinations, and dental cleanings, promoting long-term health.

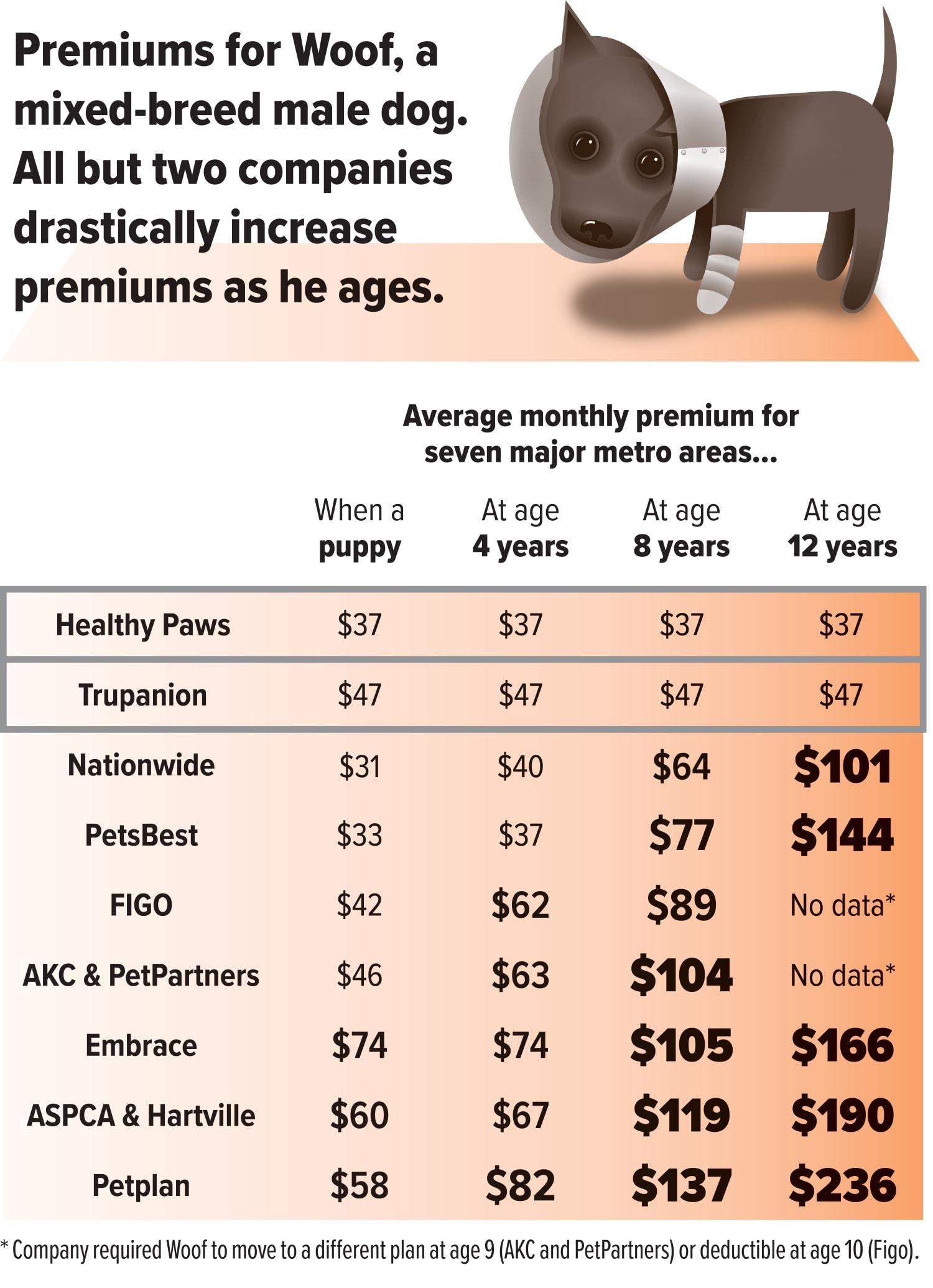

Pet insurance also fosters better decision-making regarding your pet’s health. In dire situations, the financial aspect shouldn’t determine the care your pet receives. Rather, having insurance enables you to make choices based on what is best for your pet, not your wallet. A fast glance at our comparison table illustrates how different insurance plans stack up:

| Insurance Provider | Monthly Premium | Coverage Limit | Deductible |

|---|---|---|---|

| Pet Insure Co. | $30 | $10,000 | $100 |

| Furry Health Plus | $45 | $15,000 | $200 |

| Extensive Pet Care | $35 | $12,000 | $150 |

Moreover,pet insurance can provide peace of mind,knowing that you are safeguarding your pet’s future health. Many pet owners may delay visiting the veterinarian due to cost concerns, ultimately leading to exacerbated health issues. With pet insurance,you’re empowered to seek immediate care without second-guessing your financial capacity. It’s a small price to pay for the comprehensive care that ensures your beloved companion receives the attention and treatment they need to thrive. by prioritizing their well-being,you not only enhance their quality of life but also strengthen the bond you share with them.

Exploring Different Types of Pet Insurance Plans

Choosing the right pet insurance plan can feel overwhelming; however, understanding the different options available can help simplify the decision-making process. Accident-only plans are often the most basic type of coverage, focusing specifically on injuries resulting from accidents such as broken bones or lacerations. These plans are typically lower in cost and might be ideal for pet owners who want to secure a safety net for unexpected mishaps.It’s crucial to note, though, that these plans do not cover illnesses or routine care.

On the other hand, comprehensive plans offer a much broader scope of protection, including both accidents and illnesses. These plans usually cover a wide array of medical needs ranging from diagnostic tests and surgeries to medications and treatments for chronic conditions. While the premiums may be higher compared to accident-only plans, the peace of mind that comes with knowing your pet will receive necessary care in a variety of situations can be well worth the investment. Many of these plans also allow customizable options for add-ons like dental care and wellness visits, making it easier to tailor the coverage to your pet’s specific needs.

Additionally, there’s the option of wellness plans, which primarily focus on preventive care. These plans typically cover routine check-ups, vaccinations, spaying/neutering, and other preventative measures to keep your pet healthy. While wellness plans may not provide coverage for unexpected injuries or illnesses, they can help reduce the long-term costs associated with comprehensive care. Often bundled with other plans, wellness coverage may suit those who prioritize regular veterinary visits and preventive health measures. Here’s a quick comparison of these plan types:

| Type of Plan | Coverage | Typical Cost |

|---|---|---|

| Accident-only | Injuries from accidents | $10 – $30/month |

| Comprehensive | Accidents & illnesses | $30 – $70/month |

| Wellness | Routine preventive care | $15 – $50/month |

When considering different types of pet insurance, also pay attention to variations in deductibles, copays, and coverage limits. Some plans might offer a higher deductible option with lower monthly premiums, while others focus on the opposite model. It’s crucial to evaluate which structure aligns best with your financial capacity and your pet’s potential health needs. Additionally, most insurers have a set annual or lifetime cap on how much they will pay out, so it’s important to clarify those limits as you compare plans. Ultimately, selecting the right plan requires careful consideration of both your budget and your pet’s lifestyle.

How to Choose the Right Coverage for Your Furry Friend

Choosing the right coverage for your furry friend is an essential step in ensuring that you are financially prepared for any unexpected veterinary expenses. as pet health issues can arise suddenly,it’s crucial to consider a few key factors before selecting a pet insurance plan. Start by evaluating the different types of coverage available. Most policies fall into categories such as accident-only, accident and illness, and wellness plans. Each type offers distinct benefits,so understanding your pet’s specific needs can definitely help narrow down your options.

Next, assess the specifics of each policy, focusing on important details like deductibles, premiums, and reimbursement rates.A policy may appear affordable initially; however, comprehensive examination of its terms will reveal potential out-of-pocket expenses in case of a claim. You might find it useful to create a simple comparison table to assess how various plans stack up against each other.

| Plan Type | Average Monthly Premium | Deductible | Reimbursement Rate |

|---|---|---|---|

| Accident-Only | $25 – $40 | $100 – $200 | 70% – 100% |

| Accident and Illness | $30 – $60 | $200 – $500 | 70% – 90% |

| Wellness Plans | $15 – $35 | N/A | N/A |

Lastly, consider customization options to tailor your pet insurance to your unique situation. Many providers offer add-ons that can cover extra services like dental care, option therapies, or even behavioral training. Additionally, research customer reviews and testimonials to gauge the quality of the insurer’s service, payment processing, and overall satisfaction. An informed decision will help ensure both your peace of mind and the well-being of your pet when faced with those unexpected vet bills.

Navigating the Claims Process: Tips for a Smooth Experience

Navigating the often intricate claims process of pet insurance can feel overwhelming, especially during stressful times when your pet is unwell. To ease this experience, it’s beneficial to familiarize yourself with the specific procedures and requirements of your insurance provider. Start by carefully reading your policy to understand what is covered and what documentation is needed for a claim, as clarity here can save time and frustration later. Make a checklist of required documents, which typically include:

- Completed claim form

- Itemized invoice from the veterinarian

- Medical records

Addressing potential bottlenecks before they arise can substantially enhance your claims experience. If you proactively reach out to your provider for guidance or clarification on any part of the claims process,this can minimize delays. Some insurance companies offer online portals were you can submit claims and track their statuses, so make sure to take full advantage of these convenient tools. Moreover, it’s advisable to communicate with your vet’s office; many are accustomed to working with insurance claims and can assist you in ensuring that the necessary information is accurately provided.

Lastly, keep a detailed record of all interactions related to your claims process. Whether it’s phone calls, emails, or in-person visits, document whom you spoke with and what was discussed.This information can be crucial if you need to follow up or if any issues arise. Consider using a simple tracking table to record your claims status and interaction logs, helping to ensure nothing slips through the cracks. Here’s a basic example:

| Date | Contact Person | Details of Interaction | Status of Claim |

|---|---|---|---|

| 10/01/2023 | Vet Clinic | Submitted claim form and invoice | Pending |

| 10/05/2023 | Insurance Rep | Follow-up on claim status | Under Review |

| 10/10/2023 | Insurance Approval | Received approval notification | Approved |

Real-Life Stories: How Pet Insurance Made a Difference

Q&A

Q&A: Unexpected Vet Bills? Here’s How pet Insurance Can Help

Q1: What exactly is pet insurance, and how does it work?

A: Pet insurance is a type of coverage designed to help pet owners manage unexpected veterinary expenses. When you sign up for a plan, you pay a monthly premium. In return, the insurance company will reimburse you a percentage of your vet bills for covered services after you pay your deductible. It’s like a safety net for your furry family members, covering everything from accidents to illnesses.

Q2: What types of services can pet insurance cover?

A: Most pet insurance plans cover a variety of services, including emergency visits, surgeries, diagnostic tests, and certain medications. Some policies also offer wellness plans that cover routine care like vaccinations, dental cleanings, and annual check-ups. Just be sure to review the details of each policy, as coverage can vary widely between providers.

Q3: Isn’t pet insurance just an additional expense? Why should I get it?

A: It’s true that pet insurance adds to your monthly expenses, but think of it as a safeguard against large, unanticipated costs. A single emergency vet visit can quickly spiral into the hundreds or even thousands of dollars. By investing in pet insurance, you can ease the financial burden when unexpected health issues arise, allowing you to focus on your pet’s care rather than your bank balance.

Q4: Are there any exceptions or limitations I should be aware of?

A: Yes, like any insurance, pet policies come with their own set of limitations. Common exclusions include pre-existing conditions, cosmetic procedures, and certain hereditary issues. Additionally, many plans have waiting periods before coverage begins. Always read the fine print of your policy to fully understand what is covered and what isn’t.

Q5: How can I choose the right pet insurance for my needs?

A: Choosing the right pet insurance involves considering factors like your pet’s age, health status, and breed, as these can influence policy options and premiums. Start by researching different providers, comparing their coverage plans, deductibles, and reimbursement rates. Customer reviews and ratings can also provide insights.It’s worth taking the time to find a policy that aligns well with your pet’s needs and your budget.

Q6: What happens if I decide to use my pet insurance?

A: If you have a claim to submit, the process typically involves paying your vet bill out of pocket and then filing a claim with your insurance provider for reimbursement. Be sure to keep all documentation,including invoices and medical records,as these are often required for claims processing. Many insurers also have mobile apps that streamline this process!

Q7: Can I use any veterinarian with pet insurance?

A: most pet insurance plans allow you to use any licensed veterinarian, but some might have a preferred network that could offer better rates. Always double-check your policy to see if there are any restrictions, and remember that you are generally free to choose the vet that best suits your pet’s needs.

Q8: How long does it take to get reimbursed after filing a claim?

A: The reimbursement timeline can vary by insurance provider, with many companies processing claims within a few days to a couple of weeks. After reviewing your claim, the insurance company will issue a reimbursement check or direct deposit to you based on their policy terms. Keeping your records organized can expedite this process!

Q9: Is pet insurance worth it in the long run?

A: While the answer to that question can vary from pet owner to pet owner, many find that pet insurance provides peace of mind during unexpected crises. Ultimately, it’s about evaluating your financial situation, your pet’s health history, and how comfortable you are with potential vet expenses. Life with pets can be unpredictable,and having insurance can definitely help protect you financially when those surprises come knocking.

Q10: Where can I find more information about pet insurance?

A: to explore pet insurance options, you can start by researching online comparison sites, visiting individual insurance company websites for details on their policies, or consulting with your veterinarian, who may have recommendations based on your specific needs. Remember, every pet is unique, and finding the right insurance policy can help ensure they receive the best possible care.

In Conclusion

In a world where our furry companions bring boundless joy and unexpected challenges, the importance of anticipating the unexpected cannot be overstated. Pet insurance serves as a safety net, helping pet owners navigate the often-surprising landscape of veterinary costs. By investing in a policy that aligns with your pet’s needs and your financial situation, you can ensure that your beloved friend receives the best possible care, no matter the circumstances.

As you embark on this journey of pet ownership, consider the peace of mind that comes from knowing you’re prepared for the unexpected. A little foresight today can make a world of difference tomorrow, allowing you to focus on what truly matters: the joyous moments shared with your four-legged family members. Remember, investing in their health is investing in the happiness of your home. So, take a deep breath, explore your options, and step confidently into the future, armed with the knowledge that you are ready for whatever life—or a surprised vet bill—may throw your way.